Prebiotics Market Size, and Forecast By Ingredients (Inulin, FOS, MOS, GOS), By Application (Animal Feed, Dietary Supplements and, Food and Beverages), And Trend Analysis, 2014 - 2025

- Published: September, 2018

- Format: Electronic (PDF)

- Number of pages: 100

- Industry: Nutraceuticals & Functional Foods

Industry Insights

The global prebiotics market size was valued at USD 3.34 billion in 2016 and is anticipated to expand at a CAGR of 10.0% over the forecast period. Increasing use of prebiotics in several dairy products is projected to augment the market expansion.

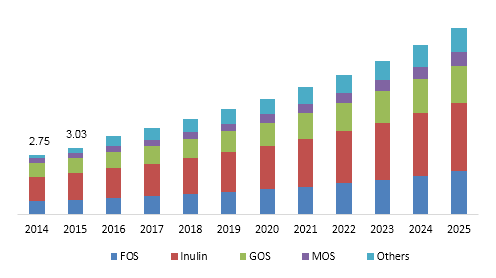

Global prebiotics market size, by ingredients, 2014 – 2025 (USD Billion)

Prebiotic ingredients help reduce digestive problems and ensure high immunity by enhancing the growth of beneficial bacteria in the gut. Rigorous R&D by leading companies for the advent of new ingredients, such as Xylo-Oligosaccharides (XOS), with enhanced functional properties have increased its scope of application in food ingredients.

Dietary fibers constitute the major source of prebiotics and their occurrence is traced in fruits and vegetables and can be consumed in the form of nutritional supplements to ensure better gut health. In terms of volume, more than 600.0 kilo tons was consumed in 2016 and is expected to witness a CAGR of 8.0% over the forecast period.

Growing demand for essential ingredients in the diet and health consciousness among consumers across the globe will offer lucrative opportunities for the prebiotic manufacturers. There has been an increasing trend of using prebiotics to treat several GI disorders, such as Irritable Bowel Syndrome (IBS), constipation, and gastroesophageal reflux disease, which will support the market growth.

Imbalanced consumption of prebiotics may have some adverse effects. This may also hamper the market growth. However, various health management programs conducted by the prebiotics manufacturers along with their rigorous research efforts aimed at developing new ingredients will further escalate the market growth.

Segmentation by Ingredients

• Fructo-Oligosaccharide (FOS)

• Inulin

• Galacto-Oligosaccharide (GOS)

• Mannan-oligosaccharides (MOS)

• Others

Inulin prebiotic ingredient segment accounted for the largest share (more than 42.0%) of the global prebiotics market in 2016, in terms of revenue and volume.. The growth of inulin segment is attributed to its usage in the production of functional foods owing to its high adaptability. Chicory roots constitute the major source of inulin. This ingredient also offers several benefits for the diabetic patients and people suffering from digestive issues, which boosts the market growth.

Galacto-oligosaccharides (GOS) held the second-largest revenue share of more than 20.0% in 2016. This growth is attributed to the rising demand for these ingredients in synbiotics and infant foods. In addition, these ingredients are used for the treatment of inflammatory bowel disease and other GI disorders.

Fructo-oligosaccharides (FOS) segment is anticipated to record the fastest CAGR of more than 10.0% throughout the forecast period. This is mainly due to the ability of the FOS to resist bacterial infections. Moreover, it supports the production of various minerals and vitamins.

Segmentation by Application

• Prebiotic Food and Beverages

• Prebiotic Dietary Supplements

• Animal Feed Prebiotics

Prebiotics ingredients find major application in the food and beverages sector to enhance the taste, texture, and nutritive value of the food products. Furthermore, rising preference for healthy energy drinks over conventional carbonates will further escalate the product usage in food and beverages, thereby propelling the segment development. Rapidly growing dairy market in emerging economies, such as China and India, will favor this application segment.

Within the food and beverage application, dairy products accounted for more than 85.0% of the total revenue in 2016 owing to high consumption of these products. Dairy prebiotics are majorly used in the manufacture of fermented milk and cheese. In addition, the dietary supplements segment is further analyzed into nutritional supplements, infant formula, food supplements, and specialty nutrients.

Among these, nutritional supplements accounted for the major share of the prebiotics market and is expected to register a CAGR of around 10.3% over the forecast period. This sub segment is likely to witness the fastest growth owing to high demand as a result of rapidly changing lifestyles and rising sports drinks market landscape in emerging countries.

Segmentation by Region

• North America

• U.S.

• Europe

• Germany

• U.K.

• Asia Pacific

• China

• Japan

• Central & South America

• Middle East & Africa

In terms of revenue share, Europe accounted for the largest share (40.3%) of the global market in 2016. The Asia Pacific region is anticipated to expand at the highest CAGR over the forecast period. The market growth in these regions is majorly attributed to consistent product modifications coupled with increasing use of these ingredients in food and beverage sectors.

North America, on the other hand, is anticipated to record a CAGR of 9.7% over the forecast period owing to the rising importance of the animal feed ingredients followed by high occurrence of diseases, such as Bovine Spongiform Encephalopathy (BSE) and Porcine Epidemic Diarrhea virus (PEDv), which has resulted in need for better quality animal feed ingredients.

Competitive Landscape

Major companies in the market are rigorously focusing on technological developments and investments to set up R&D facilities across various regions. In addition, the companies have undertaken several business expansion strategies, such as M&A and new product development, to meet the increasing demand from food and beverages sector.

FrieslandCampina Domo and U.S.-based Cargill Foods are the top two companies owing to their extensive portfolio of functional peptides and hydrolysates bioactive proteins and GOS for use in nutraceutical products. Some of the key companies in the prebiotics market include FrieslandCampina Domo; Abbott Nutrition; Clasado Ltd.; Jarrow Formulas, Inc.; and Roquette America, Inc.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service