Ethernet Cables Market Analysis By Type (Copper Cable & Fiber Optic Cable), By Application (Industrial, Broadcast, Enterprise, IT & Network Securities, Others) And Trend Analysis, 2014 - 2024

- Published: August, 2017

- Format: Electronic (PDF)

- Number of pages: 65

- Industry: Technology

Industry Insights

The global Ethernet cables market size is expected to reach USD 1.42 billion in 2024. The growing demand for high-speed internet connectivity on account increasing implementation of automation across industries is expected to fuel the market over the forecast period.

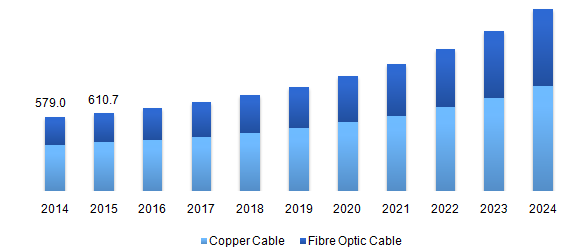

Global Ethernet cables market revenue, by type, 2014 - 2024 (USD Million)

Traditionally the industrial networks were managed separately from enterprise networks, and they were communicating via different switches routers and protocols. Enterprise networks include data routing, e-mail networks, Internet & intranet servers.

However, with the implementation of Ethernet cables across all network layers has allowed a reliable, fast and real-time communication of data. They can carry data from factory floors to the enterprise resource planning layers with higher bandwidth, and as a result of these, the market for Ethernet cable is anticipated to grow over the forecast period.

The introduction of Li-Fi technology and increasing demand for wireless internet connectivity is expected to hinder the growth of the market globally. However, the emergence of power over Ethernet coupled with increased installation of data centers is anticipated to enhance the growth of the global market.

Segmentation by Type

• Copper Cable

• Fibre Optic Cable

Copper cable dominated the global market and is growing at a CAGR of 10.0% over the forecast period owing to its ability to provide high-speed connectivity at a low price, and are the most viable choice in industrial applications. However, it is estimated that the fiber optic cable is expected to grow significantly over the forecast period due to benefits provided by it such as long distance connections, higher speed & durability and high efficiency of the internet.

At present network and internet connectivity has become a necessity for the growth of the industry. Ethernet lines deliver more speed as compared to other networking techniques such as Bluetooth technology & wireless communication.

These lines offer benefits as they allow operators to transfer data flawlessly within any setting at any given period. Moreover, there is a broad range of copper product types available with different transmission speed. As a result of technological advancement, CAT6 & CAT7 Ethernet cables were launched which has a transfer speed of 1000 Mbps. Also, they transfer data easily from long distances with fewer interruptions and provide reliable connectivity.

Segmentation by Application

• Industrial

• Broadcast

• Enterprise

• IT & Network Security

• Others

The industrial segment accounted for 36.1% of the total revenue share in 2016. The industrial line network was primarily used to increase office-level infrastructures and to transfer large data packets at great speeds. However, rising demand for Ethernet lines on account of their high connectivity and low cost is expected to grow the global market in this segment. Moreover, due to high competitiveness, many industries are upgrading to advanced industrial automation to maximise their output, economy, and quality of the products which are expected to fuel the market over the forecast period.

Ethernet cables are one of the crucial parts used for broad connectivity of several systems in various industries. They provide solutions for efficient consistency and networking. They are selected by keeping in mind different criteria such as data transfer requirements, solution requirement, type of equipment and environment.

The use of numerous advanced technologies, such as big data, Internet of things (IoT), Industry 4.0 and cloud computing requires the use of Ethernet lines among industries. As numerous organisations are shifting towards Ethernet compatible solutions, these lines have a high demand among the end-user industries such as power, oil & gas, chemicals & petrochemicals, and mining which are expected to boost the market over the forecast period.

Broadcast application segment is anticipated to grow at a CAGR of 10.8% owing to the demand in media and telecast activities. Furthermore, there has been a significant growth in the enterprise and residential market due to increasing adaptability of internet connections across the globe.

Segmentation by Region

• North America

• U.S.

• Europe

• Germany

• UK

• Asia-Pacific

• China

• India

• Rest of the World

In 2016, Asia Pacific accounted for the highest revenue share and was valued at USD 230.4 million and is expected to maintain its position over the projected period as a result of increasing population and industrial activities. China has the highest demand for fiber optic cables owing to growing demand for high-speed internet and efficient connectivity solutions. Moreover, upgrade of industrial operations and increasing disposable income in potential markets are the key factors which are expected to drive growth.

Competitive Landscape

The major players in the market emphasis on extension of their business operations in developing economies with mergers and acquisitions as a preferred strategy. Ley players include Belden Inc., Siemon, Nexans, SAB Bröckskes, Rockwell Automation, General Cable Technologies Corporation, Hitachi Ltd., Prysmian Group, Schneider Electric, Siemens AG, and Anixter Inc.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service