Global Dietary Fibers Market Size And Forecast, By Source (Whole Grain Products, Fruits & Vegetables), By Product (Soluble, Insoluble), By Application (Food & beverages, Animal feed, Pharmaceuticals) And Trend Analysis, 2014 - 2025

- Published: September, 2018

- Format: Electronic (PDF)

- Number of pages: 120

- Industry: Nutraceuticals & Functional Foods

Industry Insights

The global dietary fibers market was valued at USD 3.74 billion in 2016. Increasing demand for nutritious food as a result of rising awareness towards preventive healthcare is expected to remain a key driving factor. In addition, rising prevalence of lifestyle diseases including cardiovascular disorders and obesity among adults on account of hectic working schedule is projected to promote the consumption of functional foods and thus, in turn, will fuel dietary fibers demand.

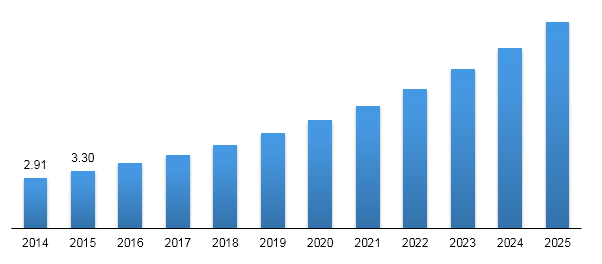

Global dietary fibers market size, 2014 - 2025 (USD Billion)

Rising popularity of functional foods for physiological benefits beyond basic nutritional requirements is expected to have a strong impact on dietary fibers demand. In addition, rising investments by manufacturers such as Danone, GSK, Arla Foods, and Cargill to incorporate fiber as key ingredient in the formulation of nutraceuticals is projected to remain a favorable trend in near future.

Functional foods are expected to witness steady rise in demand over the next few years to come. Market players are launching new product lines with dietary fibers to meet this demand. For instance, Coca-Cola Company launched Food of Specified Health Use (FOSHU) drink fortified with insoluble fiber, under the brand name, Coca-Cola Plus. The product variants are available in a package of 470 ml bottle. Such novel product launches are expected to keep the market buoyant over the forecast period.

Segmentation by Source

• Whole Grain Products

• Fruits & Vegetables

• Others

Whole grain products accounted for 41.7% of market shar ein terms of revenue in 2015. Increasing demand for whole wheat bread and biscuits, compared to flour-based products will add to the growth of the dietary fibers market. Fruits such as purple passion fruit, metamucil, orange, figs and vegetables like sweet potato, avocado, and turnip contain high levels of fibers. Growing awareness about the inclusion of these fruits and vegetables in daily diet is expected to play a key role in market growth.

Segmentation by Product Type

• Soluble

• Insoluble

The market for soluble dietary fibers was over USD 1.00 billion in 2015. Countries such as U.S., China, Japan, and India are projected to become major revenue contributors with the prevailing fiber-food consumption. These enhance immunity, enable weight management, and provide anti-inflammatory effects.

Insoluble segment held well-over three-fifth of the market share in 2015. It is expected grow in light of rising demand for functional foods and awareness regarding nutritional enrichment of packaged products such as processed meat, baked goods, and cereal bars. Insoluble dietary fibers help maintain pH balance of intestine. The segment is expected to register a double-digit growth rate during the forecast period.

Segmentation by Application

• Food

• Beverages

• Pharmaceuticals

• Others

Food industry was the largest application segment in 2015 and is projected to witness the fastest growth with double-digit CAGR from 2016 to 2025. Increasing awareness about the importance of fibers in daily meals and the growth of functional food industry at large will drive the growth.

Market for beverages is expected to cross USD 3.50 billion by 2025. Demand for functional, fortified, and convenient beverages having nutritional benefits remains buoyant given the evolving dietary habits of consumers. Rising use as functional ingredient in beverages and prebiotics is expected to propel the demand for dietary fibers in foreseeable future. Wide usage in sport and energy drinks is anticipated to further drive the segment growth over the forecast period.

Segmentation by Region

• North America

• Europe

• Asia Pacific

• Central & South America

• Middle East & Africa

In 2015, North America held around one-fourth share of the global dietary fibers market. Increasing demand for dietary fibers fortified product from U.S., and Canada is the main factor driving the regional growth. Given the busy lifestyle, consumers have increasingly included fortified beverages as an effective source of nutrients. Presence of major functional food players has added to availability of a variety of fiber rich products in the region.

Asia Pacific is expected to expand at a CAGR of well over 10.0% over the forecast period. Rising awareness about proper intake of dietary fibers to keep obesity under check and to maintain sugar levels has added to the uptake. Demand from health conscious consumers is a key trend observed in the region. A growing lot of food habit conscious consumers is avoiding unhealthy food products. This factor is anticipated to propel demand in near future. Countries such as India and China are among the key regional markets.

Competitive Landscape

Dietary fibers market is expected to become more competitive with the expected uptake over the forecast period. Companies focus on expanding their product portfolio and geographic reach. Product launches will remain a key growth strategy for most companies over the forecast period. Cargill Incorporated is one of the prominent industry participants. U.S. was the major market for the company, accounting for around 35% of revenue share in 2015.

The company is investing in emerging markets such as China and India. For instance, in December 2016, they opened a new food innovation center in China, which employed nearly 50 scientists, researchers, and nutritionists. Some other prominent companies operating in the industry include Archer Daniels Midland Company, Lonza Group AG, and Nexira, DuPont, Roquette Freres, Tate & Lyle, Grain Processing Corporation, and Grain Millers, Inc.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service