Global Men’s Toiletries Market Size And Forecast, By Product (Skin Care Products, Hair Care Products, Deodorant, Others), By Distribution Channel And Trend Analysis, 2019 - 2025

- Published: March, 2019

- Format: Electronic (PDF)

- Number of pages: 80

- Industry: Consumer Goods

Industry Insights

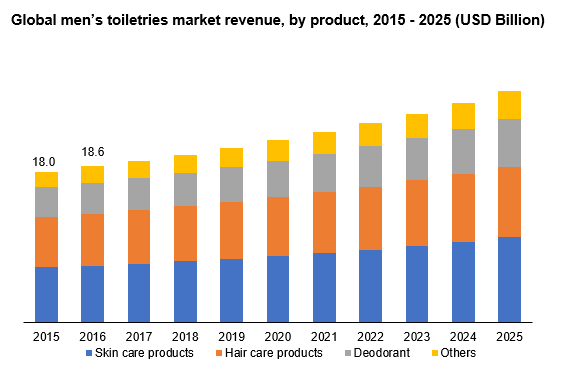

The global men’s toiletries market was valued at USD 19.2 billion in 2017 and is expected to reach USD 27.4 billion by 2025, growing at a CAGR of 4.52% from 2017 to 2025. The market growth is primarily driven by the growing metrosexual men population who are very conscious of their appearance and significantly spend on their beauty treatments, apparel, and grooming.

Besides that, the trend of celebrity endorsements in men’s toiletries is boosting the market growth. Market players are focusing on consistent product launch in the grooming and toiletries segment. For instance, the products were majorly confined to the deodorants, shaving creams, colognes, and shampoos.

In recent times there has been significant addition of product categories such as moisturizers, concealers, hair serums, face masks and creams, and a range of anti-aging products. Hence, rising usage of various product categories coupled with an increase in the number of men’s spa and salons at the global level is expected to augment the market growth.

Companies are dependent on suppliers of packaging materials, steel strips manufacturers, chemical and other manufacturers. However, the presence of a large number of suppliers in the market renders a competitive edge to the manufacturers worldwide. The established companies operate across various business segments including toiletries.

Increasing product diversification enables the manufacturers to differentiate them from others and allow to categorize into premium and mass products. Majority of the companies in this market possess a secure distribution network across the globe. The companies market their products through both physical and online retail formats.

The market players are increasingly adopting celebrity endorsements to gain a competitive advantage and increase brand visibility in comparison with their competitors. For example, Procter & Gamble had used well-known sportsmen celebrities such as David Beckham, Roger Federer, Tiger Woods, and Lionel Messi to promote its Gillette brand.

Companies like Macys and Nordstrom, Inc. are changing their store layouts to meet the need for men’s shopping experience. Some of the male toiletry product suppliers are willing to sign partnership deals with salon chains to showcase their products as well as widen their customer base. For instance, in 2016, Philips and L’Oréal jointly have launched a pop-up barbershop at Singapore Changi Airport

Segmentation by Product

• Skin care products

• Hair care products

• Deodorant

• Others

The skin care products segment was valued at USD 7.5 billion in 2017 and is expected to reach USD 11.2 billion by 2025, growing at a CAGR of 5.09% from 2017 to 2025. It is the largest and fastest growing segment in the market. Increasing penetration of media plays a significant role in influencing the target consumer to focus more on physical presentation.

Leading companies are offering a large range of traditional and premium skin care products. Spending habits of metrosexual population is increasing for skin care products. In the U.S., people spend around USD 25 to USD 45 on beauty and personal care products every month. Urban Consumers are shifting towards premium quality and sophisticated products. Usage of premium cosmetic products such as night-time formulations to repair skin, anti-aging lotions, and skin brighteners, toners, eye cream, exfoliator, beard wash are significantly growing at the global level.

