Electric Winch Market Size and Forecast, By Application (Automotive, Industrial, Marine), By Region (North America, Europe, Asia Pacific, Central & South America, Middle East & Africa) and Trend Analysis, 2015 - 2025

- Published: October, 2018

- Format: Electronic (PDF)

- Number of pages: 80

- Industry: Electronic Devices

Industry Insights

The global electric winch market size was valued at USD 2.89 billion in 2017. Growing millennial interest in adventure sports such as wakeboarding, snowboarding, waterboarding, as well as All-terrain Vehicle (ATV) mount is expected fuel demand for electric winches over the forecast period.

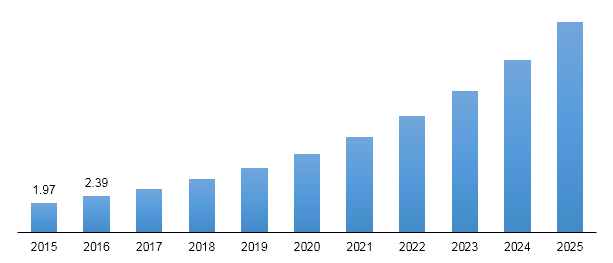

Global electric winch market revenue, 2015 - 2025 (USD Billion)

Rising demand for electric winches is attributed to the growth of shipping, construction and landscape industries where winches are used for their high quality and dependable operations. High performance, proven reliability, and simple operations of winches is set to drive the growth in terms of application.

The product is anticipated to witness significant rise in demand from drilling oil fields, since the requirement for crude oil and rig counts has been witnessing a growth over the past few years. Rising demand for Floating Production Storage and Offloading (FPSO) vessels as a result of improvement in petroleum sector in major oil producing nations including U.S., Russia, and U.K. is expected to have a positive impact.

The strong foothold of gear, electric motor, and solenoid suppliers coupled with low manufacturing costs in developing countries including China and India is expected to force the electric winch suppliers to establish their strategic business units in vicinity. However, raw material suppliers are expected to charge product manufacturers and vendors in accordance with the pricing dynamics of commodities such as steel, cast iron, and aluminum over the next eight years.

Companies including Superwinch, Hampton Products International, Ingersoll Rand, and Polaris Industries are some of the key manufacturers in the global electric winch market. These companies supply their products through numerous distribution channels including third-party agreements with vendors and wholesalers, direct supply agreements with buyers, wholesalers, and e-commerce portals.

Rising importance of e-commerce portals in an attempt to ensure the supply of finished goods to buyers due to benefits such as price discounts and timely delivery of products may promote the purchase of winches through online retailers such as Grainger and IndiaMART. Buyers are expected to use electric winch as a mechanical movement tool in operations and maintenance applications. However, the high prices of electric winches as compared to mechanical product forms is expected to encourage buyers to opt for better alternatives.

Improvements in the oil and gas sector in U.S. as a result of rising production of unconventional shale gas and tight oil sources is expected to promote the utility of FPSO. Furthermore, rising spending on the development of Liquefied Natural Gas (LNG) in Qatar, UAE, China, and Australia is expected to further boost the application of winches. The abovementioned favorable trends are expected to force manufacturers to develop customized value-added products in near future.

Segmentation by Application

• Automotive

• Industrial

• Marine

• Others

Automotive was the largest application segment, accounting for 45.4% of global market share in terms of revenue in 2017. Rising production output of automobiles in emerging markets including China, India, and Mexico is expected to increase adoption of the product over the next eight years.

Marine accounted for 33.9% of global market share in 2017. It is expected to account for 35.2% of total revenue share by the end of 2025. Rising spending on the improvement of shipping infrastructure on account of inclusion of new projects such as the China Pakistan Economic Corridor (CPEC), Chabahar Airport, and National Infrastructure Plan (NIP) by governments of China, Pakistan, India, Iran, and Mexico is expected to open new markets.

Segmentation by Region

• North America

• Europe

• Asia Pacific

• Central & South America

• Middle East & Africa

North America is set to be the largest platform for electric winches in near future owing to strong foothold in automotive, military operations, shipping yards, and ATV mounts. Growth of automotive industry is anticipated to boost the market growth. Implementation of winches saves time, human workforce, and offers mass production for global as well as regional consumers.

Asia Pacific is expected to remain the fastest growing market, witnessing a CAGR of 23.6% from 2017 to 2025. This expansion is attributed to the improvement of transportation sector including automotive and marine sectors in countries including China, India, Taiwan, and Japan.

Competitive Landscape

The electric winch market is moderately competitive with companies expanding their product portfolio and production capacity to serve growing demand, particularly in the emerging regions. The market is characterized by new entrants with their own products and existing companies investing heavily on R&D initiatives.

For instance, in 2016, KA-Winch launched a 100% electric winch named “VoltPro winch”, which has low noise and is completely emission free. The product is powered by 6.5 hp electric engine and is supplemented with a 300 m Dyneema winch rope. Voltpro was developed especially for urban wakeboarding and is capable of deep water starts. It can achieve speed of up to 35 km/hr on water.

Some of the prominent players operating in the market are KA-Winch; Verlinde Lifting Equipment; Powertek Equipment Co.; Ingersoll-Rand plc; Warn Industries, Inc.; Hampton Products International; Polaris Industries, Inc.; Northern Tool + Equipment; and Harbor Freight Tools.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service