Global Fava Beans Market Size And Forecast, By Application (Human Nutrition, Animal Feed), By Distribution Channel (Online, Offline), By Region, And Trend Analysis, 2019 - 2025

- Published: March, 2019

- Format: Electronic (PDF)

- Number of pages: 65

- Industry: Nutraceuticals & Functional Foods

Industry Insights

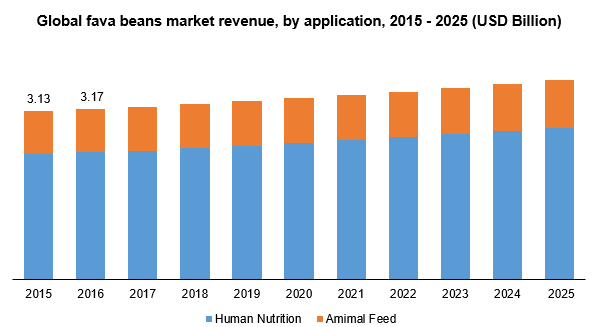

The global fava beans market was valued at USD 3.20 billion in 2017, is expected to grow at a CAGR of 1.9% from 2017 to 2025. The drive towards maintaining a healthy lifestyle by way of healthy eating trend coupled with the increasing awareness about the benefits associated with fava beans has spurred market growth. These beans are positioned as a rich source of protein which has resulted in increased demand from the fitness-conscious consumers.

Fava beans, also known as faba beans, bell beans, and broad beans, contain a variety of nutritional ingredients such as protein, vitamin K, vitamin B-complex, potassium, zinc, copper, selenium, iron, magnesium, and fiber.

The increasing popularity of vegetarianism in countries such as the U.S., Germany, UK, and France as a result of rising concerns related to adverse effects associated with the consumption of meat products is expected to increase the importance of broad beans in the formulation of functional foods.

Segmentation by Application

• Human Nutrition

• Animal Feed

Application in human nutrition dominated the market accounting for more than 75.0% of global revenue in 2017. The rising popularity of vegetarianism coupled with the trend of healthy eating is driving demand for broad beans as these are a rich source of nutrients. In the coming years, increasing inclusion of these beans in the regular diet is expected to drive demand as consumption pattern continues to shift from processed meat to plant-based proteins.

Fava bean flour is also used in the production of bread and pasta. Medamis, Falafel, Bissara, and Nabet soup are among some of the popular dishes made from Faba beans. Application of fava bean in animal feed was limited due to the presence of antinutritional factors. However, the advancement in plant breeding and animal feed processing technology has reduced its presence. Fava beans are mainly used in the diets for poultry and pigs, however, the quantity in animal feed continues to differ based on animal species and age.

Segmentation by Distribution Channel

• Online

• Offline

The offline distribution channel dominated the market accounting for more than 90.0% in 2017. The majority of the consumers prefers to shop from offline retailers such as hypermarkets, supermarkets, and convenience stores as these outlets stock a wide variety of products available at varying price points.

The online channel is expected to be the fastest growing segment at a CAGR of more than 3.0% from 2017 to 2025. Over the past few years, the online channel has become significantly popular among consumers who prefer convenience and shop on-the-go. A wide variety of fava beans including whole, unpeeled, and cooked are sold through online portals such as Amazon. The trend is gaining traction in Asia Pacific, where faba beans are consumed as snacks.

Segmentation by Region

• North America

• Europe

• Asia Pacific

• Central & South America

• Middle East & Africa

Asia Pacific was the largest market accounting for more than 40.0% in 2017. In countries such as India and China, it is an important ingredient in several traditional dishes. Growing consumption of roasted seeds as a low-fat snack in India and neighbouring countries is among the factors driving demand in the region. China and Australia are among the key fava beans producing countries globally.

North America is projected to grow at a CAGR of more than 2.0% from 2017 to 2025. The rising importance of plant-based protein products in the U.S. and Canada on account of the increasing concerns over glutamic disorders and lactose intolerances is expected to have a positive impact on broad beans consumption. Also, the high obesity rate in the U.S. is expected to support the demand of these beans as low-fat protein alternatives.

Competitive Landscape

Some of the key competitors include GrainCorp Limited, BI Nutraceuticals, Dunns (Long Sutton) Limited, Centre State Exports Pty Ltd, Sun Impex B.V., Nuttee Bean Co., and Prairie Fava. The major exporting countries include Australia, China, Ethiopia, France, France, Egypt, Germany, Saudi Arabia, and the UK.

New product launches are expected to be one of the key competitive strategies for manufacturers. Manufacturers have also increased their spending on developing new fava beans-based products. For instance, in 2016, BI Nutraceuticals, a leading manufacturer of botanical ingredients, launched two protein powders - Faba Bean Protein Concentrate 80% and Deflavored Faba Bean Protein Concentrate 60%.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service