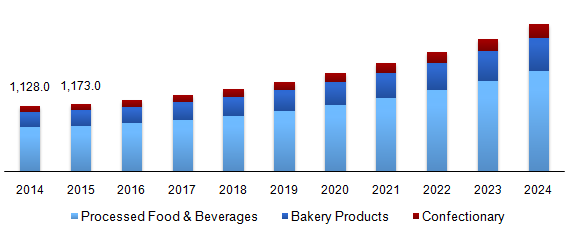

Halal Food Market Size and Forecast, By Application (Processed Food & Beverages, Bakery Products and Confectionary), and Trend Analysis, 2014 - 2024

- Published: August, 2017

- Format: Electronic (PDF)

- Number of pages: 82

- Industry: Food & Beverages

Industry Insights

The global halal food market is expected to reach USD 2.55 trillion by 2024. The growing demand for the consumption by other communities is a leading factor which is anticipated to fuel market growth over the forecast period.

Global halal food market revenue, by application, 2014 - 2024 (USD Billion)

Additionally, the halal certified food assures that the product is clean and safe for consumption and is prepared in a hygienic manner. The rising concern over the health and hygiene is one of the key factors which is adding to the growth of the market at large.

There is a rise in the Muslim population, especially their younger demographics in countries such as India and Indonesia, which is expected to add to the growth of the market over the forecast period. There is also an increase in the prevailing awareness about halal food among consumers in both Muslim and non-Muslim communities. To that end, besides Muslim population, the demand has grown within the non-Muslim community, where the positioning of these products has been portrayed as hygienic and healthy.

The global halal market of 1.8 billion Muslims (in 2015) is no longer limited to consumable products. It has now expanded its presence into other markets such as cosmetics and pharmaceuticals including service sector components such as marketing, logistics, and packaging.

The absence of a uniform standard across countries makes it challenging for vendors to get their products certified. Also, the industry is fragmented in nature, which makes it further challenging for multiple vendors to operate in different countries. In the market, there is also a need for an oversight on the halal food industry considering the meat scandals in Europe and North America regions.

Segmentation by Application

• Processed food & beverages

• Bakery products

• Confectionary

The halal market has witnessed a global evolution in the supply and demand channels of its products & services. To that end, these products are increasingly available in various stores including hypermarkets and supermarkets. Halal food is also available through online platforms such as midamarhalal.com and mullaco.com. In an attempt to entice consumers, producers in western countries are providing a wider range of products to customers.

Processed food & beverages segment dominated the industry contributing USD 836.6 billion in 2016. The growing demand for halal food for convenience as there has been an increasing acceptance of pre-cooked items are expected to fuel growth over the forecast period. Bakery products formed the second largest segment with an increasing demand for ready to eat and packaged products.

Segmentation by Region

• Americas

• Europe

• Turkey

• Asia Pacific

• Indonesia

• India

• Middle East

• Saudi Arabia

• Africa

• Egypt

The leading markets are Asia Pacific and Middle East regions, which have a considerable concentration of the around 1.8 billion global Muslim population (in 2015). Asia Pacific dominated the market by contributing USD 594 billion in 2016, with large consumer bases in multiple countries such as Pakistan, Indonesia, Bangladesh and India with the considerable Muslim population.

The market for halal food in the Americas is on the rise as well. To that end, there has been an increase in traction of the product in 2016 compared to previous years. Uptake of these products from grocery and convenience stores including Waitrose has witnessed an upward trend since 2011. In Europe, the market is expected to remain buoyant on the basis of the prevailing Muslim population. France and Britain present key growth markets as these have largest Muslim population and have witnessed a rise in the sale of these products from leading supermarket chains such as Walmart and Tesco.

Competitive landscape

The industry is fragmented in nature with the presence of both domestic and international vendors. With the current competition, vendors are focusing on differentiating their products by improving the quality of their products and occupying certificate from the halal certification organisations. The leading players in the industry are Al Islamic Foods, QL Foods, Saffron Road Food, Dagang Halal, Janan Meat, Kawan Foods, Cargill, Prima Agri-Products, Nestle and Cleone Foods.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service