Germany Clinical Trial Supplies Market Size and Forecast, by Phase (Phase I, Phase II, Phase III), by Products & Services, by End-use, by Therapeutic Use, And Trend Analysis, 2014 - 2025

- Published: September, 2018

- Format: Electronic (PDF)

- Number of pages: 78

- Industry: Medical Devices

Industry Insights

Germany clinical trial supplies market size was valued at USD 115.5 million in 2017 and is projected to grow further during the forecast period. Increasing prevalance of diseases, such as cancer and HIV, along with rising number of clinical trials are projected to support the market growth. Upsurge in biologics and biosimilar drugs are also anticipated to contribute toward the market growth. Around half of the phase I clinical trials remain outsourced and the phenomena is projected to increase further on account of globalization of clinical trials.

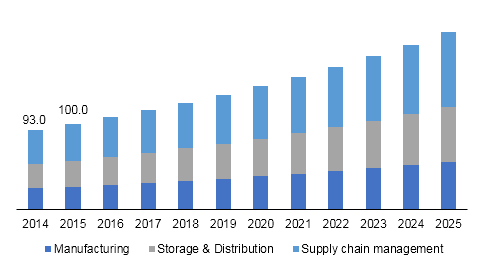

Germany clinical trials supplies market size, by product & service, 2014 - 2025 (USD Million)

Complexity in the conduction of clinical trials is driving the growth of clinical supply depots, courier companies, and comparator sourcing companies with courier companies showing considerable growth. Rising R&D in biologics and biosimilars will lead to a rise in demand for cold chain facilities. In addition, demand for biosimilars in Germany will spur the growth in cold chain supply.

Increasing complexity in clinical trials has resulted in the adoption of new technologies in Supply Chain Management (SCM). This is primarily due to the rising need for software solution for inventory management, supply chain planning, and ancillary SCM processes. Demand for comparator effectiveness trial is projected to increase the share for comparator drugs suppliers, which will propel the market for comparator sourcing.

Clinical trial supply market in Germany falls within the purview of prevailing regulatory framework. Given the regulatory framework, the market is subject to the varying regional regulations and ethical dilemmas. There exist ample opportunities in oncology segment for the market owing to the growing cases of cancer and increasing number of clinical trials being conducted. Clinical supplies can save up to one-fourth the cost.

Segmentation by Phase

• Phase I

• Phase II

• Phase III

Phase III was the largest segment and is projected to be the fastest-growing segment over the over the forecast period. Phase III trials require SCM and are usually outsourced. Outsourcing in this segment is expected to increase over the coming years because of a growing number of investigational drugs advancing to the next phase. This trend is expected to stimulate the demand for efficient supply chain and logistics in the country, thereby contributing to the market growth.

Other areas, such as Cardiovascular Diseases (CVDs), central nervous system, infectious diseases, and oncology have the largest number of phase I projects. This prevailing volume of activity will increase the complexities in the supply chain of clinical trials, thereby boosting the demand for Germany clinical trial supplies market. Growing number of sponsored and non-sponsored trials in phase II along with the complexities associated with phase II trials is also likely to drive the market.

Segmentation by Product & Service

• Manufacturing

• Storage and Distribution

• Supply Chain Management (SCM)

Supply chain management held the largest revenue share of the products and services segment in 2017. Growing adoption of inventory management software, third-party logistics, and ancillary supply management is attributed to the growth of SCM. Storage and distribution is expected to be the fastest-growing segment, in terms of revenue, during the next few years.

Storage and distribution is one of the major concerns in the industry. Rise in biologics pipeline and temperature-sensitive drugs are likely to increase the complexities related to logistics in Germany clinical trial supply market. Manufacturing includes drug and placebo manufacturing, comparator sourcing, and labeling and packaging.

Segmentation by End-use

• Pharmaceutical

• Biologics

• Medical Devices

• Others

Pharmaceutical segment held the largest revenue share in 2017. The biologics segment is projected to be the fastest-growing segment in terms of revenue during the forecast period. The demand for safe, efficacious, and cost-effective medicines is likely to augment demand in pharmaceutical drugs development. Biologics segment has gained a fair share in the recent years owing to increase in demand for effective drugs with lesser adverse effects.

Segmentation by Therapeutic Use

• Oncology

• Central Nervous System (CNS)

• Cardiovascular

• Infectious disease

• Metabolic disorders

• Others

Oncology held the largest revenue share in 2017. It is projected to be the fastest-growing segment, in terms of revenue, during the forecast period. Since oncology drugs are temperature-sensitive, they require appropriate distribution, which is expected to fuel the demand for cold chain distribution. Clinical trials for the CNS disorders are quite complex. Some of the CNS disorders include Alzheimer’s disease, Parkinson’s, epilepsy, and migraine. Increasing cases of CNS diseases will drive the segment.

Competitive Landscape

Germany clinical trial supplies market is marked by the presence of established companies such as PAREXEL International Corporation, Almac Group Ltd., and Movianto GmbH. Heavy investments in R&D, collaborations, and strategic partnerships are some of the key strategies undertaken by most of the industry participants. For instance, in 2016, The Almac Group collaborated with Exostar LLC, a leading provider of cloud-based and identity access management solutions to offer Federated Authentication access and Single SignOn to eClinical applications that used to support clinical trials.

The collaboration has helped strengthen Almac’s global client base. In May 2017, Catalent Pharma Solutions announced an agreement with Therachon AG, a biotechnology company, to support preclinical, as well as clinical, development of novel protein TA-46 for the treatment of achondroplasia, a common type of short-limbed dwarfism.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service