Hyperspectral Imaging Market Size And Forecast, By Product (Visible/Near-Infrared (VNIR), Short-Wave Infrared (SWIR), Mid-Wave Infrared (MWIR), Long-Wave Infrared (LWIR)), By Application And Trend Analysis, 2015 - 2025

- Published: January, 2019

- Format: Electronic (PDF)

- Number of pages: 65

- Industry: Display Technologies

Industry Insights

The global hyperspectral imaging market size was valued at USD 96.5 million in 2017 and is expected to grow at a CAGR of 3.8% from 2017 to 2025. Rising spending on defense and surveillance is expected to increase the application scope of these systems. The market has also received a boost from funding by governments in countries such as Canada and India for various projects utilizing hyperspectral imaging systems.

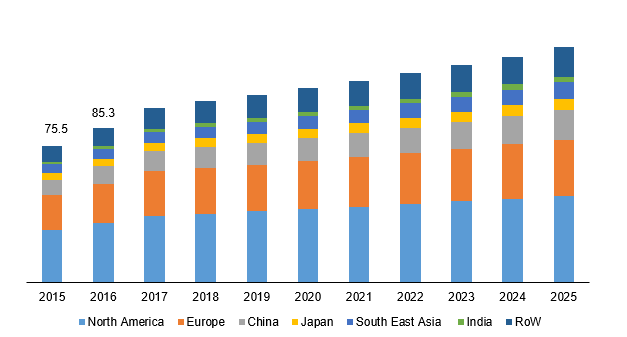

Global hyperspectral imaging market revenue, by region, 2015 - 2025 (USD Million)

Hyperspectral camera is capable of data acquisition in more detail than the human eye, which is restricted to a wavelength of about 700nm. As hyperspectral imaging is effective in characterization, quantification, and classification of objects by leveraging reflection and absorption properties in the IR region, it is expected to gain space as an important tool for surveillance. Some of the key application sectors for these imaging systems include residential, retail, transportation, hospitality, and manufacturing.

Segmentation by Product

• Visible/Near-Infrared (VNIR)

• Short-Wave Infrared (SWIR)

• Mid-Wave Infrared (MWIR)

• Long-Wave Infrared (LWIR)

In 2017, visible/near-infrared (VNIR) was the largest product segment in the hyperspectral imaging market accounting for around 40.0% of the total share. Rising popularity of VNIR as a plant health monitoring tool in agriculture sector is expected to remain a favourable factor in the near future. VNIR imaging assess a product quality by measuring its color. It is used in various applications including remote sensing, monitoring of dyed fabrics and ceramic floor tiles to ensure same color, and inspecting printing processes of official documents.

The global Mid-Wave Infrared (MWIR) hyperspectral imaging market is projected to grow at a CAGR of 4.8% from 2017 to 2025, fastest among the various product categories. MWIR is applicable to both laboratory and manufacturing sectors. These systems are used in several applications including minerals detection in geology, black polymers sorting, industrial gas leaks detection, identification of dark materials, and biomass burning events identification.

Segmentation by Application

• Defense and Surveillance

• Remote Sensing

• Life Sciences & Medical Diagnostics

• Machine Vision & Optical Sorting

• Others

In 2017, defense and surveillance was the largest application sector for hyperspectral imaging systems. The sector held around 38.0% of the market share. In the defense and surveillance sector, hyperspectral imaging is majorly used in airborne detection devices. In addition, it has become a crucial tool for monitoring images in satellites, high-altitude reconnaissance aircrafts, medium-altitude commercial aircrafts, and drones.

Over the past few years, hyperspectral imaging has gained popularity in the field of life science especially in fluorescence microscopy and vivo imaging. In multi-color label monitoring system, it provides the information about the chemical composition of human tissues. Images captured using spectral imaging technique provide information about the chemical composition of human tissues. It is also being explored for potential applications in non-invasive diagnosis.

Segmentation by Region

• North America

• Europe

• China

• Japan

• South East Asia

• India

• Rest of the World

North America dominated hyperspectral imaging industry, accounting for more than 38.0% of global share in 2017. Demand for hyperspectral imaging systems from the region is expected to grow at a CAGR of over 3.0% from 2017 to 2025. The growth is more prevalent in the U.S., where spending on scientific research and aerospace industry has increased.

As of 2017, the U.S. was the largest exporter in the aerospace and defense sector globally. In the U.S., aerospace & defense sectors are adopting hyperspectral imaging systems rapidly to gain technical and military edge over other countries.

India is projected to witness highest gains growing at a CAGR of over 6.0% from 2017 to 2025. The growth in industries including electronic manufacturing, food processing, and automotive through the implementation of Make-In India policy by the government is expected to promote the usage of hyperspectral imaging systems in machine vision technology for quality control. Furthermore, the agriculture sector in India is adopting new technologies rapidly, where remote sensing plays an important role in soil testing, plant health monitoring, and crop insurance.

Competitive Landscape

Hyperspectral imaging industry comprises both small and large players. Merger & acquisition activities with the view to expand business have been apparent in the recent past. For instance, in October 2018, Imec merged with perClass BV, a Netherlands based machine learning solution provider. The merger will help in the better analysis of the images taken by Imec’s ultrasonic SNAPSCAN cameras by leveraging perClass’ Mira software. Similarly, in January 2015, Corning acquired NovaSol, a leading advanced hyperspectral imaging company to expand its product portfolio of hyperspectral imaging solutions.

As of 2017, North America was the prime region for manufacturing of hyperspectral imaging systems on account of easy access of technologies and skilled workforce. Some of the key manufacturers include, Headwall Photonics, Resonon, Surface Optics Corporation, Corning, BaySpec, and Brimrose Corporation, Specim, Spectral Imaging, and Imec.

The establishment of strategic business partnerships in developed economies of North America and Europe on account of supportive government policies in aerospace & defense sector in the U.S. and UK is expected to remain a critical success factor in the near future. In December 2018, U.S. based Headwall Photonics announced to expand its business to Europe. In April 2018, Telops, a Canadian company, announced its partnership with Infrared Imaging LLC, a distributer, in order to strengthen its position in the U.S. market.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service