Australia Footwear Market Size and Forecast, By Type (Men, Women, Children), By Distribution Channel (Online, Offline) And Trend Analysis, 2015 - 2025

- Published: March, 2018

- Format: Electronic (PDF)

- Number of pages: 50

- Industry: Consumer Goods

Industry Insights

Australia footwear market was valued at USD 3.2 billion in 2017 and is expected to grow over the forecast period. Market is primarily driven by increasing discretionary spending coupled with the rising fashion trends in the country. The revenue for footwear industry is projected to grow on account of mounting demand for sports and fashionable shoes. Additionally, technological advancement such as 3D printing and shoe-knitting technologies together with material innovations in shoes manufacturing is expected to bolster the footwear industry production over the forthcoming years. 3D printing techniques are being mainstay for shoes manufacturers to manufacture variety of customized shoe designs to serve the needs of end-use customers.

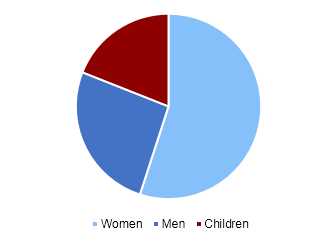

Australia footwear market revenue split, by type, 2017 (% share)

The factors such as vigorous demand for sports and athletic footwear from all age groups, increasing demand for sneakers, changing life style, rising preference for branded and high-fashioned shoes amongst youth are contributing to strengthen the demand for shoes in Australia. According to worldometers, the population in Australia was estimated at 23.79 million in 2015 and reached 24.13 million in 2016. Increasing in population coupled with spending power are vital factor boosting Australia footwear industry size over the next coming years.

Footwear are made from raw material such as plastic, rubber, leather, and others. Polyester is one of the most widely used raw material for manufacturing knitted shoes owing to the recycle characteristics of the material. The players are introducing new ways for manufacturing shoes with minimal wastages and less time. For instance, In March 2014, Adidas introduced its first knitted soccer cleat. The shoes offered both safety and comfort to the players while paying football.

Australia footwear industry is highly dependent on the economic conditions and consumer spending patterns. Fierce competition has created more options for the buyers to choose from. The technologies are helping manufacturers to carry out bulk production activities which are resulting in cost and time saving during the manufacturing process. Industry competitors are continuously concentrating on offerings and expanding product portfolio in order to survive in competitive business environment. For instance, Nike launched knitted neon shoes Magista and Mercurial cleats which were used in Soccer World Cup. The upsurge in sports activities are further expected to contribute to sports shoes in Australia.

Segmentation by Type, 2015 - 2025

• Women

• Men

• Children

Based on type, footwear market is segmented into women, men and children footwear. The women’s shoes segment accounted for the largest share in the market owing to athleisure trends amongst women’s segment. Followed by women, men segment dominated the market. Sports shoes are highly demanded type amongst athletics and other group of people. Increasing trend of exercise and fitness expected to have positive impact on the market. As need for fitness would boost the demand for sports shoes from all the age groups. Sports shoes in men’s and children’s segment is expected to create huge demand, which is further likely to reinforce the market growth during the forecast period.

Segmentation by Distribution Channel, 2015 - 2025

• Online

• Offline

Based on distribution channel, the market has been bifurcated into online and offline distribution channel. Online distribution channel is projected to grow at faster pace during the next coming years attributed to high penetration of internet and mobile in Australia. Increasing number of customers opting to shop online owing to conveyance and other factors such as free delivery and offers is expected to contribute to growth.

Retailers are focusing on consolidating their operation in response to growing competition from online channels and departmental stores. Australia footwear retail industry is dominated by Fusion Retail Brands, Betts Group, Super Retail Group, and RCG Corporation. The footwear retail industry in Australia generated more than 3 billion revenues annually.

Competitive Landscape

The market is highly competitive in nature. The Australia footwear industry is marked by the existence of well-established players in the market. The key vendors operating in the industry comprises of Nike, Inc., adidas Australia, H & M Hennes & Mauritz AB, PUMA SE, and Kickstarter, PBC. These companies together hold the large share of the market. The retail domestic players in the market comprises of Rebel Sports, Amart All Sports, target, Kmart, Big W, Rivers, Myer, David Jones, and Betts. Companies are adopting mergers and acquisitions to increase their product offering. The market scenario is highly competitive with the growing interest of local players and international brands entering into the market.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service