Laser Crystal Market Size and Forecast, By Type (Ti: Sapphire, Nd: YAG, Nd: YVO4, Yb: KGW, Yb: KYW), Application (High-intensity Laser Platforms, Optical Components, Military) And Trend Analysis, 2014 - 2024

- Published: September, 2017

- Format: Electronic (PDF)

- Number of pages: 55

- Industry: Sensors & Controls

Industry Insights

The global laser crystal market size was estimated at USD 129.8 million in 2016. They are single stones having a high thermal conductivity and a smaller emission and absorption bandwidth.

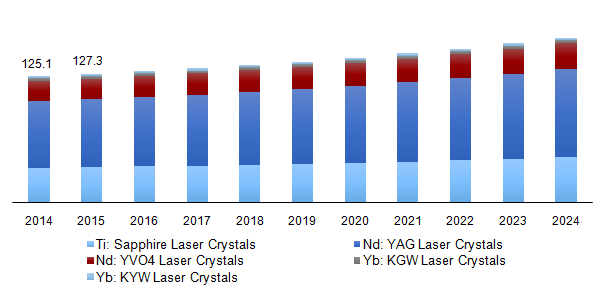

Global laser crystal market revenue, by type, 2014 - 2024 (USD Million)

The crystal cutting process has an advantage over gas lasers cutting as they can work with both metals and nonmetals. The market growth is attributed to increasing application across various industry verticals such as healthcare, military, manufacturing, and consumer electronics. Also, augmented use of lasers in minimally invasive surgeries and targeted high pulse radiation is expected to drive the industry growth over the forecast period.

Easy availability of these products based on size, shape, and surface will result in rising demand for the product. Customization enables these products suitable for a particular application. Increasing trend of consumers to purchase products from e-commerce portals is expected to drive the market growth.

In the medical field, lasers are used widely in non-invasive surgeries such as spine surgery, kidney stone removal, and skin tightening. Increasing applications of the technology in photodynamic therapy (cancer treatment) is expected to provide a lucrative opportunity for the growth of the market. Laser therapy uses high-intensity light to destroy tumors. Crystals are used to adjust the wavelength of light in instruments.

Over exposure to a laser beam imposes adverse effects on human health as it may alter organic tissues resulting in cellular death and this, in turn, limits the use of these rocks. Furthermore, stringent government regulations regarding beam exposure are expected to hinder the growth of the industry during the forecast period. For instance, in U.S. Occupational Safety and Health Administration (OSHA) determined American National Standard (ANSI Z136.3) for lasing safety requirements.

Segmentation by Type

• Ti: Sapphire Crystals

• Nd: YAG Crystals

• Nd: YVO4 Crystals

• Yb: KGW Crystals

• Yb: KYW Crystals

In 2016, Nd: YAG segment accounted for 52.9% of the market share and is expected to be the largest revenue generator owing to the rising use of laser crystals across several verticals (healthcare, defense, consumer electronics, manufacturing, and metal processing). Properties such as high damage threshold and homogeneity have attributed to the increasing acceptance of the Nd: YAG.

Ti: Sapphire segment finds major application in medical and biotechnology fields and is expected to grow at CAGR of 3% during the forecast period from 2017 to 2024 owing to increasing use of Ti: sapphire crystal in medical and biotechnology field for dental surgeries and x-ray imaging. Also, Ti: Sapphire is broadly used in X-ray imaging and laser spectroscopy platforms. Furthermore, enhanced use of Ti: Sapphire in dentistry for soft tissue surgeries is expected to foster the market growth.

The growth of Nd: YVO4 segment is attributed to escalating demand from automotive industry. Nd: YVO4 laser crystal is utilized for marking and engraving of automotive parts. It is also used for welding and cutting of metals, semiconductors, and other alloys. Use of Nd: YVO4 lasers is increasing in aerospace and defense industry primarily employed in high precision engraving will further support the market growth.

Segmentation by Application

• High-intensity laser platforms

• Optical components

• Healthcare

• Military

• Other

Healthcare application segment is expected to grow at the highest CAGR of 3.4% over the forecast period. In healthcare, laser crystals are used for surgeries such as LASIK eye surgery, dentistry, dermatology, and cosmetic treatments. Additionally, escalating adaptation of non-invasive procedures for the treatment of diabetic retinopathy, spine surgery, and superficial tumors are expected to drive the market growth over the forecast period.

In the military, the laser systems are majorly used in rangefinder devices. Also, these systems are used as an alternative to radar rangefinders. Demand for crystals in the military is anticipated to increase on account of rising use of LIDAR system (Light Detection and Ranging). Increasing use of lasers for marking targets such as missiles and drones is expected to result in growing demand for the product in the military sector.

Segmentation by Region

• North America

• U.S.

• Europe

• Germany

• Asia Pacific

• China

• India

• Japan

• Middle East & Africa

• Central &South America

In 2016, North America accounted for 47% of the market share owing to increasing adoption of laser systems primarily across defense and healthcare sectors. Furthermore, the presence of a majority of manufacturers in the region and their strong distribution network are expected to augment the growth of the market during the forecast period.

Asia Pacific is anticipated to record the highest CAGR of 3.5% in projected years owing to the increase of automotive manufacturing and consumer electronics sectors in countries such as China and India. Increasing application of lasers in high refractive lens surgery in China is expected to increase the demand for crystals over the forecast period. For instance, refractive lens surgeries market in China is projected to grow at a CAGR of 11.8% over the forecast period. In 2013, refractive surgeries in China was estimated at 9,50,000 by volume and is anticipated to reach 28,85,403 in 2023.

Competitive Landscape

The market is consolidated owing to the limited number of players. Northrop Grumman Corporation., FEE GmbH, II-VI Optical Systems, Inc., and Scientific Materials Corp. were the top four companies, accounting for more than 60% of market share in 2016. Other vendors observed in this industry are Cryslaser, Inc., Beijing Opto-Electronics Technology, Co. Ltd., Chengdu Dongjun Laser Co., Ltd., CASTECH Inc., and Laser Materials Corporation. Companies are extensively investing in R&D for innovation and new product development.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service