China Food Robotics Market Size and Forecast By Robot Type (Articulated, Parallel, SCARA, Cylindrical), By Application (Packaging, Repackaging, Palletizing, Picking, Processing), By Payload, And Trend Analysis, 2014 - 2025

- Published: September, 2018

- Format: Electronic (PDF)

- Number of pages: 54

- Industry: Technology

Industry Insights

China food robotics market size was valued at USD 109.4 million in 2016 and is expected to grow further over the forecast period. Increasing labor costs have paved the way for automation of manufacturing, processing, and packaging activities in the food sector in the region. Developments in automation technologies have resulted in cost effective and high-quality production with increased capacity. This is also anticipated to augment the market growth. Increasing costs and wages of skilled labor are driving the industry towards adopting the robotics technology in multiple applications. Food robotics and automation solutions facilitate operational efficiencies in manufacturing process by reducing human errors.

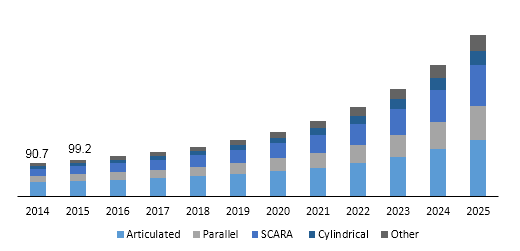

China food robotics market size, by robot types, 2014 - 2025 (USD Million)

Technological innovations are driving the demand for robotics in various industries. Automation in manufacturing process is expected to reduce the complexity of repetitive tasks thereby, improving production efficiency.

Although it has a vast application scope in the food sector, the lack of skilled workforce is leading to ineffective implementation of automation systems. The food robotics market requires technical expertise and sound knowledge to meet the operational manufacturing.

Various measures undertaken by the Chinese government for food safety are anticipated to fuel demand for automation solutions. Robotics implementation is assisting food production and processing industries in achieving production objectives and maintaining uniformity in product quality.

The value chain of China food robotics market comprises parts and components suppliers, software solution, and system integration services. The service providers cater to the robotic and automation needs of the end-customers. The components used include physical parts for handling robotics operations in the food industry. The software solutions in the industry enable operation and management of physical robotics structures.

Segmentation by Robot Type

• Articulated

• Parallel

• SCARA

• Cylindrical

• Others

The articulated robots segment accounted for the highest revenue share in 2016. This growth was attributed to the widespread applications in palletizing and material handling operations. The segment is estimated to witness a steady growth during the forecast years as these robots have a high degree of flexibility and multiple interacting arms to fit tools or grippers. They also have a variety of payload capacities, which makes them useful in the food industry.

Segmentation by Application

• Packaging

• Repackaging

• Palletizing

• Picking

• Processing

• Others

The packaging segment is anticipated to grow at a relatively high rate as compared to the other applications. High demand for packaged foods is a key factor driving the segment growth. Use of robotics systems in packaging processes helps in optimizing the production capacity, bringing efficiency in food production and processing, reducing wastage, and enhancing consistency in packaging.

The palletizing application accounted for the largest market share in China food robotics market in 2016, owing to lower operating costs and higher turnaround time and production. Palletizing refers to the process of loading and unloading heavy boxes and parts to and from pallets in food and beverage manufacturing and distribution facilities and warehouses.

Segmentation by Payload

• Low

• Medium

• Heavy

Medium payload segment is the dominant segment in the market and is expected to maintain its dominance over the forecast period. These robots usually have payload capacity between 15 kg and 80 kg. Most of the automated processes require a certain degree of flexibility to drive the changing manufacturing essentials, which is offered by these robots.

Competitive Landscape

The regional market is witnessing high competition owing to the presence of established companies offering a wide range of advanced solutions. Companies in this market compete on the basis of revenue, R&D capabilities, product portfolio, and geographic presence. Collaborations, M&A, and product development are some of the popular business strategies undertaken by the leading firms to maintain their industry position. Some of the key companies in the China food robotics market include ABB Group; Kawasaki Heavy Industries Ltd.; Yaskawa Electric Corporation; Rockwell Automation, Inc.; Mitsubishi Electric Corporation; and Staubli International AG.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service