Electric Bus Market Size And Forecast, By Product (Purely Electric, Plug-in Hybrid), By Region (China, Europe, U.S.), And Segment Forecast, 2015 - 2025

- Published: December, 2018

- Format: Electronic (PDF)

- Number of pages: 60

- Industry: Automotive & Transportation

Industry Insights

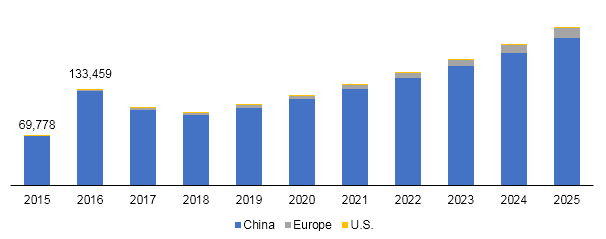

The global electric bus market demand was 108,407 units in 2017 and is expected to expand at a CAGR of 9.4% from 2017 to 2025. The growth could be attributed to subsidy allocation for purchasing these vehicles by governments of developing economies, including China and India.

For instance, the Government of China paid more than average of USD 10,000 per electric vehicle (EV) in 2017. It also announced substantial incentives to various companies, which increased production of electric buses from over 1,000 units in 2011 to 132,000 units in 2016. In addition, implementation of various policies including increased access to carpool lanes and assured permit of vehicle license adopted by the state-owned and city-based authorities is expected to drive the electric bus market. For instance, the City of Beijing exempts the lengthy process and assures licensing for EVs.

Global electric bus market demand, by region, 2015 - 2025 (Units)

Over the past few years, governments of developed economies, including U.S., Canada, and Germany, have framed numerous policies in order to promote usage of clean fuel and minimize air pollution. This has, in turn, resulted in increased spending on EVs. For instance, in 2018, Edmonton Transit Service, a Canada-based Public Transport Authority, ordered 25 new 40-foot Proterra Catalyst E2 max vehicles, winter compatible electric buses with a range of up to 400 kilometers. Furthermore, Bivab and Uddevalla, transport providers of Western Sweden, ordered two four Volvo 7900 Electric buses with a capacity of 200 kWh battery.

Exceptional benefits associated with EVs, including fuel and noise efficiency, are expected to boost market growth in future. Transit stations, including Boreal Transport of Norway, Massachusetts (U.S.), Nashville Metropolitan Transit Authority, and Worcester Regional Transit Authority, have deployed electric buses. Favorable trends towards implementation of green transit facility in order to reduce pollution and environmental impact is projected to expand market scope in future.

Increasing investments by manufacturers is expected to remain a key driving factor for the market. Companies are focusing on setting-up new manufacturing plants with reduced costs and tapping new markets. For instance, in 2017, BYD Company Ltd., a China-based electric automobile manufacturer, opened a new production facility in Komarom, Hungary, with an aim to cater to demand for electric buses and expand its market share in Europe.

Segmentation by Product

• Purely Electric

• Plug-in hybrid

Purely electric buses can store electricity on board or can be fed continuously from external sources. Onboard stored-electricity-operated buses can be categorized based on source of electricity as battery electric buses and Capabus. The former has gained popularity on account of their ability to run over 200 km with one charge and lesser price compared to their diesel-operated counterparts. However, low storage capacity of these vehicles is projected to restrain its growth in future.

A Capabus uses a double-layer capacitor as a source of power. Ongoing experiment on Capabus in China has shown that 50% of the battery can be charged in 40 seconds from any terminal. Various software companies are helping fleet operators to manage their charging schedule and operate it safely, without any unplanned stops and inconvenience to passengers.

Segmentation by Region

• China

• Europe

• U.S.

China held a prominent share in the global electric bus market. As of 2017, the country deployed 99% of electric buses, with more than 385,000 buses on the road, which accounted for 17% of the country’s total fleet. India and Japan are also projected to witness significant growth in the market.

In Europe, countries such as U.K., Germany, France, and Netherlands are expected to remain potential markets. In 2015, the U.K. government launched double-decker electric buses in London. The government of Netherlands is also encouraging 100% sales of zero-emission vehicle (ZEV) public transport by 2025. Environmental benefits of these vehicles, including zero carbon emission, are encouraging governments of European Union to promote their usage.

Competitive Landscape

Major manufacturers operating in the electric bus industry include Volvo Group; Proterra Inc.; EBUSCO; New Flyer Industries Inc.; King Long United Automotive; BYD Company Ltd.; Belkommunmash; Yutong; Solaris Bus; and Alexander Dennis Limited. Manufacturers are adopting various strategies such as mergers and acquisitions and establishment of new facilities. For instance, Proterra Inc. opened a new manufacturing facility in Los Angeles, U.S., in order to cater to rising demand for transit electric buses in the country.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service