Cellulose Acetate Butyrate (CAB) Market Size and Forecast, By Application (Printing Inks, Paints & Coatings, Lacquers) And Trend Analysis, 2014 - 2025

- Published: July, 2017

- Format: Electronic (PDF)

- Number of pages: 60

- Industry: Bulk Chemicals

Industry Insights

The global cellulose acetate butyrate (CAB) market size was estimated to be USD 672.8 million in 2016 and is expected to grow over the forecast period driven primarily by the growth of the paints & coatings market. Increasing construction activities and increasing automobile production are projected to provide further growth impetus. In addition, growing demand for decomposable products is expected to spur the demand for cellulose acetate butyrate over the next few years.

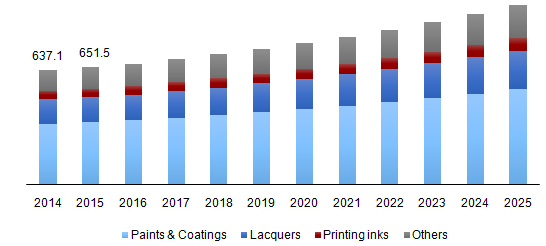

Global cellulose acetate butyrate (CAB) market, by application, 2014-2025 (USD Million)

Cigarettes and cigarette filter tow also present growth opportunities for the market over the next few years. To that end, an increase in consumption of cigarettes has driven the CAB market in a few regions including Asia Pacific. However, stringent government regulations related to health hazards has adversely impacted the growth prospect of the market in various regions.

Technology advancements along with expansion in capacity and development in R&D are expected to be some of the key driving factors for the cellulose acetate butyrate market in the coming years. Over and above that, CABs’ unique properties such as high resistance to UV radiations, lower moisture absorption rate, and high impact strength is expected to have a positive impact on its growth prospect in various applications such as blister packaging, printing inks, lacquers, and paints & coatings.

Segmentation by application

• Printing inks

• Paints & coatings

• Lacquers

• Others

Paints & coatings were the highest revenue generating segment of the global market accounting for 53.1% in 2016. The segment is expected to grow steadily over the forecast period on account of rising demand from end-use industries such as automobiles, architecture, and infrastructure.

Lacquers are anticipated to witness above-average growth over the projected period owing to its extensive use in coating formulations as well as packaging. The development of these sectors is expected to augment the growth of CAB subsequently.

Segmentation by region

• North America

• U.S.

• Europe

• Germany

• UK

• Asia Pacific

• China

• Japan

• Central & South America

• Middle East and Africa

In 2016, Asia Pacific dominated the market with a volume share of 48.8%. The rising consumption of fast moving consumer goods with the developing textile and electronics sector in the majority of the countries are some of the key reasons which have resulted in a rising use of cellulose acetate butyrate over the past few years. This trend is likely to continue over the forecast period.

China led the cellulose acetate butyrate market in Asia Pacific generating revenues worth USD 133.4 million in 2016. The increasing use of print inks and coatings in the textile industry is expected to result in influencing the growth of cellulose acetate butyrate market positively. Moreover, the country accounted for nearly one-third of the world’s smokers, which is expected to boost the sales of cigarettes.

U.S. led the cellulose acetate butyrate market in North America, whereas Germany and UK played a key role in driving the growth of the industry in the European region. Increasing demand for e-cigarettes and vaporisers is expected to hamper the sales of traditional tobacco-based products. Thus, the market is projected to witness steady growth at a volume CAGR of 3.5% over the next eight years.

Competitive landscape

The global market is monopolistic in nature, with Eastman being the leader in 2016. Other key players with a global presence include Mitsubishi Rayon, Diacel and Celanese. These companies distribute their products through tie-ups with authorised dealers to ensure quality and seamless supply demand.

Other vendors in the industry include Xiamen Hisunny Chemical Co., Ltd., Chemos GmbH & Co. KG, Haihang Industry Corporation, and Simagchem Corporation. Companies are focusing on manufacturing blends of polymers with CAB to enhance the resistance of the base material against UV rays. In addition, to ensure the supply of CAB to other application industries, manufacturers are entering into partnerships with authorised dealers across the world. Moreover, companies focusing on R&D are expected to gain an edge over their competitors through product innovation, increasing applications scope, and stable prices.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service