Chewing Gum Market Size & Forecast By Ingredient (Sugared Chewing Gum, Sugar-free Chewing Gum), By Distribution Channel (Convenience Store, Supermarket & Hypermarket, Drug Store, Others), And Trend Analysis, 2019 - 2025

- Published: February, 2019

- Format: Electronic (PDF)

- Number of pages: 80

- Industry: Consumer Goods

Industry Insights

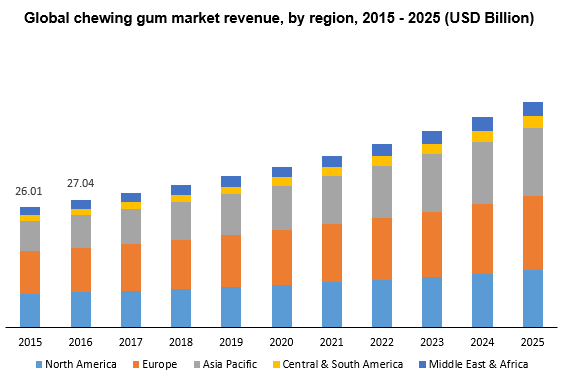

The global chewing gum market was valued at USD 29.0 billion in 2017 and is projected to reach USD 48.68 billion by 2025. The market is estimated to grow at a CAGR of 6.7% from 2017 to 2025. The market is anticipated to witness a significant growth as a result of consistent product innovations coupled with strong marketing campaigns by manufacturers. The manufacturers are focusing on diversifying their product offerings by introducing new flavors, and fortified products with the addition of functional ingredients, thereby registering significant growth in the market.

The rising demand from the modern age populations for the products such as sugar-free chewing gum which aids for oral hygiene by preventing dry mouth problems will further provide growth opportunities for the manufacturers. These products render health benefits as a result of fortification of minerals and vitamins in them. As per the International Research Association (IRA), it is suggested that repetitive chewing of gums enhances concentration on a particular task that requires continuous monitoring. Moreover, it contributes to relieving stress and aids in weight management.

The chewing gum market is growing at a considerable CAGR owing to its popularity among the working-class segment and millennials. The demand for sugar-free products due to the significant health problems has been considered high in the developed countries of Europe. The rising concerns about oral health risks such as tooth decay due to the presence of sugar have been a concern for the manufacturers to come up with the new offerings in sugar-free categories in the market. For instance, in August 2016, Wm. Wrigley Jr. Company launched a Doublemint Mints, a sugar-free gum in the spearmint and peppermint flavors.

The rising concern for health issues has increased the demand for functional variants in the market. The manufacturers are introducing new innovative, functional categories such as lifestyle, weight, oral health, and nicotine products which overshadows all other functional confectionery categories. Besides, functional product categories are demonstrating a high growth rate, beating chewing product and nutraceuticals confectionery. According to the market scenario, functional chewing gum has a CAGR of around 4.2% over the forecast period due to increasing recommendations for these products from the dental practitioners.

Segmentation by Ingredient

• Sugared Chewing Gum

• Sugar free Chewing Gum

The sugar-free products are the largest and the fastest growing ingredient segment. The market is growing at a CAGR of around 7.8% from 2017 to 2025. According to a study on the sugar-free products in the European population, it was estimated that the product could save about 130.31 USD million per year on dental care.

With increasing fitness concerns, the consumer is switching towards low calories products. This is driving the market for products which contain artificial and natural sweeteners. The manufacturers are also focusing on improving the product performance for the growing concerns over functional product categories. For instance, in 2017, Project7 launched a useful product as Midnight which is known to be fortified with Vitamin B. The above factors contributes to the rising growth of the product in the market.

Segmentation by Distribution Channel

• Convenience Store

• Super market and Hyper market

• Drug Store

• Others

The supermarket and hypermarket is the largest segment in the distribution channel category contributing a share of around 32.5% in 2017. Market growth is attributed to the significant contribution of the channel by providing a more extensive section for the confectionery products in the stores. However, the rising incidence of health issues has anticipated rising demand for the medicated product category. This, in turn, has led the super and hypermarkets to increase the visibility of these product categories.

The convenience stores segment is anticipated to record the fastest growth rate of around 7.5% from 2017 to 2025. The rising number of flavors in the product category results in increased sales of the product through convenience stores category. However, the increasing preference for different variants such as diet, functional, and flavored products by millennials and teenagers will further escalate their movement through convenience stores in the market.

Segmentation by Region

• North America

• U.S.

• Europe

• France

• Asia Pacific

• China

• Japan

• Central & South America

• Brazil

• Middle East & Africa

The Asia Pacific region is anticipated to witness significant growth, attributed to rising oral health awareness coupled with the presence of a large target population across the region. Countries, such as China and India, are contributing significantly to market growth as a result of the increasing acceptance of confectionery products from Generation Z and millennials. Rising preference for healthy chewing products has rendered a definite demand for the product in the market.

Europe accounts for the largest market contributing a share of around 32.9% by 2025. The consistent modifications in existing products are surging demand for sugar-free chewing variants such as functional, and nutraceuticals products. This, in turn, will upsurge the demand for the product. Manufacturers are focusing on launching new variants loaded with benefits. For instance, in 2017, Mondelez International introduced a series of new flavors under each of the brands such as Hollywood, Stimorol and Trident in Europe.

Competitive landscape

The market is consolidated in nature on account of the presence of few players contributing a major share. Key players in the market include Chocoladefabriken Lindt & Sprüngli, Mars, The Hershey Company, Perfetti Van Melle., LOTTE. Ferrara Candy Company, Ford Gum, Inc., HARIBO of America, Inc.

Major players are concentrating and expanding their base in economies such as China, France, and Brazil. For instance, Kraft Food had introduced its first chewing gum in the Chinese market, with the name Stride. The Kraft Food has also added eight manufacturing facilities in China.

The market players are increasing their investments in R&D activities to spur the demand in the market. For instance, a Gumlink Confectionery Company A/S invested around USD 7.89 Million for its confectionery facilities in the UK. However, the rise in the product developments incorporating the functional benefits also increases the demand for the product in the chewing gum market. For instance, In 2018, Roelli Roelli, a Swiss confectionery company launched a cannabis chewing gum for the medical uses in psychosis, anxiety and nausea.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service