Limonene Market Size and Forecast, By Application (Food & Beverage, Pharmaceutical, Personal Care, Industrial) and Trend Analysis, 2015 - 2025

- Published: February, 2019

- Format: Electronic (PDF)

- Number of pages: 65

- Industry: Bulk Chemicals

Industry Insights

The global limonene market was valued at USD 245.9 million in 2017 and is expected to grow at a CAGR of 4.6% from 2017 to 2025. The demand for limonene is expected to increase from multiple end-use industries such as food & beverages and personal care, where it is used as an anti-oxidant and flavouring agent.

Growing concern towards the environment is also expected to spur the demand of limonene, particularly in the industrial sector, as it is biodegradable and has low toxicity. Furthermore, rising adoption of organic personal care products over synthetic products particularly by the millennials is translating into greater demand from natural and organic cosmetics, where it is used in products as an effective solvent and an ingredient for fragrance.

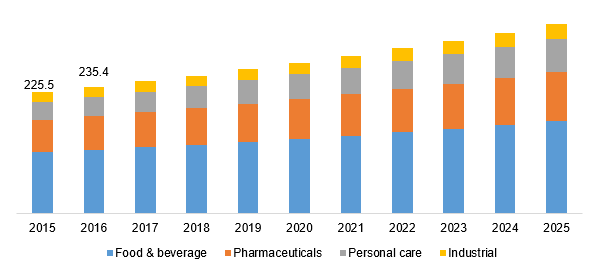

Global limonene market revenue, by application, 2015 - 2025 (USD Billion)

Limonene is known for its nutritional value and is effective in reducing cholesterol level and weight, which are among the properties that have added to its demand from the pharmaceutical sector. It is also used in household detergents and air fresheners, maintenance cleaner for concrete pads, parking complexes, and airport runways.

Regulatory policies play a vital role in shaping the development in limonene market. Regulatory agencies such as the U.S. Food and Drug Administration (FDA formulate and establish policies associated with flavor usage in food and beverages to protect consumers and the environment.

Segmentation by Application

• Food & Beverage

• Pharmaceutical

• Personal Care

• Industrial

In 2017, limonene demand from food & beverages market accounted for the largest market share. In 2017, the sector was valued at over USD 123 million and is expected to grow at a CAGR of more than 4.0% during 2017–2015. The growth is attributed to the increased consumption of citrus juices particularly lemonade that has 10 to 20 times more limonene content as compared to commercial orange juices.

It is also used as a functional ingredient in ice creams, sweets, baked goods, and puddings. Its increasing popularity as a product having nutritional value and health benefits is expected to drive the market in the future. Limonene is also consumed for reducing cholesterol level and lowering the blood pressure.

The personal care segment is expected to be the fastest growing segment. The segment is expected to grow at a CAGR of more than 5.5% from 2017 to 2025. Demand growth in fragrances market on a global level is expected to promote the consumption of limonene as a functional ingredient. Additionally, limonene is used in various personal care products such as hair care products, and skin care products.

Usage of limonene as a functional ingredient in medicinal applications is expected to remain a favorable factor driving the demand from the pharmaceutical industry. The pharmaceutical industry accounted for revenue of more than USD 64.0 million in 2017.

Segmentation by Region

• North America

• Europe

• Asia Pacific

• Middle East & Africa

• Central & South America

In 2017, North America was the largest market for limonene. The region is expected to grow at a CAGR of more than 4.0% from 2017 to 2025. Increasing demand from food & beverages industry is expected to remain a key driver for the market over the coming years.

Asia Pacific, on the other hand, is expected to be the fastest growing region with a CAGR of over 5.5% from 2017 to 2025. Increasing demand from the personal care products market is expected to be an important trend in the region over the coming years. A vast consumer market, especially in China and India coupled with the increasing demand from end-use industries such as personal care and food & beverages present a considerable growth opportunity in the region.

Competitive Landscape

The global limonene market is highly competitive with the presence of established companies such as Florida Chemical Company and Firmenich. Companies are actively looking at consolidating their presence in the end-use application sectors, especially personal care, pharmaceutical, and food & beverages. Companies are also focusing on consolidating their market presence through mergers & acquisitions.

For instance, in the second half of 2018, Firmenich completed the acquisition of Senomyx, Inc., a company offering novel flavor ingredients and natural sweeteners to various companies in the food & beverages industry. Some other key companies in the market include TROPFRUIT NORDESTE S.A., Citrosuco, Citrus Oleo, Ernesto Ventos S.A., Sucorrico SA, AGROTERENAS, Florachem, and LemonConcentrate S.L.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service