Japanese Confectionery Market Size and Forecast by Type (Chocolate, Sugar Confectionery, Gum), by Distribution Channel (Hypermarket & Supermarkets, Convenience Stores, Specialist Retailers), And Trend Analysis, 2015 - 2025

- Published: July, 2018

- Format: Electronic (PDF)

- Number of pages: 55

- Industry: Food & Beverages

Industry Insights

The Japanese confectionery market was valued at USD 10.29 billion in the year 2017 and is expected to grow over the forecast period. Increasing awareness related to the health benefits of chocolates among the Japanese consumer is the key factor expected to driving the growth of the market in the projected period. Japanese people are more health conscious and prefer healthy products. Cocao is the fine blend of minerals such as iron, calcium and magnesium which helps in reducing obesity, cancer, fat deposition in arteries, blood pressure, as well as minimizes stress and is also effective in allergy. Confectionery manufacturers are introducing new products and flavor is expected to provide significant growth opportunity in the market over the forecast period. For instance, in 2011, around 200 - 250 new products were launched in Japan.

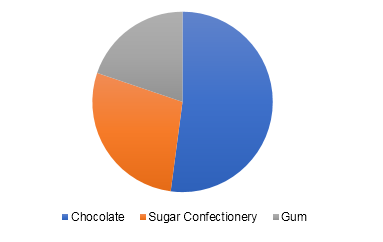

Japanese confectionery market revenue split, by type, 2017 (% share)

Sugar confectionery is routinely consumed as these are consumed by individual and comes in smaller packets, while chocolate confectionery is widely preferred in holidays such as White Day and Blossom Festival. Improving economic condition is expected to have positive impact on consumer spending which in turn is projected to boost the market for confectionery in Japan.

About 50% of Japanese consumers choose sugar or chocolate confectionery foods as a snack for an afternoon refreshment between lunch and dinner. Products that offers good taste along with health advantage are preferred on a major scale. Items that provide advantage, such as white teeth, fresh breath, etc. are more favored by young adults. However, rising obesity issues among children within age range of 9 - 17 years and increasing number of health-conscious people is expected to hamper the Japan confectionery market. Furthermore, most of the population in Japan are elderly and have low birth rate which is expected to hamper the growth of sugar confectionery owing to the health concern such as high blood pressure and obesity.

Segmentation by Type

• Chocolate

• Sugar Confectionery

• Gum

In terms of types, chocolate confectionery dominated the market is projected maintain its leading position throughout the forecast period. Followed by chocolate, sugar confectionery and gum held major market share in 2017. Premium chocolate along with boxed chocolate collections is trending as a gift-giving on festive occasion. Gums confectionery are gaining popularity as they are considered as quick means of satisfying the crave for sweetness. Jellies, mints and Pastilles are also gaining ground at the expense of gum.

Seasonal chocolate has been doing well in this market and is expected to show the similar trend over the foreseeable future. However, high cost of seasonal chocolate products is expected to have impact on growth in comparison with other less expensive confectionery products. Furthermore, easy sharing and consumption ability of sugar confectionery products such as jellies, gums, and chews are expected to hinder the growth of chocolate in the next coming years. Mint flavor chocolate is another lucrative market and is likely to display fast growth owing to purported benefits such as increasing alertness and breath-freshening. This instant satisfaction combined with their handiness and subtle consuming ability, has give rise to mints as a commonly favored gum.

Segmentation by Distribution Channel

• Hypermarket & Supermarkets

• Convenience Stores

• Specialist Retailers

• Others

Supermarkets, hypermarkets and convenient stores are expected to enjoy maximum profit margin owing to upcoming construction activity in the form of shopping malls which is expected to provide opportunities to new players to establish their market and local players can further grow their market with in-store promotions and on-site demonstration. Offline distribution is still the leading distribution channel for confectionery products in Japan and has accounted for a maximum market revenue share in the year 2016 and is expected to show descent growth in the future. Online distribution channel which has accounted for very minimum market revenue share in the year 2016, however, is expected to grow in future owing to an ageing population that prefer to buy online instead of visiting stores.

Competitive landscape

Manufacturers with major market share are coming up with new strategies besides product diversification. It is anticipated that, manufacturers will have to come up with innovative ways in order to retain more and more customer. For instance, Nestlé opened a Kit-Kat retail store in Tokyo in the year 2014 which was a success for the brand. The key companies in the Japanese confectionery market includes Lotte Group, Meiji Holdings Co. Ltd., Morinaga & Co. Ltd., Mondelez International Inc., Asahi Group Holdings Ltd. Meiji Holdings is expected to account for a maximum market revenue share of about 20%.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service