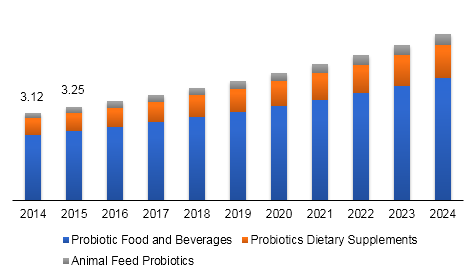

Probiotics Market Size And Forecast, By Application (Probiotic Food & Beverages, Probiotic Dietary Supplements, Animal Feed Probiotics), By End-use (Human Probiotics, Animal Probiotics) And Trend Analysis, 2014 - 2024

- Published: September, 2018

- Format: Electronic (PDF)

- Number of pages: 120

- Industry: Healthcare

Industry Insights

The global probiotics market size was valued at USD 38.32 billion in 2016. Increasing prevalence of Irritable Bowel Syndrome (IBS), inflammatory bowel disease, digestive disorders, and dermatitis is expected to drive product consumption. Probiotics are also used for treating diarrhea, Urinary Tract Infections (UTI), and intestinal infections. Over the forecast period, probiotic usage for the treatment of mental illnesses, heart disorders, and allergies is expected to increase.

U.S. probiotics market size, by application, 2014 - 2024 (USD Billion)

Rising importance of fiber fortification in food and beverage for enriching nutritional level in human body is expected to boost the product use. This, in turn, is anticipated to drive the probiotics market over the forecast period. Moreover, increasing inclination of working class population towards weight management to prevent obesity and cardiovascular disorders will also fuel demand for probiotic-based functional foods.

Consumer inclination towards dietary supplements for additional nutrition across all age-groups is expected to remain a favorable trend. Probiotics in infant nutrition present growth opportunity, especially in Middle East and Africa. Probiotic supplements have relatively less penetration in countries such as Brazil, India, China, and South Africa compared to their counterparts in North America and Europe.

In the forthcoming years, a targeted approach to acquire new customers through product promotion and strengthening distribution channels is expected to be a key focus area for manufacturers. On similar lines, manufacturers are expected to collaborate with online platforms to gain more visibility.

Segmentation by Application

• Food and Beverages

• Dietary Supplements

• Animal Feed

In 2016, food and beverages segment held 84.1% revenue share in the global probiotics market. Increasing awareness about benefits associated with the product is projected to be one of the key driving factors among consumers, especially in the 18 to 34 years age group. Furthermore, increasing use in functional foods for patients suffering from cardiovascular diseases and diabetes will provide growth opportunity over the forecast period.

The dietary supplement segment is expected to expand at the fastest CAGR of 7.5% during the forecast period. Favorable regulatory framework related to the incorporation of natural ingredients in food products in countries such as U.S. will keep the product demand buoyant over the forecast period.

Segmentation by End-use

• Human Nutrition

• Animal Nutrition

Human nutrition is expected to emerge as the dominant segment, accounting for well over 85% share of the market. Commonly consumed probiotic dairy products which benefit the human gut microflora include yogurt and yogurt-based beverages. Probiotics are microorganisms responsible for maintaining the pH balance inside gut. High consumption of the product can strengthen human immune system and gut health.

Probiotic animal feed is increasingly used for altering gastrointestinal flora and to improve animal health. As dietary intake affects the structure and activities of the gut microbial flora, improper food intake results in impaired health and reduced yield. The addition of this product in animal feed can also reduce mortality rate.

Segmentation by Region

• North America

• Europe

• Asia Pacific

• Central & South America

• Middle East & Africa

Asia Pacific was the dominant segment, accounting for 42.0% of the market share in 2016. Increasing use for the treatment of irritable bowel syndrome and ulcerative colitis is expected drive the regional market. China and India are projected to remain key growth markets in Asia Pacific. However, the market is expected to witness a shrink in revenue in Japan owing to the substitutional threat from prebiotic food and supplements.

On the other hand, Europe has a higher product penetration compared to Asia Pacific. However, probiotics consumption in Western European countries such as France, Germany, and U.K. is expected to witness a slowdown in near future.

Competitive Landscape

The probiotics market is highly competitive in nature with the presence of well-established companies. Most companies are focusing on new product developments and vendor relationship management to strengthen their sourcing efforts.

Companies are also entering into partnership agreements with local players to enhance their product portfolio and geographical reach. For instance, in September 2016, BioGaia signed an exclusive distribution agreement with Phillips Pharma Group for selling BioGaia ProTectis drops, tablets, and Oral Rehydration Solution (ORS) in Ghana, Nigeria, and Kenya.

Some of the key players operating in the market are Arla Foods, Inc.; BioGaia AB; Chr. Hansen Holding A/S; Danone; Danisco A/S; General Mills, Inc.; I-Health Inc.; Lallemand Inc.; Lifeway Foods Inc.; and Mother Dairy Fruit & Vegetable Pvt. Ltd.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service