Medical Morphine Market Size and Forecast, By Route of Administration (Oral, Injectable), By Indication (Cancer, Arthritis) And Trend Analysis, 2014 - 2024

- Published: September, 2017

- Format: Electronic (PDF)

- Number of pages: 75

- Industry: Pharmaceuticals

Industry Insights

The global medical morphine market size was valued at USD 10.75 billion in 2016. Increasing use of the drug to relieve pain in cancer, arthritis and postoperative surgeries is expected to drive market growth over the forecast period.

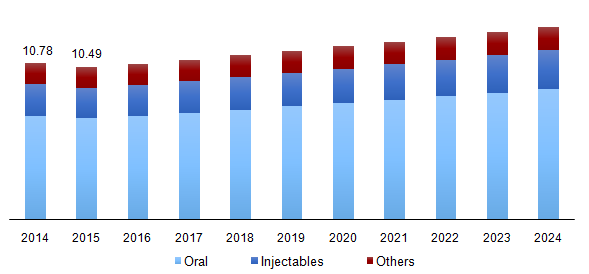

Global medical morphine market revenue, by route of administration, 2014 - 2024 (USD Billion)

In terms of consumption, the U.S. accounts for largest market share as compared to other countries. To that end, U.S. consumed more than 70% of the global opioid supply in 2015. Morphine is permitted for medicinal use in the U.S. and its resultant increasing adoption over other opioid class of drugs such as fentanyl contributes to the market growth.

A decline in the morphine production has been observed owing to low opium production in Afghanistan, which accounts for a major share in opium plant cultivation. Other key countries for opiate production include Myanmar in South East Asia and Mexico in Latin America.

Segmentation by Route of Administration

• Oral

• Injectables

• Others

The oral segment is expected to grow at the fastest CAGR over the forecast period. Higher dose accuracy coupled with the ease of carrying makes it a preferred formulation. This segment held a majority market share in 2016 and is expected to dominate the market over the forecast period as well.

The injectables segment is expected to grow at a CAGR of 2.7% over the forecast period. Injection for dosage is preferred due to its immediate analgesic action and higher bioavailability.

Segmentation by Indication

• Cancer

• Arthritis

• Others

The others segment is expected to generate maximum revenue over the forecast period owing to ease of availability of morphine for conditions such as postoperative pain in the U.S. Morphine is one of the analgesics used in terminal stage cancers to reduce the pains.

The cancer segment is expected to reach USD 4.39 billion over the forecast period. Due to rising prevalence of cancer and increasing use of morphine in reducing pain in patients suffering from terminal stages of cancer.

Segmentation by Region

• North America

• U.S.

• Europe

• Germany

• Asia Pacific

• China

• India

• Rest of the World

In 2016, North America dominated the global medical morphine market and is expected to retain the position in global market attributed to its increasing consumption in the U.S. In 2016, the U.S. consumed more than 70% of the global medical morphine industry, and this trend is expected to continue over the forecast period. Increasing opioid prescriptions in this region are expected to drive the market for this drug.

Morphine along with its therapeutic use is also one of the most abused drug globally leading to the increased number of deaths. In order to address opioid abuse issue, several nations’ governments are introducing regulatory initiatives. For instance, in August 2017, the U.S. government announced regarding the implementation of stringent laws pertaining to appropriate use of morphine.

Europe is expected to grow at a CAGR of 2.4% over the forecast period. The lucrative growth of healthcare sector coupled with increasing prevalence of arthritis in the region is expected to drive the demand in the region.

Increasing consumption of this drug in countries such as Austria and Germany to treat cancer-related pain is expected to support the market. In 2015, the morphine consumption in Austria was 213.45 mg/capita and had increased in 2016. Furthermore, in the same year, consumption in Germany stood at 19.05 mg/capita and had increased in 2016.

Competitive Landscape

The global medical morphine market is consolidated in nature owing to the dominance of few companies in manufacturing and processing. Morphine production is regulated by stringent regulation policies passed by several countries which would hamper its manufacturing.

Market players are focusing on the expansion of production capacities to mark their presence in the global market. For instance, in 2014, Alcaliber S.A. started a new extraction plant which increased the overall production capacity by 50%. Some of the key players in the market are Mallinckrodt Pharmaceuticals, Alcaliber S.A., Purdue Pharma L.P., Pfizer Inc., Johnson Matthey Fine Chemicals, Sun Pharmaceutical Industries Ltd., Verve Health Care Ltd., and Taj Pharmaceuticals Limited.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service