Australia Alcoholic Drinks Market Size And Forecast By Type (Beer, Cider & Flavored Alcoholic Beverage, Wine, Spirits) By Distribution Channel (Off-Trade, On-Trade) And Trend Analysis, 2015 - 2025

- Published: May, 2018

- Format: Electronic (PDF)

- Number of pages: 55

- Industry: Food & Beverages

Industry Insights

The Australia alcoholic drinks market size was valued at USD 28.89 billion in 2017 and is expected to witness a significant growth, pertaining to the growing drinking population and premiumisation effect in the country. The topmost 20% of the population falling under drinking-age in 2013 consumed about three-fourth of the total alcohol produced and the highest 5% ingested more than a third of the total production. The awareness for consumption of alcohol amongst the substantial drinkers has essentially augmented in the current years. The highest 10% of alcohol consumers accounted for around 49% of the total alcohol consumption in 2001, which has grown to more than 53% after 2013 and is expected to drive the demand for alcoholic drinks in Australia.

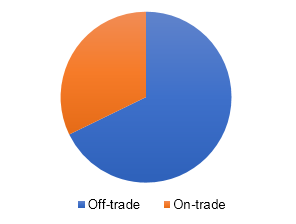

Australia alcoholic drinks market revenue split, by distribution channel, 2017 (% share)

Australians nowadays are getting more and more aware and conscious about their food and drinking habits and what they are putting in their bodies, owing to the rise in the wellness and health concerns here is a huge impact on the alcoholic drinks industry. With Australian consumers opting to decrease their overall alcohol consumption, there is a noticeable drop in the per capita consumption of alcoholic drinks over the forecast period. Furthermore, Australian population is indulging to use more high quality and premium products while drinking. This has led to the rise in the premiumization effect especially in spirits, beer and wine market. With the rise in consumption of alcoholic drinks and premiumization effect in Australia, the market for alcoholic drinks is estimated to record a strong growth over the forecast period. These factors are expected to drive the growth for alcoholic drinks in the country in the coming years.

Segmentation by type

• Beer

• Cider & flavored alcoholic beverage

• Wine

• Spirits

The beer segment occupied the largest market share in the alcoholic drinks market in Australia, owing to the presence of huge number of craft beer drinkers in the country. The beer industry accounts for around 1% of the total Australia’s GDP. Around 95% of the beer produced is consumed by the consumers. It is one of the major economic contributors and provides domestic jobs to several industries such as agriculture, brewing, packaging, freight and distribution, retail, hospitality and tourism. A major trend driving the beer sector in the country is the growing domination of Woolworths and Coles stores who are selling craft beer at the retail level.

The wine industry in Australia occupies the second largest share in the alcoholic drinks industry owing to the rise in the premiumisation trend which is expected to drive the growth of the wine segment over the forecast period. Wine consumers are becoming keener on exploring interesting and unique products launched by the local brands. With the rising awareness of fitness and health benefits offered by wine, the alcohol consumers are expected to shift their drinking practices and shift towards wine, which is anticipated to drive the growth for this segment. Huge marketing and sales efforts adopted by the competitors present in the market is anticipated to fuel the market growth for alcoholic drinks in the country over the forecast period.

Segmentation by distribution channel

• Off-trade

• On-trade

The sale of alcoholic drinks through off-trade distribution channels is expected to grow at a significant rate over the forecast period. The sale via supermarkets, hypermarkets, convenience stores, kiosks, mini markets, wines & spirits shops is expected to grow owing to the presence of several alcoholic drinks brands in these retail stores and the various options to choose for different occasions. Major alcoholic drinks brands such as Lion Nathan and Fosters have an extensive distribution and retail network which makes the drinks available to consumers in this market. The bulk of sales volumes is produced by giant supermarket chains such as Woolworths and Coles, which adopt a lot of sale strategies, tactics and in-store promotions which include several activities such as tastings for selective products and price off promotions. The Australian alcoholic drinks market have a presence of too many brewers and it is a crowded market and it is very important to position their brands in the market on account of the shift in drinking preferences and adoption of healthy drinking choices by the consumers which is anticipated to drive the sales of alcoholic drinks through off trade distribution channels in the country.

Competitive landscape

The Australia alcoholic drinks market is a highly competitive and cluttered in nature with a presence of large number of existing and emerging new players and brewers. Major players in the market comprise of companies such as LION, Australian Beer Company Pty Ltd., Anheuser-Busch InBev, Accolade Wines, Vickery Wines and several others. Competitors are taking strategic initiatives and gaining confidence of their consumers to occupy a good market share and boost the competition over the forecast period.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service