High-Brightness (HB) LED Market Size and Forecast, By Application (Consumer Electronics, General Lighting, Automotive, Signals & Signage), and Trend Analysis, 2014 - 2024

- Published: August, 2017

- Format: Electronic (PDF)

- Number of pages: 60

- Industry: Semiconductors & Electronics

Industry Insights

The global high-brightness (HB) LED market was valued at USD 15.6 billion in 2016 and is expected to grow on account of its increasing demand in various applications including lighting for automobiles and electronics. Increasing sales of these segments are expected to provide an impetus to the growth of the market over the projected years.

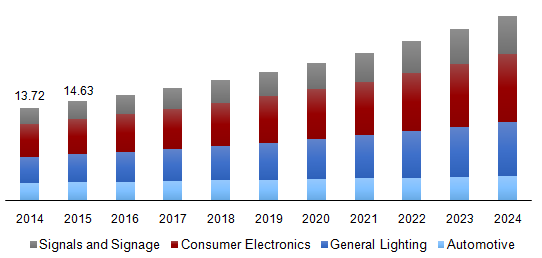

Global HB LED market, by application, 2014 - 2024 (USD Billion)

The majority of the LEDs available commercially offer a lifespan of 50,000 to 60,000 hours. This attribute makes the high-brightness LED bulbs favorable in lighting and other applications. They are one of the most energy efficient technologies and can save up to 50% to 70% of the energy required as compared to other traditional solutions.

High brightness LED bulbs deliver superior illumination by consuming low voltage and significantly has a longer lifespan which reduces the long-term cost of replacement and maintenance. Increasing awareness about energy saving devices and government initiatives is expected to drive the growth of the market.

The global high-brightness LED market is diversified making it highly competitive. The rise in the sales of high-brightness light emitting diodes is also attributed to factors such as the low cost of the components of LED which has reduced the average selling price.

Segmentation by Application

• Automotive

• General Lighting

• Consumer Electronics

• Signals and Signage

HB LEDs are used in televisions and other display screens to improve brightness and provide better clarity to the consumer. In addition to clarity, they allow for the generation of true which results in minimal distortion of the picture being displayed. Moreover, as these devices along with their components consume minimum space and weight, they allow manufacturers flexibility in designing the final product.

HB LED wafer manufacturing has witnessed a growth over the past few years on account of their increasing usage in mobile phones, tablets and notepads. Long life span of these panels has resulted in enhancing the performance of the final product with minimum intervals for repair and maintenance.

Taking into account these factors, the consumer electronics segment is anticipated to grow at a CAGR of 5.8% over the projected period. High penetration of LEDs and HB LEDs in the segment coupled with the need for fewer panels is expected to result in relatively lower growth. However, increasing application scope is expected to provide opportunities for the growth of the market.

The market for general lighting was valued at USD 3.39 billion in 2016 and is likely to witness above average growth. These lamps are more energy efficient and have a better life span and more brightness as compared to the regular incandescent bulbs. These are used for residential as well as commercial purposes.

Segmentation by Region

• North America

• U.S.

• Europe

• Germany

• UK

• Asia Pacific

• China

• India

• Rest of the World (RoW)

North America and Asia Pacific led the global high-brightness LED market in 2016. The presence of a robust automobile and electronics manufacturing sector in the region coupled with rising awareness among manufacturers the benefits of HB LED including adherence with safety norms at low cost is expected to augment demand for the product. Increasing production at these sites is expected to result in driving the growth of the market. Asia Pacific, in particular, is expected to witness above average growth at a 7.8% CAGR over the next few years.

Over the past few years, several countries registered an increased use of high-brightness LED because of the growing awareness of environmental problems and reducing carbon footprints. The European region also registered growth in the market share of high-brightness LED.

Various government initiatives around the world to restrain the usage of traditional technologies and to use LEDs is also a main factor for the rise in the demand and sales of high-brightness LED. Central & South America, as well as MEA, are anticipated to witness growth on account of the presence of a large aftermarket. Together the regions are likely to generate revenues worth USD 5.27 billion by 2024.

Competitive landscape

The industry is highly competitive owing to its diverse nature. It comprises of players including Samsung Electronics, Sharp, OSRAM GmbH, Seoul Semiconductors, and Phillips among others. These players are now targeting appliance manufacturers and patents to increase their presence in the domestic and the overseas market. Certain companies such as Samsung have integrated operations where the corporation uses HB LEDs across a host of products such as televisions, laptops, and mobile phones.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service