Low Carb Alcohol Market Size and Forecast, by Product (Beers, Spirits, Wine & Champagne), by Distribution Channel (Supermarkets/Hypermarkets, Hotels/Clubs/Bars, Speciality Stores) and Trend Analysis, 2015 - 2025

- Published: January, 2019

- Format: Electronic (PDF)

- Number of pages: 65

- Industry: Food & Beverages

Industry Insights

The global low carb alcohol market was valued at USD 166.7 billion in 2017 and is anticipated to grow at a CAGR of 7.3% from 2017 to 2025. Shifting preference towards alcoholic drinks with limited carbohydrate content especially among the adults in developed economies including the U.S. and Germany is expected to remain a favorable factor for the growth of the market over the forecast period.

Over the past few years, consumers in the age group of 16-24 years have shifted their focus towards alcohol avoidance or moderation. For instance, more than 84% of young consumers on a global level are choosing not to drink alcohol or trying to reduce alcohol intake.

As a result of rising popularity of the phrase ‘happy hours’ among consumers is projected to promote the consumption of low carb alcoholic drinks as an alternative to their conventional counterparts.

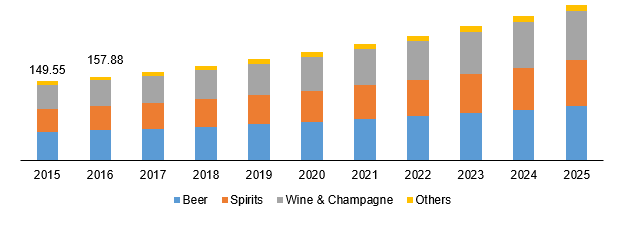

Global low carb alcohol market revenue, by product, 2015 - 2025 (USD Billion)

There is a growing cases of cardiovascular diseases and it has been proven that they have a direct relationship with excessive consumption of alcohol and junk foods. As a result, majority of individuals, particularly, adults are preferring low carb alcoholic drinks in order to maintain their cardiovascular health.

On account of the increased number of brand campaigns by food & beverage companies towards nutritional management, there is a rise in spending on health and wellness especially among working class professionals around the globe which is expected to remain one of the key growth factor in the near future.

Segmentation by Product

• Beer

• Spirits

• Wine & Champagne

• Others

In 2017, beer held the largest value share accounting for more than 35% of market revenue. Product launches by established brands has been evident in the market. For instance, low-carb gender-neutral beer by Heineken. New product launches are expected to continue over the coming years as well.

Wine & champagne is expected to be the fastest growing segment witnessing a CAGR of over 7.0% from 2017 to 2025. Due to various health benefits, there is an increased consumption of wine & champagne on a global level. Over the coming years, Asia Pacific is expected to remain a lucrative market for wine & champagne growing at a CAGR of 8.4% from 2017 to 2025.

Wines strengthen the immune system with their anti-oxidant content, increase bone density and decrease the risk of heart diseases. Millennials are projected to remain one of the key buyers of wines & champagnes over the next eight years.

Segmentation by Distribution Channel

• Hypermarkets and supermarkets

• Hotels, clubs, and bars

• Speciality stores

• Others

In 2017, speciality stores generated a revenue of over USD 65.0 billion. The increasing preference for individual well-being has affected food and alcohol consumption habits of consumers. This made producers launch alcoholic drinks with lower calorie level. As specialty stores carry a wide assortment of low carb alcohol, these outlets remain highly frequented by consumers.

Sale of low carb alcohol from hypermarkets and supermarkets is expected to exceed 28.0 billion liters by the end of 2025. The shifting trend towards shopping in hypermarkets or supermarkets compared to other channels among working-class professionals is expected to remain one of the favorable factors in the near future.

Sale through other channels is expected to grow at a CAGR of over 6.5% from 2017 to 2025. This growth is also attributed to the online channel which is increasingly gaining traction among consumers, though it remains regulated depending on local legal framework.

Segmentation by Region

• North America

• U.S.

• Europe

• UK

• Germany

• Asia Pacific

• China

• India

• Middle East & Africa

• Central & South America

In Europe, the demand for low carb alcohol is expected to surpass USD 60.0 billion by the end of 2025. Companies operating in the market are expected to strengthen their portfolio of low carb alcohol in the coming years. Some of the key companies operating in prime markets such as Germany, UK and France include Slendier, Corona, and Gordon.

Asia Pacific is expected to be the fastest-growing market with a CAGR of more than 8.0% from 2017 to 2025. Shifting trend towards healthy drinks consumption among the working-class professionals in countries such as China and India are expected to remain a key market driver over the forecast period.

Middle East & Africa, on the other hand is expected to reach around USD 24.0 billion by the end of 2025. This growth is attributed to the increasing awareness towards health hazards associated with the consumption of conventional alcoholic drinks among adults in African countries including Kenya and Ethiopia.

Competitive Landscape

Over the past few years, companies including, Diageo have increased their spending towards expanding their reach buyers in the non-alcoholic drinks segment. Therefore, the company is expected to increase expenditure for the development of low carb alcoholic beverages as an alternative to conventional non-alcoholic beverages. Pernod Ricard is also introducing itself in the zero-alcohol drinks arena, with a launch and distribution of Ceder’s distilled non- alcoholic gin in the U.K.

Some of the key manufacturers include Constellation Brands, Castel Group, The Wine Group, Diageo, Concha Y Toro. Majority of the companies are wine producing firms with their strategic business offices located across the globe. These companies produce varietals of wine catering to every age group and gender. Diageo continues to be among the key manufacturers having a strong foothold with its brand such as Smirnoff and Johnnie Walker.

Other companies such as Accolade Wines, Treasury Wine Estates, Trinchero Family Estates, Pernod-Ricard are also among the leading players having wide range of products and strong R&D foothold.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service