Fructo Oligosaccharides (FOS) Market Size And Forecast, By Source (Inulin, Sucrose), By Application (Food & Beverages, Infant Formula, Dietary Supplements, Animal Feed, Pharmaceuticals), And Segment Forecast, 2013 - 2024

- Published: September, 2018

- Format: Electronic (PDF)

- Number of pages: 120

- Industry: Nutraceuticals & Functional Foods

Industry Insights

The global Fructo Oligosaccharides (FOS) market size was estimated at USD 1.15 billion in 2015. Increasing consumer awareness regarding high prevalence of chronic diseases such as high blood pressure, diabetes, gut problems, and rickets is projected to propel product demand. In addition, rising consumption of functional foods, particularly in developed markets like U.S. and Germany will add to demand in the near future.

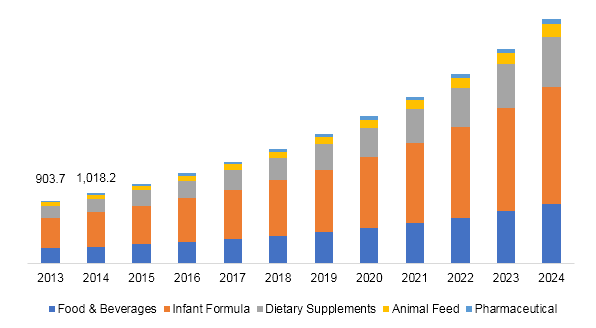

Fructo Oligosaccharides (FOS) market size by application, 2013 - 2024 (USD Million)

FOS belongs to the prebiotics group and finds application as a sweetener in food and beverage industry. It improves mineral absorption and decreases levels of serum cholesterol, triacylglycerols, and phospholipids. Fructo oligosaccharide also helps in stimulating growth of nonpathogenic intestinal micro flora. Over the past few years, the U.S. Food and Drug Administration (FDA) and European Union (EU) listed it under Generally Recognized as Safe (GRAS) category, which approves for use in infant formulations.

Rising application of fructo oligosaccharides as a key functional ingredient in dairy, processed meat, soups, and chewing gums is projected to remain a favorable factor. Rising consumption of low calorie, fat free food is anticipated to have a positive impact on the FOS market. Inulin- and sucrose-based FOS are projected to remain novel dietary fibers used as functional ingredients in formulation of fat free food products.

Other applications include usage in dietary supplements, pharmaceuticals, and animal feeds. Growth of pet food industry in Asia Pacific, particularly in India and China is expected to provide growth opportunities to the FOS market over the forecast period. However, rising importance of ginger-based nutraceuticals as a stimulant for milk production among pregnant women is projected to limit scope of FOS as an ingredient. Besides, launch of new probiotic supplements can pose a threat to growth of the fructo oligosaccharides market in near future.

Segmentation by Source

• Inulin

• Sucrose

Sucrose was the largest segment commanding half of the market share in 2015. It is projected to expand at a CAGR of around 8.1% over the forecast period. Availability of raw materials in China and India owing to abundance of sugar farming land, is expected to encourage use of sucrose as a key ingredient for FOS. Inulin is projected to expand at more than 8.6% CAGR over the forecast period. Benefits such as improved digestive health and weight loss are anticipated to propel this growth over the forecast period.

Segmentation by Application

• Food & Beverages

• Infant Formula

• Dietary Supplements

• Animal Feed

• Pharmaceuticals

High infant mortality rate owing to lack of protective enzymes in infant formulas is likely to augment fructo oligosaccharides market growth. In 1990, global mortality rate of infants was 63 deaths per 1,000 live births. In 2015, the rate declined to 32 deaths per 1,000 live births. With rising knowledge and better understanding of its functions, the demand for FOS is projected to rise. Moreover, changing lifestyle coupled with rising concerns regarding health and hygiene is projected to promote adoption of functional foods. As a result, nutraceutical product manufacturers are projected to invest more in adoption of FOS as a feedstock during food processing.

Segmentation by Region

• North America

• Europe

• Asia Pacific

• Latin America

• MEA

Europe accounted for two-fifth of total market share in terms of volume in 2015. Increase in baby food consumption and presence of key manufacturers of infant formula such as Abbott Nutrition and Danone is projected add to the market growth. Asia Pacific followed Europe in 2014, accounting for around 37.0% of global market share. Market players such as Cargill and FrieslandCampina are investing in R&D and implementing technologies for fish feed, bio-industrial products, animal nutrition, and meat protein. Asia Pacific is a key market and is projected to cross billion-dollar revenue mark by 2025. Growing demand for functional food from developing economies such as India, China, Japan, and Indonesia is projected to have a positive impact on the market expansion in near future.

Competitive Landscape

Presence of a large number of manufacturers has led to high competitive rivalry in the market. Given the production of sucrose in China and India, there is a high concentration of FOS manufacturers in the region. Some of the key manufacturers in the fructo oligosaccharides industry include Cargill; BENEO-Orafti SA; Cosucra Groupe Warcoing SA; Roquette Frères; Jarrow Formulas; Meiji Holdings Co.; Baolingbao Biology, Co.; Cheil Foods & Chemicals, Inc.; Nutriagaves De Mexico SA de CV; and GTC Nutrition.

Market players are involved in research to develop technologies for large scale production of FOS. In October 2014, Roquette Frères inaugurated a high-technology pharmaceutical application development center in Pas de Calais, France. This move is expected to strengthen their position as a supplier of excipients and active ingredients to pharmaceutical industry. In addition, high cost is another major issue faced by market players. Sucrose is used as a major source of FOS owing to its easy availability and low cost unlike inulin, which is costly and highly dependent on climatic conditions. With development in production techniques, demand for fructo oligosaccharides is expected to grow over the forecast period.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service