Beta Carotene Market Size and Forecast By Source (Algae, Fruits & Vegetable Synthetic), By Application (Food & Beverages, Dietary Supplements, Cosmetics, and Animal Feed) And Trend Analysis, 2014 - 2024

- Published: August, 2018

- Format: Electronic (PDF)

- Number of pages: 70

- Industry: Food & Beverages

Industry Insights

The global beta carotene market size was valued at USD 466.7 million in 2017. It is anticipated to expand at an estimated CAGR of 4.1% over the forecast period. Emphasis on natural source products and rising health concerns globally have resulted in steady rise in demand for the product. Furthermore, shift in consumer preference from synthetic to natural product is a key factor driving demand for beta carotene.

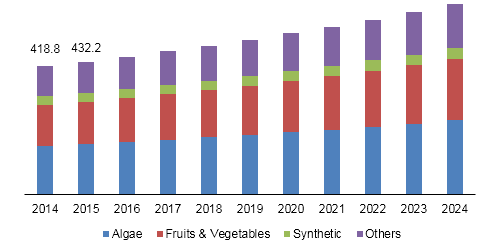

Beta carotene market revenue, by source, 2014 - 2024 (USD Million)

Increasing demand for beta carotene from end-use industries, such as food and beverages, cosmetics, dietary supplements, and animal feed is resulting in development of new products and technologies. In food and beverages, it is commonly used as food coloring. In personal care and cosmetic products, it is used in the formulation of bath products, aftershave lotions, cleansing products, shampoo, suntan products, makeup, hair conditioners, skin care products, and shampoos.

Regulatory bodies across the world have laid down regulations for the usage of beta carotene in various end-use industries. For instance, the European Food Safety Authority (EFSA) has created EC 1333/2008 and EU 231/2012 guidelines specifying the norms for addition of additive (such as color) in food and beverages. Dietary Supplements Health and Education Act (DSHEA), which specifies the regulatory framework for assuring the safety of dietary supplements, has also formulated regulations regarding dietary supplementation.

Segmentation by Source

• Algae

• Fruits & Vegetables

• Synthetic

• Others

Algae accounted for a major market share of 38.08% in terms of revenue in 2017. It is the fastest growing as well as the largest segment in the global market and is anticipated to maintain its dominance over the forecast period. Advantages associated with beta carotene extracted from various genera of algae is the primary demand driver.

For instance, Dunaliella salina; a marine microalga, is a rich source of beta-carotene. Most algae are projected to yield about 1% to 2% of the product. However, Dunaliella salina can yield more than 10% of the product when cultivated in proper conditions, such as hyper saline water, warm climate, and minimum cloudiness. Other strains of algae that are rich in beta carotene includes, Chlorella, Spirulina platensis, and Caulerpa taxifolia.

Fruits and vegetables is another main source of the product. This segment accounted for a market share of around 30% in terms of revenue in 2017. Sweet potato, peas, onion, carrot, pumpkin, spinach, and plums are some of the natural sources. Fruit and vegetable segment is estimated to expand at more than 4% CAGR in near future future.

Segmentation by Application

• Food & Beverages

• Dietary Supplements

• Cosmetics

• Animal Feed

Food and beverage dominated the global beta-carotene market and has contributed more than 30% market share in terms of revenue in 2017. Consumers prefer food and beverages rich in taste and color. However, they tend to avoid products manufactured using unethical processes, such as petroleum-based colors. Hence, there is a steady rise in demand for natural color additives in food and beverage. This factor is projected to drive natural based beta carotene over the projected period.

Unique antioxidant properties of the product protect human cells from damaging. Human body converts beta carotene to vitamin A that prevents certain lifestyle diseases, such as asthma, heart disease, and depression among others. It prevents sunburn and is also given to malnourished or underfed women to prevent death during pregnancy and postpartum fever and diarrhea. Rising awareness regarding healthy lifestyle is projected to propel demand for beta carotene in dietary supplements.

Cosmetics segment is projected to expand at a CAGR of 4.2% over the forecast period. Application in cosmetics includes, makeup, aftershave, skin care, cleansing, and haircare products. Demand for natural cosmetics is on the rise across the globe. Natural and organic products are preferred more than their synthetic counterparts likely to cause skin irritation and acne. This factor is anticipated to propel market in the forthcoming years.

Government bodies, such as U.S. Food and Drug Administration (FDA) and Environmental Protection Agency (EPA) have laid down stern regulations to encourage production of natural and skin-friendly cosmetics. For instance, as per the revised cosmetic instruction in 2013, Europe banned nearly 1328 chemicals from being used in cosmetics. Also, in 2018, U.S. banned nearly 30 chemicals from being utilized for the similar purpose. Hence, demand for natural beta carotene is estimated to witness a steady rise over the foreseeable future.

Segmentation by Region

• North America

• U.S.

• Europe

• Germany

• France

• U.K.

• Asia Pacific

• China

• Japan

• India

• Central & South America

• Middle East & Africa

Europe dominated the global beta-carotene market with maximum revenue share of about 35.44% in 2017. Consumption of beta carotene is highest in Europe owing to sustained in-vitro synthesis and rising demand of healthy products that has led to large-scale production.

Regulations regarding production and marketing of micro-algae based products are more stringent in this region. For instance, there are two EU regulations active when it comes to authorization of such products. These regulations are the Novel Food Regulation and Food Safety Regulation. Furthermore, procedure to introduce beta carotene based food and beverages is more complex. This makes the market more competitive, providing further room for development.

Asia Pacific is the fastest growing regional segment and is anticipated to expand at a CAGR of 4.6% over the forecast period. Rising demand for dietary supplements, animal feed, cosmetics, and food products from populated countries, such as India and China is anticipated to propel regional demand over the forecast period.

Competitive Landscape

The global beta carotene market is dominated by a few giant players, such as DSM and BASF. The industry has a smaller number of international players and a large number of small-scale regional players. Giant and key players are trying to increase their market share by investing in R&D activities and technological innovations. The presence of small number of large and experienced players and big number of small-scale regional players has resulted in increased fragmentation and competition. Giant and experienced players have achieved full integration across the value chain to strengthen their market position.

Penetration in end-use industries is much higher than other carotenoid products. Key industry players include Chr. Hansen Holding A/S, Foodchem International Corporation, D.D. Williamson & Co., DSM N.V., BASF SE, Flavorchem Corporation, LycoRed, Nutralliance, Zhejiang Medicine Co. Ltd., BioExtract, Ltd, and Parry Nutraceuticals.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service