Biofertilizers Market Size and Forecast, By Product (Nitrogen fixing, Phosphate solubilizing), By Application (Seed treatment, Soil treatment) And Trend Analysis, 2014 - 2024

- Published: March, 2018

- Format: Electronic (PDF)

- Number of pages: 60

- Industry: Agrochemicals & Fertilizers

Industry Insights

The biofertilizers market was estimated at USD 699.6 million in 2016 and is projected to grow over the forecast period on account of increasing inclination towards natural and organic food products which has resulted in growth of associated markets such as biofertilizers. There has been a steady increase in bio-based plant growth enhancers, besides regulatory frameworks advocating the reduction in using synthetic/chemical growth enhancers.

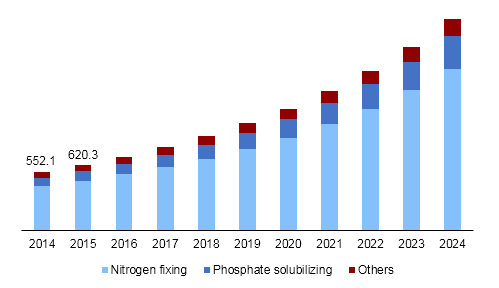

Global biofertilizers market revenue, by product, 2014 - 2024 (USD Million)

Biofertilizers are gaining momentum in the agricultural industry owing to its attributes of serving as an efficient substitute to chemical fertilizers. In recent times, the excessive usage of agrochemicals to increase production is leading to soil contamination. Bio-fertilizers enhance the absorption capacity of nutrients such as phosphorus and zinc in plants. Additionally, the use of biofertilizers in agriculture aids the decomposition of organic residues and stimulates overall plant development and growth.

Increase in prices of chemical fertilizers coupled with commercial response to growing food cost is expected to be one of the key drivers for biofertilizers industry over the coming years. Growing need for high agricultural yield in order to meet increasing demand has also added to the use of biofertilizers. Also, biofertilizer presents an effective alternate to inorganic chemical fertilizers, which are harmful to both environment and human health.

Segmentation by Product, 2014 - 2024 (USD Million)

• Nitrogen Fixing

• Phosphate Solubilizing

• Others

Based on product, the market is segregated into nitrogen fixing, phosphate solubilizing, and others. Nitrogen fixing accounted for the major revenue share during 2016. Nitrogen fixation segment witnessed high penetration as it improves nitrogen yield of the soil as well as its organic and microbial population. Prevailing demand for biofertilizers particularly in North America and Europe is expected to propel growth of nitrogen fixing bacteria over the forecast period.

Phosphate solubilizing is the second most widely used nutrients in fertilizers and accounted for approximately 14.0% of the overall revenue in 2016. Bacillus, pseudomonas, and aspergillums are majorly used bacteria for providing phosphorous macronutrients to plants. Growing need for phosphate solubilizing in organic farming is expected to fuel its demand over the forecast period.

Segmentation by Application, 2014 - 2024 (USD Million)

• Seed Treatment

• Soil Treatment

The major applications include seed treatment and soil treatment. The seed treatment market was estimated to be the largest application segment, accounting for more than three-fifth of global biofertilizers market revenue in 2016. Plant seeds are treated with bio-based products in order to prevent bacteria and virus attacks that reduce crop yield. In addition, these fertilizers help in harnessing atmospheric nitrogen and making it available to the plant.

Seeds treated with biofertilizers are capable of increasing phosphorous content of soil by solubilizing it and improving their availability. The key aim of incorporating these bio-products for seed treatment applications is to impart nutrients such as phosphorous, nitrogen and sulphur. The addition of nutrients in seeds increases the nutritional content of crops, fruits, and vegetables. Rising importance of organic foods on account of growing concerns over crop yield using chemical-based fertilizers is expected to increase the application scope of biofertilizers for seed treatment in the near future.

Segmentation by region, 2014 - 2024 (USD Million)

• North America

• U.S.

• Canada

• Mexico

• Europe

• France

• Spain

• Asia Pacific

• China

• India

• Central & South America

• Brazil

• Middle East & Africa

• Egypt

North America was the largest market, accounting for around one-third of global revenue in 2016. Positive agriculture industry outlook in North American countries such as U.S. and Canada along with increasing awareness towards the application of eco-friendly products in farming is expected to have a favourable impact on the industry over the forecast period. In addition, prevalence of favourable government support for use of eco-friendly products and increasing production output of organic foods is expected to augment market growth over the forecast period. Central & South America and Asia Pacific are expected to remain promising markets over the coming years. Growth opportunities in food & beverage market in Asia Pacific and Central & South America is expected to play a crucial role in enhancing agriculture output at domestic level and thus expected to increase application scope of bio-based products over the forecast period.

Competitive Landscape

The market for biofertilizers is marked by the presence of multiple companies focusing on regional markets. The players operating in market are focusing on technological innovations aimed at improving the manufacturing process of bio-products coupled with new product developments using various microbial strains. For instance, in April 2015, Rizobacter Argentina S.A has increased its investment in research and development and infrastructure. The company installed four new bio-reactors which are expected to increase its production capacity. The company is targeting multiple markets including Turkey, Germany, Kenya, and Ukraine. Its alliance with DE SANGOSSE, a French company, allows it to cater to the local as well as international markets for biofertilizers. Novozymes A/S and Biomax are among some of the prominent players in the market, besides other players such as AgriLife, Lallemand Inc., and National Fertilizers Limited.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service