Europe Chlorinated Rubber Market Size and Forecast, By Product (Low Viscosity, Medium Viscosity, High Viscosity), By Application (Adhesive, Traffic Paint, Marine Paint), And Trend Analysis, 2013 - 2025

- Published: September, 2018

- Format: Electronic (PDF)

- Number of pages: 51

- Industry: Plastics, Polymers & Resins

Industry Insights

Europe chlorinated rubber market size was valued at USD 3.91 billion in 2017. Growing applications in container paints, swimming pool paints, fabric coatings, fireproof paints, and marine paints are expected to augment market growth over the forecast period. Properties of chlorinated rubber such as resistance to abrasion, weather, mildew, and fire make it a suitable elastomer in paints and adhesive industry.

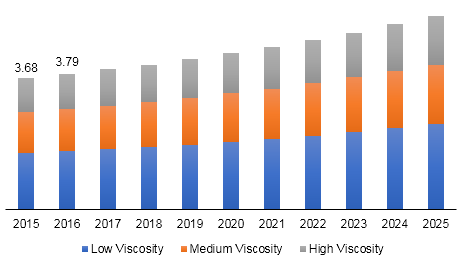

Europe chlorinated rubber market size, by product, 2013 - 2025 (USD Billion)

Growing demand for paints with fast-drying and wear resistance properties produced using chlorinated rubber is expected to add to the growth of the market over the forecast period. Presence of chlorine content induces incombustible properties, which promote its use as a core ingredient in the formulation of anti-corrosive and fire-resistant paints.

Growing awareness regarding adverse effects of synthetic chemicals has resulted in the advent of eco-friendly production methods. For instance, Shandong Tianchen Chemical uses eco-friendly, aqueous phase suspension method for the production of chlorinated rubber resin. This factor is likely to have a positive impact on the market growth. European countries are working towards strengthening road safety regulatory framework. Thus, traffic marking coating segment is expected to play a key role in increasing the usage of the product as a functional ingredient.

In addition, demand for anti-corrosive paints in automotive, construction, and marine sectors is expected to spur market growth in the forthcoming years. Stringent government regulations related to the production of paints made from natural materials will also drive the market. For instance, the European government adopted Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) initiative for the protection of environment and human health from the risks posed by chemicals.

Natural rubber is a precursor for the production of chlorinated rubber. Thus, growing need for natural rubber, on account of rising demand from widespread applications including automotive and construction, would drive the market. As of 2017, over 90% of natural rubber was exported from South East Asian countries including Thailand, Indonesia, Malaysia, and Vietnam. In 2017, the European Commission (EU) listed it as a critical raw material. Sustainable supply of natural rubber for the production of chlorinated rubber in European Union is expected to drive the market over the expected period.

Segmentation by Product

• Low Viscosity

• Medium Viscosity

• High Viscosity

In 2017, low viscosity products accounted for more than two-fifth of the overall Europe chlorinated rubber market. Growing demand from high-end printing ink application is expected to promote the consumption of low viscosity product over the forecast period. High chemical resistance and durability is expected to drive the medium viscosity segment, particularly in agricultural and industrial applications.

Moreover, growing applications in marine paints will further drive the segment. Applications in traffic paint and adhesives is expected to drive the high viscosity product segment over the forecast period. Underlying adhesion properties coupled with effective mechanical strength makes it ideal for adhesive applications.

Segmentation by Application

• Adhesive

• Traffic Paint

• Marine Paint

Chlorinated rubber prevents permeation of water, vapor, and oxygen, which makes it suitable for coatings in swimming pools and filming applications. In 2017, adhesive accounted for more than one-fourth of the Europe chlorinated rubber market. Increasing renovation activities in commercial and residential infrastructure is expected to boost product demand in carpet laying, countertop lamination, pre-finished panels, and flooring. Effective bonding and mechanical strength is also expected to augment demand in near future.

Introduction of waterborne coatings, solid coatings, and radiation-curable coatings is expected to drive demand for chlorinated rubber in traffic paints application. Traffic paint manufacturers are also developing temperature-sensitive paints, which can withstand adverse environmental conditions, such as snowfall and heavy rains. Growing adoption of condition-based monitoring instead of breakdown maintenance in marine industry is expected to play an important role in boosting the market growth. In addition, the product offers protection against fouling, corrosion, and external contamination, which makes it apt for use in marine paints.

Competitive Landscape

Prominent companies operating in the Europe chlorinated rubber market include include Covestro, Shandong Tianchen Chemical, Rishiroop Group, Bech Chem, LLC, Xiangshui Ruize Chemical Co. Ltd., and Fenghua Yuron Chemical Industry Material Co., Ltd. These companies focus on new product development to gain competitive edge and expand their business. For instance, Covestro launched Pergut, a water and microbes-resistant product used in highly durable coatings.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service