Global Nuclear Air Filtration Market Size and Forecast, By Product Type (Portable and Stationary) And Trend Analysis, 2015 - 2025

- Published: September, 2018

- Format: Electronic (PDF)

- Number of pages: 70

- Industry: HVAC & Construction

Industry Insights

The global nuclear air filtration market size was estimated at USD 97.7 million in 2017. It is anticipated to reach USD 118.2 million by 2025. Market growth is primarily driven by rising demand from a number of nuclear power plant and reactor construction projects across various regions, such as North America and Asia Pacific. Additionally, increasing capacity of existing power plants in countries such as U.S., Finland, and Spain will boost the demand in near future. High energy demand on account of growing population coupled with increasing share of nuclear energy in the global energy matrix is also anticipated to drive the expansion of this industry.

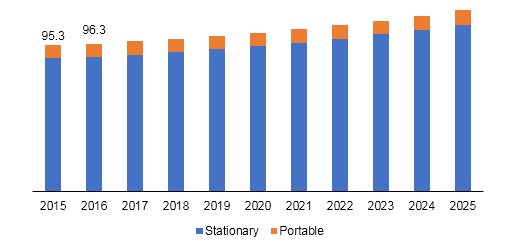

Nuclear air filtration market size, by product type, 2015 - 2025 (USD Million)

According to the International Atomic Energy Agency (IAEA), 448 nuclear power reactors were in operation with an installed capacity of net 391 GW (e) in 2017. Additionally, about 61 units are under construction according to the World Nuclear Association (WNA). This factor is expected to augment demand for air filters in the forthcoming years. In North America, in both high cases and low cases, electricity production through nuclear power plants is expected to rise in the next fifteen to twenty years.

Within Africa, the total nuclear energy outputs are expected to remain steady till 2030, but it is expected to increase by 5 GW (e) by 2050. This is expected to augment the nuclear air filtration market growth in the years to come. Nuclear energy is efficient and has low impact on environment, which makes it a preferred source. Every year, it saves up to 555 million metric tons of CO2, which is equivalent to taking more than 110 cars off the road.

Increasing energy generation through nuclear power plants, as it is considered as a clean source of energy, will have a positive impact on the industry growth. In U.S., nuclear is the largest source of clean energy and supplies more electricity than solar, geothermal, and hydro combined. Depletion of non-renewable energy sources has spurred the industry growth over the last few years. This trend is likely to continue in near future as well. Increasing efforts to reduce dependency on non-renewable energy sources are expected to have a positive impact on market growth.

Segmentation by Product Type

• Portable

• Stationary

Stationary segment is expected to lead the global market over the forecast period. Stringent regulations mandating use of air filters in nuclear facilities are expected to keep the industry buoyant over the forecast period. Portable air filters have a high air exchange rate that helps in removal of radioactive materials from the air. Efficient removal of these materials prevents risk of cancer and various other health problems. Established companies such as M.C. Air Filtration Ltd. offer portable filters for nuclear applications. Also, deployment cost of portable High Efficiency Particulate Air (HEPA) filters is lower than personal respiratory equipment.

Segmentation by Region

• North America

• U.S.

• Europe

• Germany

• Asia Pacific

• China

• Japan

• India

• Rest of the World

Europe commands the largest share of electricity generated using nuclear power. The region has the highest number of nuclear power plants, thus it is a strong platform for air filtration products. Presence of several under-construction facilities in countries such as Bulgaria, France, Russia, and U.K. make Europe a potential market for these systems. According to the World Nuclear Association, European Union is the largest importer of energy with an import of around 53% of total energy demand. In 2012, the Energy Efficiency Directive (EED) established various measures with an objective to generate 20% of its energy requirement and to decrease the import ratio by 2020.

Such initiatives are projected to drive the industry. Demand for air filtration products is higher in China as compared to other countries in Asia Pacific. As of April 2018, Asia Pacific was the fastest-growing market for overall electricity generation, which included power generation through atomic power plants. Capacity expansion of existing power plants and a number of ongoing construction projects for new plants are anticipated to support market demand over the forecast period.

Competitive landscape

Some of the prominent companies in nuclear air filtration market are The Camfil Group; American Air Filter Company, Inc.; and The MANN+HUMMEL Group. Most of these companies concentrate on expanding their business by providing efficient products and maintenance services. They also focus on potential regional markets where a number of new power plants are under construction.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service