Coconut Water Market Size And Forecast, by Form (Liquid, Powder), by Packaging (Tetra Pack, Plastic Bottle, Others), by Distribution Channel (Offline, Online), by Region, and Trend Analysis, 2015 - 2025

- Published: February, 2019

- Format: Electronic (PDF)

- Number of pages: 65

- Industry: Food & Beverages

Industry Insights

The global coconut water market was valued at USD 961.9 million in 2017 and is expected to exhibit growth at a CAGR of more than 25.0% from 2017 to 2025. It is a new-found phenomenon especially in North America and Western Europe, where the demand has started to take off.

The demand is expected to strengthen further over the coming years as consumers turn towards healthy low-calorie soft drinks alternatives. Coconut water is low in fats, is an effective source of amino acids, vitamins and minerals, and is considered a natural isotonic.

The demand for is emerging in the western countries including U.S., U.K., and Germany which are witnessing an increase in consumption of functional drinks, given the increasing inclination of consumers towards health and wellness products at large.

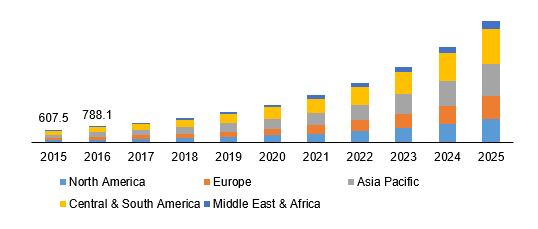

Global coconut water market revenue, by region, 2015 - 2025 (USD Million)

Segmentation by Form

• Liquid

• Powder

Liquid form coconut water is expected to reach well over USD 4.50 billion by the end of 2025. Rising awareness related to health benefits offered by coconut water due to its anti-oxidant properties is expected to add to the demand over the coming years. In addition, its consumption as sports drinks is gaining traction among consumers. To this end, recommendations from established agencies also play a vital role in spreading awareness. For instance, the American Chemical Society (ACS), has recommended coconut water as a sports drink especially for light exercise and workout.

Coconut water processed to powder form retains its natural flavor and keeps nutritional benefits intact. As powder form retains its vitamins, minerals, and medicinal properties, it is gaining traction in ready-to-drink (RTD) packaged forms among consumers.

Segmentation by Packaging

• Tetra Pack

• Plastic Bottle

In 2017, plastic bottles accounted for a share of more than 20.0% of the packaged coconut water market in volume terms. Plastic bottles packaging is available in various shapes, is easily moldable and has good recyclability.

Tetra packs, on the other hand, is expected to witness the highest CAGR of more than 25.0% in revenue terms from 2017 to 2025. Tetra packs are eco-friendly and recyclable and provide extended shelf life to coconut water.

Other packaging includes glass and metal cans. Metal cans are preferred as they provide effective oxidation protection and enhance durability. Glass and metal packaging accounted for more than 30.0% of the market revenue in 2017.

Segmentation by Distribution Channel

• Offline

• Online

Sale from offline channel accounted for more than 80.0% of the revenue share in 2017. In the offline channel, hypermarkets and supermarkets dominated the market with their network and geographical reach. These stores are positioned as a one-stop shop for everyday living essentials and carry a wide assortment of coconut water brands. Some of the popular hypermarket and supermarkets include Carrefour, Walmart, and Auchan.

Sale through the online channel is also on the rise, as consumers find it convenient and it allows product comparison and the flexibility to shop while on the go. The channel’s appeal is more in the younger generations and millennials who are among the prime consumers given their inclination towards fresh and healthy beverages. Some of the key online retailers offering coconut water include Amazon and Rakuten.

Segmentation by Region

• North America

• Europe

• Asia Pacific

• Central & South America

• Middle East & Africa

In 2017, Central & South Africa accounted for more than 30% of global volume share. Brazil and Argentina have considerable coconut farming land and have significant demand for coconut water as functional drinks.

In North America and Europe, the increasing inclination of consumers towards functional and healthy drinks is expected to benefit the market. Europe is expected to witness revenue growth at a CAGR of more than 23.0% from the period of 2017 to 2025.

In France and UK, coconut water is used as isotonic sports drink and is considered a great source of hydration after moderate exercise. Also, as per Centre for the Promotion of Imports (CBI), total consumption of coconut water in UK increased to 25 million liters in 2015. The demand is expected to remain buoyant over the coming years with its increasing adoption as an effective health drink.

Competitive Landscape

The market is highly competitive with manufacturers focusing on new product launches and business expansions. For instance, in 2018, Tropicana launched Coco Blends in North America. Mergers & acquisitions are gaining the limelight in the market. In April 2017, New Age Beverage Corporation acquired Maverick Brands LLC, the parent company of Coco Libre brand for USD 35 million.

On similar lines, in 2013, The Coca-Cola Company completed the acquisition of ZICO, one of the active players in the market. Some of the companies in the market include All Market Inc., Naked Juice Company, New Age Beverages Corporation, Celebes Coconut Corporation, C2O Pure Coconut Water, LLC, PepsiCo (O.N.E. Coconut Water), The Coca-Cola Company (ZICO), and Harmless Harvest.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service