Anti-Aging Products Market Size and Forecast, By Demography (Baby Boomers, Generation X, Generation Y), By Product (Skincare, Haircare), And Trend Analysis, 2014 - 2024

- Published: August, 2017

- Format: Electronic (PDF)

- Number of pages: 78

- Industry: Specialty & Fine Chemicals

Industry Insights

The global anti-aging products market size was estimated to be USD 106.35 billion in 2016, driven primarily by the ageing issues such as wrinkles, fine lines, skin tanning, crow’s feet surrounding eyes, greying of hair, balding and hair loss. Factors such as drastic climate change, increasing environmental pollution and direct exposure to skin from ultra violet radiations which cause premature skin ageing and other skin related issues are fueling the market worldwide.

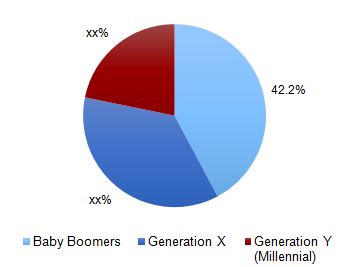

Global anti-aging products market, 2016 (%)

Growing ageing population of baby boomers and high demand for anti-aging products from generation X are major factors driving the growth during the forecast period. The population of aged people born during the 1946-1965 period is growing at an average of over 4%. With the growing population, the demand for anti-aging items from baby boomers and generation X is expected to rise notably compared to than any other age group. With the substantial growth of the anti-aging phenomenon, the market for these products is anticipated to grow over the forecast period.

New and advanced technologies have led to new anti-aging products and treatments, which is boosting the anti-aging industry growth. The rising awareness of ageing signs, desk-bound routine and obesity are fueling the market expansion. The awareness and use of natural and organic ingredients are also one of the major factors that are predicted to increase the market share for anti-aging products worldwide. However, their high cost is expected to restrain the market growth. Moreover, the side effects and inverse action from the excessive use coupled with the availability of duplicates in the market at low prices are the major restraints for the industry.

Segmentation by Demography

• Baby Boomers

• Generation X

• Generation Y

The baby boomers segment referring to the people born between 1940 and 1960 occupied the largest market in 2016 and is expected to grow at a CAGR of 5.9% over the forecast period. The economies with a large share of baby boomers generated more revenue in the past than the countries with the lesser number of baby boomers owing to the high demand for anti-aging products.

Generation X refers to the people within the 37-51 age group is expected to be one of the most lucrative demography for the market during the forecast period. The segment is anticipated to account for 37.2% of the market share in 2016.

Segmentation by Product

• Skincare

• Haircare

Skincare accounted for 38.8% of the market share in 2016 and is expected to witness the fastest growth over the forecast period. Skin and hair show the first visible signs, especially among women. Thus, numerous companies have launched products catering to these segments.

Owing to the rising awareness of skin problems related to ageing such as wrinkles, fine lines and pigmentation in both men and women has resulted in companies manufacturing problem-specific products. The rising curiosity and growing interest for organic and natural ingredients by women of all ages is anticipated to drive the market.

Segmentation by Region

• North America

• U.S.

• Europe

• Germany

• UK

• Asia Pacific

• China

• Japan

• Central & South America

• Middle East and Africa

North America accounted for the maximum revenue share of 30.2% in 2016 and will continue dominating the market over the forecast period owing to the presence of huge customer base and presence of giant anti-aging players including Olay, Lotus, Neutrogena etc. and enormous aging population.

Europe was the second largest market in 2016, closely followed by Asia Pacific. Asia Pacific is expected to witness a significant growth over the forecast period owing to the large population with a high ratio of women. Increasing penetration of anti-aging products on account of rising awareness regarding appearance, particularly in China and India, is expected to drive demand. Rise in per capita expenditure and ease of availability is likely to drive growth.

Competitive Landscape

The global market is highly fragmented in nature owing to the competitive nature within different players such as Revlon, Unilever, Procter & Gamble, Beiersdorf, L’Oreal, Avon, COTY INC., Missha, Lotus Herbals, Oriflame Cosmetics AG, Chanel, SKINFOOD, Rachel K Cosmetics, NATURE REPUBLIC, and Clarins.

Companies are using implementing product launch and expansion as the two major strategies to expand their portfolio and strengthen the customer base. However, customers are choosing to buy from the brand outlet, supermarket, and retail outlets followed by online shopping. The regulations set by FD&C for prohibiting adulterated or harmful skincare products and growing demand for natural and organic skin care and hair care items are anticipated to supplement the growth of the market over the forecast period.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service