Global Flavors And Fragrances Market Size and Forecast, By Product (Natural flavors & fragrances, Aroma Chemicals), By Application (Flavors, Fragrances) And Trend Analysis, 2014 - 2025

- Published: August, 2018

- Format: Electronic (PDF)

- Number of pages: 350

- Industry: Food & Beverages

Industry Insights

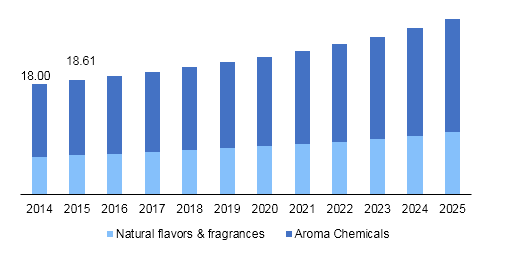

The global flavors and fragrances market size was valued at USD 18.61 billion in 2015. It is anticipated to expand at a substantial CAGR of 4.5% during the forecast period. Growing demand for food and beverage and natural personal care products created using various aromatic compounds and essential oils is expected to drive the market in near future.

Flavors & fragrances market revenue, by product, 2014 - 2025 (USD Billion)

Rising demand from cosmetics and toiletries and food and beverages is anticipated to drive the global market at a notable pace. Food and beverage is projected to expand at a high CAGR in near future owing to demand for processed food, ready-to-eat meals, juices, snacks, and beverages. Mounting global demand for food and beverages is anticipated to bode well for market expansion during the forecast period.

Rising adoption of flavors in pharmaceuticals, nutraceuticals, and dietary supplements is also projected to augment market in near future. Natural fragrances are considered to be therapeutic, healthier, and safe. Manufacturers sometimes charge a “green premium” on products developed using natural aromas. Rising awareness regarding health and wellness is anticipated to boost adoption of natural flavor ingredients over the forecast period.

Segmentation by Product

• Natural Flavors & Fragrances

• Essential Oils

• Orange

• Corn Mint

• Eucalyptus

• Pepper Mint

• Lemon

• Oleoresins

• Paprika

• Black Pepper

• Turmeric

• Ginger

• Others

• Aroma Chemicals

• Esters-based

• Alcohol-based

• Aldehyde

• Phenol

• Others

Aroma chemicals are anticipated to hold the largest market share of more than 70.0% by 2025. Rising awareness regarding fitness and changing consumer lifestyle are predicted to provide lucrative prospects for aroma chemicals. Furthermore, rising investments in development of fragrance composites is anticipated to propel demand in near future. The segment is further categorized into esters, alcohols, phenols, aldehydes, and others. Aroma chemicals are crucial to enhance flavor and appeal of products. Esters emerged as the largest contributor with more than USD 5.0 billion in terms of revenue in 2016. Esters render pleasant aromas and are increasingly being used in perfumes and other products owing to their pleasant aromas.

Natural flavors and fragrances segment is expected the fastest expansion at a CAGR of 4.9% from 2016 to 2025. This growth can be attributed to a significant shift towards natural products, especially in emerging countries. The segment is further categorized into essential oils, oleoresins, and others. Essential oils is expected to emerge as the fastest growing as well as the largest segment. Rising demand for exotic essential oils in aromatherapy, pharmaceuticals, and natural cosmetics is projected to propel the demand over the forecast period. Demand for functional fragrances and natural oil-based perfumes is anticipated to remain high in near future. Thus, many exotic essential oils like, lavender, rosemary, geranium, junipers, and sandalwood are finding applications in new blends.

Segmentation by Application

• Flavors

• Fragrances

Flavors accounted for 52.5% of market share in 2015. By 2025, it is projected to reach a revenue share of 54.1%. Food and beverage industry is anticipated to register high demand on account of growing application in convenience foods and functional beverages. Increasing investment in R&D for products catering to home care, hospitality, personal care, and pharmaceutical industries is expected to further drive demand. Busy lifestyles in developing and developed economies are projected to boost hospitality and food processing sectors. Rising number of retail outlets providing ready-to-eat meals is expected to further augment growth of the flavors and fragrances industry.

Fragrances is predicted to be the fastest growing application segment in terms of revenue from 2016 to 2025. Growing usage in domestic and commercial food and beverage applications is expected to be a major driving factor. Demand for flavors in beverages is projected to expand at the highest CAGR over the forecast period. It is anticipated to be valued at USD 4.43 billion by 2025. New product launches coupled with high demand for functional beverages and juices is projected to further boost expansion over the forecast period.

Segmentation by Region

• North America

• U.S.

• Europe

• Germany

• U.K.

• France

• Asia Pacific

• China

• India

• Japan

• Middle East & Africa

• Saudi Arabia

• Central & South America

• Brazil

North America accounted for 25.2% of market share in 2015 and is anticipated to expand at a substantial CAGR over the forecast period. Europe and North America together held more than 50.0% of global market share. The regions are predicted to register significant growth over the forecast period owing to strong presence of cosmetics industries.

Asia Pacific is anticipated to hold 33.2% of total market share by 2025. It is anticipated to expand at the maximum CAGR of 6.5% from 2016 to 2025. Rapid growth of flavors segment in emerging economies such as India and China on account of mounting application in pharmaceuticals, food processing, dietary supplements, and nutraceuticals industries is anticipated to bode well for regional expansion.

Soaring demand for exotic flavors coupled with changing consumer preference is expected to further augment regional flavors and fragrances market. India, Thailand, and other South Asian economies along with Africa are the major exporters of natural flavors and prominent cultivators of essential oils and oleoresins. Although these countries are the major producers, lack of awareness and high prices have led to decreased regional demand. Middle East and Africa is anticipated to witness a CAGR of more than 10.0% during the forecast period.

Competitive Landscape

The flavors and fragrances market is marked by the presence of well-established players such as Biolandes SAS, doTerra International, Young Living Essential Oils, and Symrise AG. The companies have established themselves as the leading players by adopting strategies such as mergers and acquisitions, partnerships, and innovative expansion of existing product portfolios. Companies such as BASF SE, Symrise AG, and Vigon International, Inc. are expected to emerge as the key market players owing to their business strategies such as expansion of product portfolio, acquisitions, mergers, and partnerships.

Industry participants focus on product innovations and implement initiatives for developing cost-effective products to capture maximum market share. For instance, Symrise diversified its product portfolio for natural beverage flavors through the acquisition of California-based Flavor Infusion. Furthermore, majority of companies are focusing on integration of operations to provide raw materials along with the manufactured products to reduce raw material procurement and operational costs.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service