Hair care products segment is estimated to be the second largest product segment. As of 2017, this segment accounted for 32.4% of the global market and is expected to grow at a CAGR of 3.75% from 2017 to 2025. A growing trend in the fashion industry coupled with increasing acceptance of grooming services is accelerating the market growth. It is estimated that, in the U.S., there are more than 80,000 salons of which 76,000 are beauty salons, and 4,000 are barber shops. Regis, Premier Salons, Sports Clips, and Ratner are some of the major salons in the country.

Segmentation by Distribution channel

• Grocery retailers

• Health and beauty stores

• Department stores

• Online retailers

• Others

The health and beauty stores segment dominated the global market and is expected to grow at a significant pace in future. It was valued at USD 7.8 billion in 2017 and is expected to reach USD 11.4 billion by 2025. This distribution channel will retain its dominance in the forecast period as well.

The personal care industry is changing rapidly witnessing consistent product developments and innovation. Health and beauty stores are convenient options for consumers to choose their personal care products. Men across different age groups are facing variety of skin and hair related problems in their daily life due to pollution, stressful lifestyle, and poor eating habits.

Due to better shelf-display, greater brand variety, and attractive discountsconsumers tend to purchase toiletries from their nearest health and beauty stores. Leading companies like L’Oréal S.A., Procter & Gamble prefer to showcase their product on specialty stores, pharmacy, online stores and other retail stores.

Online retailers segment is expected to growing at a CAGR of 4.86% from 2017 to 2025. It has been observed that millennials and generation X population prefer to search product information through online platforms over other modes. Increasing partnership deals between toiletry manufacturing companies and the online retailers will favor the market growth. For instance, ten Japanese toiletry companies signed a partnership deal with Alibaba in order to ensure their strong presence and boost their sales. Other major online retailers such as Amazon, Heldenlounge are selling products of different retailers in a single platform.

Segmentation by region

• North America

• Europe

• Asia Pacific

• Central and South America

• Middle East and Africa

The Europe region accounted for largest market share in 2017 and was valued at USD 7.08 billion. This region is anticipated to witness a growth rate of 4.33% during the forecast period. As per the details provided by the Cosmetics Europe, the personal care association stated that more than 70% of the consumers consider the usage of cosmetics and personal care products as very crucial aspect in their daily lives.

Hair, skin and body care products were found to be the most popular categories preferred by men in Europe. Also, around 80% of the consumers stated that they find these products are crucial for building self-esteem. These insights collectively favor the acceptance of toiletry products in the region.

U.K., Germany, France, Italy, and Spain are the major markets and contributes more than 50% to the Europe market. Procter & Gamble is the most dominated player in Europe market. In France, around 44% of the market is catered by them. Energizer Holdings, Inc., L’Oréal S.A. and Bic accounts for around 25% of the France market.

The Asia Pacific region is anticipated to be the fastest growing men’s toiletries market. It is expected to grow a CAGR of 5.91% from 2017 to 2025 and reach USD 6.32 billion by 2025. Supportive initiatives by the government, the increasing spending power of people, coupled with increasing metrosexual population is augmenting the market growth. South Korea, India, China, Australia, and Japan are the major revenue generators in this region.

Competitive Landscape

Some of the key players operating in the market are Unilever, L'Oréal SA, Estée Lauder Inc. Procter & Gamble, Beiersdorf, Shiseido Co., Ltd., Johnson & Johnson, The Hut.com Ltd., The Grooming Lounge, and others. Global male toiletries market is fragmented in nature marked by the presence of many players in the market. By understanding the opportunity in this market, many startup companies are coming with innovative products. For instance, a Silicon Valley based startup named Walker & Company Brands has come up with shaving products which mainly targets people with coarser hair who often face irritation due to skin and razor bumps.

Furthermore, the retailers are offering lucrative service offerings to widen their customer base and boost the sales. For instance, DOLLAR SHAVE CLUB offers monthly services for razor blades home delivery and the restock service options to ensure the continuous usage of the products.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service