Cloud Security Market Size And Forecast, By Type [Cloud Identity & Access Management, Data Loss Prevention (log & SIEM), Email & Web Security, Cloud Database Security (Virtualization), Cloud Encryption, Network Security (Firewall)], By Deployment (Public, Private, Hybrid), By End User (Large Scale Enterprises, Small & Medium Scale Enterprises), By Vertical (Healthcare, BFSI, IT & Telecom, Government, Retail) And Trend Analysis, 2014 - 2024

- Published: August, 2017

- Format: Electronic (PDF)

- Number of pages: 80

- Industry: Technology

Industry Insights

The global cloud security market size was estimated at 1.41 billion in 2016 and is expected to grow on account of increasing adoption of security solutions in large as well as small enterprises to protect data from illegal hackers. This software focuses on the security parameters such as data protection, compliance, governance, endpoint monitoring, identity and access, encryption, and intrusion detection.

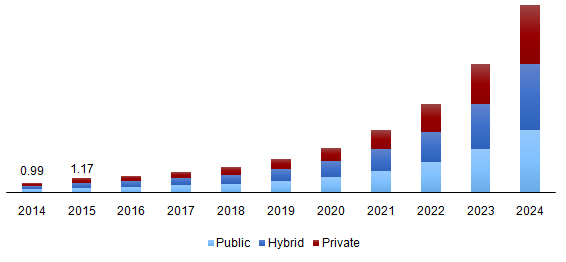

Global cloud security market revenue, by deployment, 2014 - 2024 (USD Million)

Increasing use of cloud services for data storage, data identity and email & web safety in organizations has been creating demand for the market across the globe. Moreover, implementation of these services in non-traditional sectors such as online gaming, online music stores, and social networking is expected to drive the market. Cloud security solutions are based on a secure network connection. However, numerous developing nations are equipped with slow network connections, which is expected to hinder growth.

Segmentation by Type

• Cloud Identity & Access Management

• Data Loss Prevention (log & SIEM)

• Email & Web Security

• Cloud Database Security (virtualisation)

• Cloud Encryption

• Network Security (Firewall)

Email & web security and cloud identity & access management are extensively used owing to increasing demand for high-level safety of data and identity security in organisations. In 2016, identity & access management accounted for the largest market share and was valued USD 287.3 million.

The application of email & web applications has increased across numerous organisations owing to threats, such as malware and Ransomware. For instance, in June 2017, the world has suffered ransomware which affects not only pharmaceutical companies but also many IT companies and banks. Data loss prevention is anticipated to witness considerable growth over the forecast period owing to the stringent regulatory policies by various governments to ensure efficient and effective use of technology to protect organisations and individual data.

Segmentation by End User

• Large scale enterprises

• Small & medium scale enterprises

Large scale enterprises dominated the cloud security market accounting for 58.5% of the share in 2016. These enterprises have adopted these services owing to the frequent attacks on data centres and for the protection of encrypted data.

Small & medium scale enterprises are driving growth as they are increasingly aware of the security threat. Though small and medium scale enterprises were initially slow to adopt cloud based security solutions, the availability of smaller packages has added to the growth of the market.

Segmentation by Deployment

• Public

• Private

• Hybrid

Public services held the largest market share and accounted for 35.6% in 2016. It is mostly used in large scale enterprises owing to its high cost. Public solutions are easily available, inexpensive service. However, it is not suitable for every organisation owing to limitations for security.

Segmentation by Vertical

• Healthcare

• BFSI

• IT & Telecom

• Government

• Retail

• Others

BFSI dominated the global market and accounted for USD 265.9 million in 2016 followed by IT & Telecom. Increasing digital identities in organizations and advances in cyberattacks are expected to increase their demand.

The retail industry is estimated to show considerable growth on account of increasing online shopping and enabling protection of customer sensitive data and digital identities. Demand for safety solutions in government agencies is also growing, to protect the classified data from cyberattacks.

Segmentation by Region

• North America

• U.S.

• Europe

• UK

• Asia Pacific

• China

• Japan

• Central & South America

• MEA

In 2016, North America was the largest market valued at USD 582.5 million. Early adoption of cloud security solutions and established IT infrastructure has resulted in the dominance of the market in the region over the past few years.

Followed by North America, Europe holds the second largest market share. Countries such as U.K. and France are mostly affected by cyber-attacks; hence, they are most prominent users of these solutions. Asia Pacific is expected to witness considerable growth over the forecast period owing to increasing adoption of these products in countries such as Japan, China, and India.

Competitive Landscape

The global cloud security industry consists of companies such as Trend Micro, Cisco Systems, CA Technologies Inc., Fortinet Inc., IBM Corp., Symantec Corp., Intel Corp., Sophos, and Panda Security. These players have formulated strategic alliances, partnerships, and collaborations with other industry players to stay afloat in the competitive market. Active companies in the market are adopting the strategy of merger & acquisition. For instance, in 2016, Symantec acquired Blue Coat to expand its operation in cybersecurity space.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service