Brazil Ice Cream Market Size and Forecast, By Type (Artisanal, Impulse, Family pack) And Trend Analysis, 2015 - 2025

- Published: March, 2018

- Format: Electronic (PDF)

- Number of pages: 50

- Industry: Food & Beverages

Industry Insights

Brazil ice cream market size was estimated at USD 6.14 billion in 2017 and is expected to grow over the forecast period. The growth is largely attributed to the rising disposable income of the country’s population coupled with the shift in consumer taste preferences towards ice creams and other frozen desserts. The market growth is derived by the mounting demand for confectionery products and frozen sweet dishes.

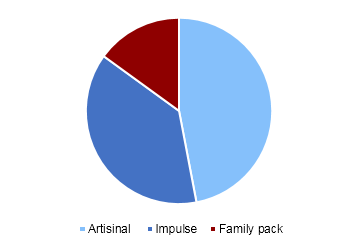

Brazil ice cream market revenue split, by type, 2017 (% share)

The economic turmoil during 2015 - 2016, affected the overall performance of retail industry. The economic and political crisis was the result of the dissatisfaction of the political system in the country. The country’s GDP recoded a downfall of about 3.0% in year 2015 and 2016. In 2016, the crisis came to an end and the abundant inflows of capital and commodity price cycle played an important role in improving the economic performance of the country. Brazilian economy accounted the upsurge in 2017, impacting the retail industry growth positively on account of the rising disposable income and increase in buying power of the consumer in the region.

Hypermarkets, supermarkets, and convenience stores are the main channels for selling the ice creams and other confectionery products in the country. Entrance of new retailers and development of retail distribution channels is expected to contribute to the market revenue owing to the convenience factor in near future.

The industry participants are undertaking many mergers and acquisitions and launching innovations in product to boost the performance of the company. For instance, several ice-cream companies are manufacturing lactose-free ice creams to cater to the demand of lactose-intolerant consumers, as consumption of lactose cases many problems such as diarrhoea, gas, and bloating. The availability of lactose-free ice cream is probable to enhance the market growth.

Segmentation by Type, 2014 - 2025

• Artisanal

• Impulse

• Family pack

The ice cream market in Brazil is segmented on the basis of product type and shape. The product type primarily comprises of artisanal, impulse, and family pack. Whereas, based on shape, market can be categorized into buckets, sticks, floats, sundae, and frozen novelties. Artisanal segment is most consumed and fastest growing segment amongst the other product segments.

In the country, the branded products such as Unilever and Nestle dominate impulse and take-home category of ice creams in the market. The soft ice cream products contributed a share of about 8 % to 10% in total production of the market. Subsequently, the continuous increase in consumption of ice cream in Brazil is further expected to have positive impact on the revenue growth during the forthcoming years.

Competitive Landscape

The market for ice cream in Brazil is fragmented in nature with the presence of numerous large and small-scale players in the industry. The ice cream market scenario in country is highly competitive with vendors competing for distribution, pricing, and product innovations. The industry comprises of few well-established players such as Unilever Brazil, Nestle, Jundiá Sorvetes, and General Mills Brasil Alimentos. Some other premium brands in Brazil are Diletto, Mil Frutas, Frutos do Brasil.

Unilever Brazil held major market share. This is attributed to the strong distribution channel and brand positioning. Kibon is one of the leading brand of the company and is also the one of the leading contributor to company’s revenue. As a part of strategic initiatives, the company introduced a version of Chantibon bulk ice cream in 2015. Followed by Unilever, Nestle held major market share in the country. The key players in the industry are implementing mergers & acquisitions in order to expand company business. Additionally, market players are introducing new products to cater increasing consumer demand.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service