Indian Alcohol Ethoxylates Market Size And Forecast, By Product (Fatty Alcohol Ethoxylate, Lauryl Alcohol Ethoxylate, Linear Alcohol Ethoxylate), By Application, By End Use And Trend Analysis, 2015 - 2025

- Published: September, 2018

- Format: Electronic (PDF)

- Number of pages: 80

- Industry: Organic Chemicals

Industry Insights

The India alcohol ethoxylates market is is expected to expand at a CAGR of 5.6% in terms of revenue from 2017 to 2025. Development of major industries such as cosmetics, pharmaceuticals, textile, metal working fluids, and paper is anticipated to propel the country to be one of the largest market for the product. Rising demand for ethoxylates, especially alcohol-based, for applications such as cleaners and detergents, is projected to drive market growth over the forecast period. Growing agrochemicals industry driven by increase in consumption of fertilizers and pesticides for agricultural applications is estimated to have a positive impact on growth in India.

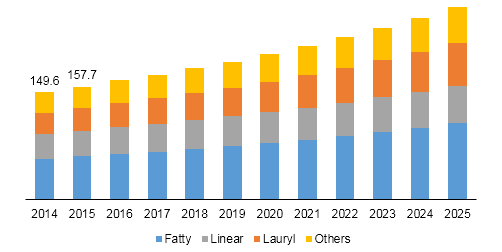

India Alcohol Ethoxylates market by product, 2014 - 2025 (USD Million)

Alcohol based ethoxylates are mainly used in the production of low foam detergents due to their stability at extreme pH and low foaming properties. They give the finished product good solubility, detergency, and wetting properties. High usage as surfactants for detergent and cleaner formulations in industrial and institutional sectors is expected to be one of the primary growth drivers for the market.

Segmentation by Product

• Fatty

• Lauryl

• Linear

• Others

In 2017, the fatty alcohol ethoxylates segment dominated Indian market and is expected to expand over the forecast period. Wide use in various industries for cleaning because of low toxic levels of the product is anticipated to bode well for growth. The demand is mainly driven by ready availability of basic materials such as fatty alcohol and ethylene oxide. In addition, demand from pharmaceutical segment and agrochemicals is expected to fuel market expansion over the forecast period.

Lauryl alcohol ethoxylates are biodegradable nonionic and are used for cleaning purposes in industrial, institutional, and household detergents. Increase in demand for lauryl alcohol ethoxylates is projected to fuel market growth in the forthcoming years.

Linear alcohol ethoxylates exhibit properties such as low foam cleaning and negligible toxicity levels, hence they are mainly used in perfumed detergent formulations. The use in the production of advanced detergents, emulsions, and pharmaceutical is estimated to drive the market growth over the forcast period.

Segmentation by Application

• Emulsifier

• Dispersing Agent

• Wetting Agent

• Others

Growing demand for applications as emulsifiers such as paints and coatings and personal care industries is projected to fuel the alcohol ethoxylates market growth over the forecast period. Application as dissolving agents for the formulation of different pharmaceuticals, cosmetics, and paints and coatings is estimated to fuel growth in near future. Branched alcohol ethoxylates is projected to develop as one of the major segments on account of growing demand for wetting agents for hard surface.

Segmentation by End Use

• Cleaning

• Metal Working

• Textile Processing

• Paper Processing

• Agrochemicals

• Pharmaceuticals

• Others

Cleaning is one of the major applications that has high consumption of alcohol based ethoxylates. High stability of ethoxylates based emulsions offers good performance for various operations on metal surface, such as rolling, cutting, drilling, and pressing. Good emulsification properties are expected to fuel demand for the product from agrochemicals and pharmaceuticals over the forecast period.

Competitive Landscape

Indian alcohol ethoxylates market is highly competitive with the presence of a number of multinational companies such as Stepan Company, BASF SE, Arkema, AkzoNobel N.V., Clariant AG, Dow Chemical, and E.I. du Pont de Nemours and Company. These companies procure the required raw material such as ethylene oxide from major suppliers present in India such as Reliance Industries, INEOS Plastics, and Eastman Chemical Company.

Other major market players such as The Dow Chemical Company, BASF SE are backward integrated and involved in value addition of the product through procurement of raw material to manufacturing finished product and direct distribution. They are adopting various strategies to occupy a major market share. AkzoNobel N.V. offers a whole product portfolio of ethoxylates, which is helping in generating high revenues for the company. The companies also focus on development and innovation of new products to benefit from increasing demand for detergents and cleaners and to attract more customers.

The companies distribute products through a combination of direct and third party distribution channels. However, a large proportion of product distribution is done mainly through direct distribution channels as the major market players have an established distribution networks to reduce the logistics cost.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service