Ballast Water Treatment Systems Market Size and Forecast, By Technology (Mechanical Method, Physical Disinfection, Chemical Method), By Type (Dry Tankers, Container Ships, General Cargos, Bulk Carriers), And Trend Analysis, 2015 - 2025

- Published: August, 2018

- Format: Electronic (PDF)

- Number of pages: 60

- Industry: Water & Sludge Treatment

Industry Insights

The global ballast water treatment systems (BWTS) market size was valued at USD 20.05 billion in 2017. The growth of this market is majorly attributed to the favorable initiatives undertaken by government authorities for the ballast water treatment. Ballast water is a water that carried in vessels’ ballast tanks to improve balance, and stability.

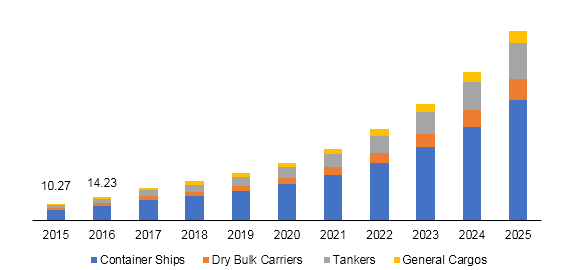

Global ballast water treatment systems (BWTS) market revenue, by type, 2015 - 2025 (USD Billion)

Owing to the inadvertent transfer of harmful pathogens and aquatic organisms, authorized ocean dumping, and oil & chemical spills, the requirement for ballast water treatment has become important for effective shipping operations.

For example, the International Maritime Organization (IMO) introduced the “International Convention for the Control and Management of Ships’ Ballast Water and Sediments”, an international legislation in order to regulate ballast water discharge and to reduce the risk of non-native species from it. Thus, increasing focus on Marine Environmental Protection program by government authorities to regulate ballast water discharge drive the market growth significantly.

In addition, the demand for ballast water treatment is increasing owing to the rising volume of seaborne trade. For instance, as per the Maritime Transport, more than 90% of the European external freight trade is seaborne. This, would, in turn, further fuel the demand for ballast water treatments among end-users, driving the industry growth. However, rising concerns about the storage of by-products generated after ballast water treatment hamper the industry growth to some extent.

Segmentation by Technology

• Physical Disinfection

• Mechanical Method

• Chemical Method

Multiple factors such as space availability, implementation cost, and level of environmental friendliness play a vital role when deciding for ballast water treatment systems. Of the different technologies, physical disinfection accounted for the largest share in 2017 and is projected to dominate the market over the study period. This technology includes deoxygenation, UV irradiation, cavitation and ultrasonic treatment methods. Physical disinfection technology is considered to be the most effective compared to other technologies and thus it is being utilized by many ocean freight operators.

Chemical method generated a revenue of USD 5.60 billion in 2017. This technology comprises electrochlorination, direct chemical injection, ozonation, electrolysis, chlorine dioxide, or any other kind of advanced oxidation process. Associated benefits such as residual disinfectants being carried in the ballast tank after initial treatment and lower power consumption help this segment to grow consistently over the forecast period.

Segmentation by Type

• Container Ships

• Dry Bulk Carriers

• Tankers

• General Cargos

Depending upon types, the market size for container ships accounted for the highest revenue share of the global ballast water treatment systems market, which was valued at USD 12.50 billion in 2017. In a loaded container ship, ballast water systems are used to decrease the instability and unusual movement during the voyage. The center of gravity of wing ballast tanks is much better than that of double bottom tanks. Double bottom tanks help in reducing bending moment but are not very useful in ensuring stability. Adding further, container ships are anticipated to account for more than 80% of sea transportation which is estimated to be a lucrative opportunity for the global ballast water treatment market. Several shipping companies are collaborating with water treatment companies, this will in turn facilitate the growth of the market.

For instance, CMA CGM S.A., a French shipping and container transportation company has ordered 17 container ships in contract with France based BIO-UV Group Company. BIO-UV Group is a specialist in water treatment that utilizes ultraviolet technology to treat water. As per the contract, 9 container ships will run on LNG fuel with two BIO-SEA B 10-1500 FX units that will have capacity of 3,000 m3/h. Another 8 are opera class vessels that will be retrofitted with one BIO-SEA B 10-1000 FX unit that will have the flow rate of 1,000 m3.

Tankers are expected to be the fastest growing segment in the global ballast water treatment systems market with a CAGR of 25.5% during the forecast period. It allows easy installation and provides relatively more space. Japan, South Korea, and China accounts for major tanker production. It is estimated that nearly more than 60% of the tanker ship were built in these countries.

Hence, the demand for ballast water treatment systems is anticipated to be on the higher side from these countries in terms of retrofitting and building of new vessels. Dry bulk carriers and general cargos together accounted for around 20.0% of the market share in 2017. The segment is anticipated to witness steady growth over the forecast period.

Segmentation by Region

• North America

• U.S.

• Europe

• UK

• Germany

• Asia Pacific

• China

• Japan

• Rest of the World

North America dominated the ballast water treatment systems market, accounting for more than 40.0% revenue share in 2017. Prevailing trade volumes and strict IMO regulations have supported the growth of this industry in North America. On contrary, Asia Pacific is expected to witness the fastest growth with a CAGR of 25.4% over the future period.

This region remains a key growth market for BWTS with an increase in ocean freight volumes from various countries such as China, India, and South Korea to other parts of the world. It is anticipated that growth in the ocean freight over the coming years, will result in the higher adoption of Marine Environmental Protection program, which in turn will spur market growth. Growing number of containers ships & tankers along with strong trade volume in the region is further adding to the regional growth.

Competitive Landscape

Ballast water treatment systems market is competitive in nature marked by the presence of well-established players, such as Xylem Inc, Wärtsilä Corporation, Calgon Carbon Corporation, Evoqua Water Technologies LLC, Mitsubishi Heavy Industries, and Veolia Environnement S.A. Key players are actively engaged in developing effective treatment solutions that enable to treat ballast water for a wide range of ship types and sizes.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service