Military Radar Systems Market Size and Forecast, By Platform (Ground-Based, Naval, Airborne, Space-based), By Application (Weapon guidance, Surveillance), And Segment Forecasts, 2014 - 2024

- Published: August, 2017

- Format: Electronic (PDF)

- Number of pages: 60

- Industry: Technology

Industry Insights

The global military radar systems market size was estimated at USD 11.45 billion in 2016 and is anticipated to witness growth. The rise in demand for hi-tech weaponry, national disputes, threats from adjoining countries, increasing safety concerns, and the growing investment in the defense sector by the governments of various countries.

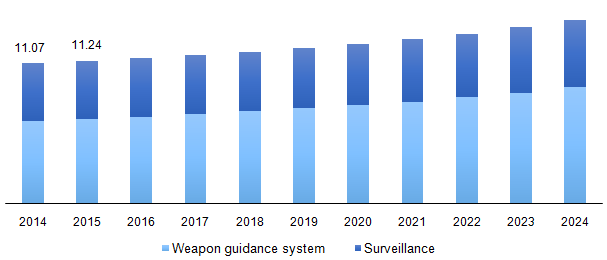

Global military radar systems market, by application, 2014 - 2024 (USD Billion)

The escalation in demand for multi-function object-detection system which is used for various activities such as surveillance, missile control, and early warnings is projected to be a significant factor driving the growth of the market over the forecast period. Radars play a very vital role in war zones; they can be mounted on motor vehicles, aircraft and other objects to detect enemies position and track their movements.

Segmentation by Platform

• Ground-Based

• Naval

• Airborne

• Space-based

Ground-based radars segment accounted for the largest revenue share of 32% in 2016 and will continue to maintain its dominancy over the forecast period owing to its rising demand during warfare conditions to obtain real-time information. Furthermore, these object-detection systems can detect unexploded bombs, underground tunnels, movement near buildings and infrastructure which are helpful in battle fields.

The rise in the use of ground-based radars coupled with naval, airborne, and space-based radars for target incorporation will boost the market at large. There is an ongoing demand for ground based radars in war zones such as Afghanistan and Syria which is expected to add to the growth to the market.

Segmentation by Application

• Weapon guidance

• Surveillance

Weapon guidance application is anticipated to register the fastest growth over the forecast period owing to its uses and application in tracking and guiding of aircraft, missiles, ships by calculating their velocity and changes in the position of the object. Furthermore, the rise in demand for highly accurate and meticulous military radar systems by defense establishments worldwide will drive the market growth for weapon guidance segment. Ground orientation, laser control, and other systems used for weapon guidance require various sensors for functioning in a precise manner which is expected to add to the growth of the market over the forecast period.

Segmentation by Region

• North America

• U.S.

• Asia Pacific

• China

• India

• Europe

• France

• UK

• RoW

The North America market for the military radar systems was estimated at USD 3.79 billion in 2016. Certain government initiatives and programs such as the Three-Dimensional Expeditionary Long-Range Radar (3DELRR) program and the Air and Missile Defense Radar (AMDR) program are projected to fuel the regional market growth. The U.S. army is known to be equipped with the latest technologies and procures quality detector equipment and defense vessels, consequently boosting market growth in the region.

Asia Pacific region is estimated to witness the highest growth rate over the forecast period. Modernization and advancement of surveillance systems are driving the detector market in India, a key country for defense equipment in the Asia Pacific region. Object-detection systems have also turned out to be a fundamental part of armored vehicles, aircrafts, UAVs, and naval vessels.

The rise in border disputes and political tensions in countries such as India and China, and the increase in investment activities for procurement of advanced weapons and equipment is expected to boost the demand for military radar systems in this region. For instance, In August 2013, the Indian Navy confirmed the naval satellite GSAT-7 for trying and testing on a non-Indian launch system which is fortified with innovative object-detection systems.

Competitive Landscape

The global market is consolidated in nature with the presence of well-established vendors. North America and Europe tend to dominate the market with multiple vendors operating from countries such as U.S. and U.K.

Some of the key active vendors in the market include Lockheed Martin Corporation, Boeing, Northrop Grumman Corporation, Raytheon Company, Saab Sensis Corporation, BAE System PLC, Airbus Group, General Dynamics Corporation, Leonardo DRS and Harris Corporation. Active competitors in the industry are focusing on R&D and product innovation to increase their presence globally over the coming years.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service