E-cigarette Market Analysis By Product (Disposable, Rechargeable, Modular), And Segment Forecasts, 2014 - 2024

- Published: July, 2017

- Format: Electronic (PDF)

- Number of pages: 60

- Industry: Electronic Devices

Industry Insights

The global e-cigarette market size was USD 7.1 billion in 2016 and is likely to observe considerable progress on account of rising consumer demand for resource efficient and eco-friendly products. Electronic cigarettes are gaining popularity across the globe as another option to conventional cigarettes filled with tobacco.

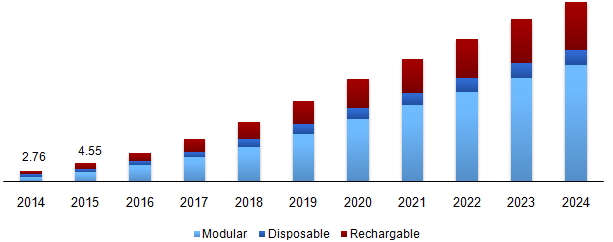

Global e-cigarettes market revenue, by product, 2014–2024 (USD Billion)

Due to the consistent design of e-cigarettes and their segregation with the vapor made by ordinary cigarettes (tobacco rolled), these are thought to have a relatively less harmful impact on health. Moreover, changing lifestyle, expanding e-commerce businesses and mergers & acquisitions between traditional cigarette and e-cigarette manufacturers are a few noted trends within the global market.

The prohibition on smoking in public places in a few nations coupled with the anti-smoking drives may affect the growth of electronic cigarette market. The key driver for the market is the less perilous effect of these products when compared with standard cigarettes; besides the increasing awareness about the ill-effects of smoking traditional (tobacco rolled) cigarettes. Factors such as availability of different nicotine levels and flavors are also portraying a role in the growth of electronic cigarettes industry.

Also, the increasing costs of standard cigarettes are also adding to the growth of the market. E-cigarettes are relatively sparing than general cigarettes as overwhelming taxes collected on cigarettes have fundamentally increased their costs.

For instance, in the UK, the Spring Budget in 2017 has resulted in the increase in the prices of cigarettes. To that end, the price of a pack of 20 cigarettes increased by 35 pence in the country ever since the Spring Budget was implemented. Even previously, UK taxation on tobacco has been the highest compared to other nations in the European Union.

However, the government in many developed countries, such as U.S., do not approve e-cigarette as a smoking cessation tool. Thus, these governments are imposing rules and regulation on the manufacturing of this product.

E-cigarettes are less harmful than tobacco cigarettes, yet there is instability concerning its long term impacts on human health. However, increasing research & development is being undertaken to match the consumer expectation and preferences, such as a variety of e-cigarette devices, flavors, and nicotine strength.

Segmentation by product

• Modular

• Rechargeable

• Disposable

Modular e-cigarettes accounted for 57% of the market share in 2016 and are anticipated to observe progress over the forecast period due to its customization and use of automizer. On the other hand, rechargeable products accounted for the second highest revenue share in the same year, followed by the disposable e-cigarette. Rising demand for rechargeable liquids and reusable devices on accounts of cost saving from consumers’ perspective is expected to drive the growth.

Disposable devices are expected to witness a loss in market share on account of recurring expenses of purchasing the products, However, the segment is expected to grow at a CAGR of 13.3% over the projected period.

Segmentation by region

• North America

• U.S.

• Europe

• UK

• Italy

• Asia Pacific

• China

• Malaysia

• ROW

North America and Europe together accounted for over 75% of the market in 2016. High prevalence of vape users in these regions as a viable solution for consumers to quit smoking has resulted in the substantial demand for these products over the past few years. Europe would be a conspicuous market all throughout the predicted period, with nations, for example, the UK and Italy being significant growth contributors.

Asia Pacific showed an increment in market share over the past few years and contributed to over 20% of the revenues in 2016. The development in Asia Pacific is driven by the expanding consumer interest in electronic cigarettes in countries such as China, Malaysia, and India. The prevailing addiction rate of tobacco in the region and changing lifestyle with increasing disposable income is expected to drive the market in the region over the coming years.

Competitive landscape

The global market is relatively concentrated in North America and Europe. However, relatively less penetrated markets in the Asia Pacific and Rest of the World presents a growth opportunity for the industry over the forecast period. The industry is marked by the presence of multiple established vendors such as Altria Group, Inc., British American Tobacco Plc, and Philip Morris International Inc.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service