Global Bakery Premixes Market Size and Forecast By Product (Complete Mix, Dough Base Mix, and Dough Concentrates) By Application (Bread and Non-Bread Products) And Trend Analysis, 2019 - 2025

- Published: March, 2019

- Format: Electronic (PDF)

- Number of pages: 60

- Industry: Food & Beverages

Industry Insights

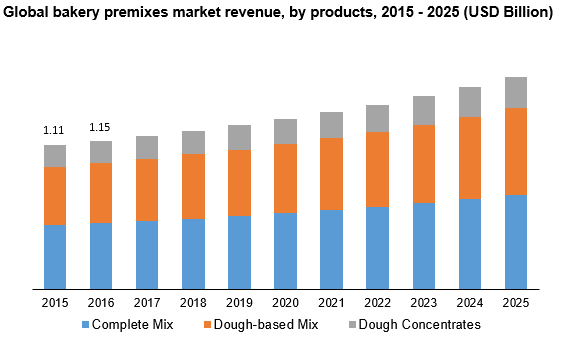

The global bakery premixes market was estimated at USD 1.18 billion in 2017 and is expected to grow at a CAGR of 4.27% from 2017 to 2025. Premix ingredients are gaining an increasing acceptance among the consumers and the food service industries to meet the requirements for various customized bakery products.

Premixes are mixing ingredients added in the initial stage of the manufacturing process of bakery products. Baking premixes add taste, color, flavor, and texture to the bread based and non-bread products such as, rolls, muffins, flour, donuts to name a few.

Bakery premixes offer greater and improved product consistency thereby, reducing the probabilities of incorrect measurement of raw materials that are used in the process. Application of premix ingredients are beneficial for the manufacturers as they are coupled with decreased labor and inventory costs. Manufacturers are preferring the use of blends of various premixes for preparing bakery goods in an effort to cater to the customers’ increasing demand for customized products. Moreover, using baking premixes helps in increasing the shelf life of the finished products.

Besides consumers’ demand for customized products, the increasing preference for foods made from natural ingredients is driving the growth of the global bakery premixes market. According to a report by the World Bread and Bakery, the global bread and bakery products have witnessed a sustainable growth from 122,000 tons in 2007 to 129,000 tons in 2016.

The consumption value was worth USD 358 billion in 2016. The countries reported to have the highest consumption of these products were the U.S., China, Russia, UK, Germany, Egypt, and Italy. Together they accounted for about 41% in 2016. The increasing consumption of these products in the developed and developing countries is expected to drive the demand for global bakery premixes market to cater to the changing preferences of the consumers.

Segmentation by Product

• Complete Mix

• Dough-based Mix

• Dough Concentrates

The complete mix market was estimated to account for a major share of more than 45% in the global market. This market was estimated to witness a significant demand among the consumers. This includes a blend of dry powder which needs addition of water to produce a thick batter. Complete mix is majorly used by the commercial baking industries to achieve cost-effective processes.

The dough-base premixes refer to the partial mix that needs water, shortening and eggs which can also be modified by adding other ingredients to prepare various bakery products. The dough concentrate is usually a combination of various ingredients such as shortening, dough conditioners, dehydrated eggs and flavors which are mixed in baking flour.

Segmentation by Application

• Bread Products

• Non-Bread Products

Bread products account for the largest share of more than 50% of the global market. Bread is the most common and highest consumed bakery products across the world. These products include, toast bread, specialty bread, whole-meal bread rolls, white bread rolls, whereas non-bread products include pastries, muffins, cakes, pancakes and donuts. Bread products have been witnessing an increasing demand among the developed countries.

The U.S. accounted for the highest consumption of about 13,000 tons of breads in 2015 and is expected to continue witnessing high demands in the future years. Considering the consumers’ changing taste and product preferences, the manufacturers will be focusing on using premixes to cope up with the increasing demand for customized and new bread products. This is expected to drive the demand for the global market in the next few years. Other countries accounting for significant consumption of breads include Germany, Russia, UK, and Italy to name a few.

Segmentation by Region

• North America

• U.S.

• Europe

• Germany

• UK

• Asia Pacific

• India

• China

• Central and South America

• Middle East and Africa

North America held the maximum share of about 28% in 2017 and is expected to register a growth of more than 4% from 2017 to 2025. Europe accounts for a fair share of about 25% of the global market. This region has emerged as the largest market in the bakery premixes market followed by Europe. The market growth is attributed to the consumers’ awareness with respect to the benefits of including customized premixes in the bakery products. Moreover, addition of essential ingredients such as vitamins and minerals, has also contributed to the increasing traction of the global bakery premix industry.

Increasing consumption of various bread based and non-bread products among the western countries is expected to result in the demand for bakery premixes market. Countries with higher per capita consumption in 2016 includes UK with a volume of 96 kg/year, followed by China, Italy, Germany, Russia, and France. As per the trend sin 2016, the U.S. per capita consumption was slightly on a lower side 46 kg/year; which still accounted for a higher amount than the world average of about 18kg/year.

Competitive landscape

Key players operating in the global market include Archer Daniels Midland Company, Enhance Proteins Ltd., WATSON-INC, Echema Technologies LLC, Puratos, Karl Fazer Ab., Allied Mills, Swiss Bake Ingredients Pvt Ltd, Malindra Group, Lesaffre, and Bakels Worldwide to name a few. The manufacturers are aiming to expand their business either by setting up new production plants or broadening their product offerings in global bakery premix market.

Bakery mixes offered by PURATOS include Tegral Mixes which require the addition of yeast and water and Easy Bases which demand the addition of flour along with water and yeast. Its other product ranges such as Puravita mixes include combination of grain and seed which offer innovative healthy options. Puraslim bakery mixtures offer premixes that produce soft and sweet bread products that are induced with different tastes and textures along with an improved nutritional content.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service