Brazil and Argentina Glass Packaging Market Size and Forecast, By Application (Food, Alcoholic Beverages - Beer, Spirits, Wine, Non-Alcoholic Beverages) and Trend Analysis, 2014 - 2024

- Published: October, 2018

- Format: Electronic (PDF)

- Number of pages: 50

- Industry: Specialty Ceramic, Glass And Fiber

Industry Insights

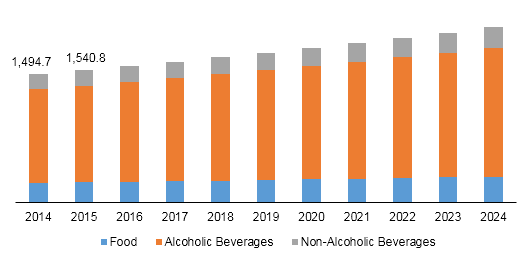

The Brazil glass packaging market size was valued at USD 1.55 billion in 2017. It is projected to exhibit a CAGR of more than 3.0% over the forecast period. Lucrative demand for alcoholic beverages such as beer, spirits, and wines is expected to drive demand for glass packaging in Brazil. The Argentina glass packaging market size was valued at USD 894.7 million in 2017. It is expected to expand at a CAGR of about 2.0% over the forecast period. Rising investments in the food and beverage sector is projected to fuel demand for glass packaging in Argentina.

Brazil glass packaging market volume, by application, 2014 - 2024 (Thousand Tons)

Low labor cost and higher profit margins for glass bottle manufacturers are some of the major factors attracting global conglomerates to invest in the region. Increasing demand from microbreweries is expected to drive the industry in Brazil and Argentina over the forecast period. Additionally, growing demand for processed foods owing to change in lifestyle is likely to fuel demand.

The Brazil market is driven by the manufacturing sector, which accounts for about 29.0% of the GDP. Potential investments and existing user-friendly policies are expected to uplift per capita income and increase spending power. For instance, there has been a 30.0% reduction in tax on manufactured products. In 2009, the Brazilian government passed a law requiring companies to reduce greenhouse gas emissions by 2025. Such policies are anticipated to favor the industry.

Prevalent liquor consumption in these countries is attracting various domestic and international beer manufacturers to expand their footprint in the liquor market. For instance, average consumption of pure alcohol is 8.7 liter/year in Brazil whereas, the same average stands at 6.9 liter/year on a global level.

Argentina’s liquor consumption is slightly consolidated in nature, offering little scope for development of new players. The liquor market is mainly dominated by A-B InBev, whichaccounts for nearly 70.0% share in the overall revenue. Compañía Cervecerías Unidas (CCU), a Chile-based company, accounts for a share of about 20.0% in the market. Unstable economy in Argentina is expected to hamper foreign investments, resulting in a decline in the economy.

However, growing demand for metal cans and easy availability of substitutes such as cartons, plastic, and metal packaging are projected to restrain the industry in Brazil and Argentina.

Segmentation by Application

• Food

• Alcoholic Beverages

• Beer

• Spirits

• Wine

• Non-alcoholic Beverages

In 2017, alcoholic beverages accounted for a major share in the Brazil and Argentina glass packaging market. Brazil is the third largest market for beer in Latin America, with a consumption rate of approximately 140 million hectoliters per year.

Beer and wine are the most popular alcoholic beverages in Argentina. Growing disposable income of the middle class working population has given rise to a trend of consuming expensive alcohol variants. Furthermore, Argentina is well-known for its wine and olive oil industries, which presents several opportunities for glass packaging.

Beer dominated the alcoholic beverage segment in the overall market in terms of units of bottles produced. For instance, in 2015, glass packaging production in Brazil was estimated at 3,948.3 million units, wherein beer accounted for approximately 3,372.1 million units. Glass bottles are said to be more viscous than plastic. Owing to its better containment property and inert nature, it is strongly favored by consumers.

Competitive Landscape

Expanding application scope and effectiveness, on the heels of rising consumer demands, is one of the key steps taken up by players in the market. They are also introducing applications with high durability to strengthen their presence in the market.

Argentina is marked by presence of domestic as well as international glass manufacturers. Major domestic players in the market include Rigolleau, Cattorini, Ardagh, Amposan S. A., and Durax. International glass packing manufacturers operating in Argentina include Owens-Illinois (O-I) and Verallia.

The Brazil and Argentina glass packaging market is highly consolidated in nature. Leading players account for nearly 68.0% share in the overall revenue. Owens-Illinois (O-I), Ardagh, and Verallia are expected to account for a major share in the forecast period owing to presence of numerous manufacturing plants and emerging glass making factories.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service