Probiotics Ingredients Market Size And Forecast, By Product (Bacteria, Yeast, Spore), By Applications(Food & Beverage, Dietary Supplements), By End Use (Human, Animal) And Trend Analysis, 2015 - 2025

- Published: September, 2018

- Format: Electronic (PDF)

- Number of pages: 211

- Industry: Nutraceuticals & Functional Foods

Industry Insights

The global probiotics ingredients market size was valued at USD 1.95 billion in 2017 and is expected to grow further over the forecast period. Rising preference towards preventive healthcare coupled with awareness regarding the inherent benefits of fiber ingredients is expected to boost the overall market growth in the next few years.

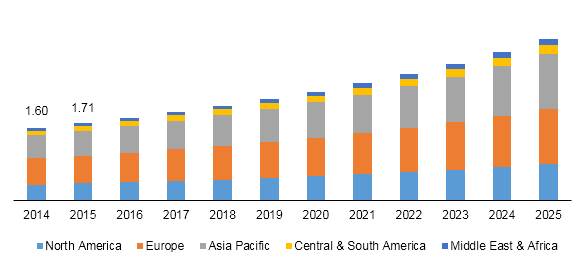

Probiotics ingredients market size, by region, 2014 - 2025 (USD Billion)

Probiotics ingredients play a crucial role in preventive healthcare as they reduce the occurrence of a disease by strengthening the immunity system of the body. These ingredients, when consumed in sufficient amount, improve gut health, reduce intestinal inflammation, and improve digestive tract.

Segmentation by Product

• Bacteria

• Lactobacilli

• Bifidobacterium

• Streptococcus

• Yeast

• Spore

• Formers

Bacteria as probiotic ingredient was valued at USD 1.62 billion in 2017 and is expected to be the fastest-growing segment over the forecast period. Therapeutic benefits of bacteria are expected to boost their usage in functional foods, such as yogurts and custards, thereby augmenting the market growth.

Probiotics help prevent various health problems including liver disorders, common cold, tooth decay, and Inflammatory Bower Disease (IBD). Growing consumer awareness regarding the benefits has increased demand for probiotics over the past few years. Lactobacilli is the largest sub-segment, which was valued at over USD 950 million in 2017. It is projected to witness steady growth over the forecast period owing to various benefits offered by the bacterial ingredients.

Segmentation by Application

• Food & Beverages

• Dietary Supplements

• Animal Feed

Food and beverage led the global probiotics ingredients market in 2017 accounting for 81.5% of the global share. Extensive R&D initiatives have spurred the usage in different food items to help improve digestive health, relieve stress, and blood pressure problems. Growing consumption of foods, such as yogurt, sauerkraut, and kefir, has also increased demand for dietary ingredients. This factor is anticipated to further drive the segment.

New product launches by major food manufacturers is expected to add to the growth of food and beverage sector in near future. For instance, in September 2016, Tropicana Products, Inc. launched Tropicana Essentials Probiotics Strawberry Banana fortified with vitamins and artificial flavors.

Dietary supplement is expected to be the fastest-growing application segment over the forecast period. Increasing consumer demand to fulfill their daily nutritional intake, such as vitamins and minerals is anticipated to bode well for the market. Positive outlook towards sports nutrition sector as a result of rising awareness about weight management and endurance is expected to tap new markets in near future.

Segmentation by End-use

• Human

• Animal

The human food segment is expected to generate revenue exceeding USD 3.00 billion by 2025. Inculcation of probiotics in a variety of products such as juices, cheese, and cereals has broadened the product portfolio for human use. This trend is expected to expand the reach of the market for probiotic ingredients over the forecast period.

For instance, the U.S.-China Health Products Association focused on the food segment, rather than supplements, which accounted for 94.0% of probiotic sales in China. In addition, growing awareness regarding adverse effects of antibiotics in animal feed has prompted a rise in usage of animal feed probiotics, as they do not have any side effects.

Segmentation by Region

• North America

• Europe

• Asia Pacific

• Central & South America

• Middle East & Africa

North America accounted for over 20% of global market share in 2017 and is expected to grow well over the forecast period. Increasing preference for health and wellness products is anticipated to propel global probiotics ingredients market over the forecast period. Europe generated revenue exceeding USD 690 million in 2017 and is likely to expand further in near future. Consumer awareness brand campaigns by the International Probiotics Association (IPA) will contribute significantly to the market growth. Asia Pacific is estimated to be the fastest-growing region, registering a CAGR of around 8.0% over the forecast period. Expansion of functional drinks market in emerging countries, such as China and India, is expected to contribute to the regional growth.

Competitive Landscape

Major companies in probiotics ingredients industry are increasing their R&D spending to introduce new products for pharma, animal feed, and food and beverage industries. In January 2018, Healthy Directions LLC launched Gutsy, a nutritional powder, which provides immune and digestive health support through functional properties of probiotics and vitamin D. Some of the leading companies operating in the market include Ganeden Inc.; Sabinsa Corporation; and Biocodex, Inc.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service