Recreational Vehicles (RVs) Market Size and Forecast By Product (Towable and Motorhomes), By Application (Commercial and Residential) And Trend Analysis, 2015 - 2025

- Published: February, 2019

- Format: Electronic (PDF)

- Number of pages: 70

- Industry: Automotive & Transportation

Industry Insights

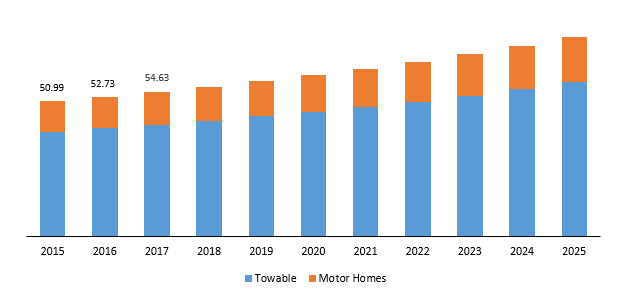

The global recreational vehicles market was estimated at USD 54.63 billion in 2017 and is anticipated to reach USD 75.38 billion in 2025, growing at a CAGR of 4.11% from 2017 to 2025. The demand for recreational vehicle (RV) is increasing, driven by the rising ownership among consumers especially in the U.S. More than 11.0% of the U.S. population aged between 35 years to 45 years own a recreation vehicle, thereby contributing to an upswing in the global demand.

Global recreational vehicles market revenue, by product, 2015 - 2025 (USD Billion)

Frequent changes in the duration of vacations mostly favor the demand for recreational vehicles According to the prevailing adoption trends, consumers are preferring to travel short distances with hassle-free planning, which is making these vehicle a convenient travel option for them. The market is witnessing consistent innovations wherein manufacturers are developing lightweight towable and fuel-efficient compact motorhomes also known as campers or camper trailers.

Increasing environmental concerns are driving the manufacturers towards he introduction of green technologies such as solar panels. For instance, solar panels are being integrated with the vehicles with an aim to curb down the energy consumption. Across California, the recreational vehicles based parks are focusing on investing more in solar energy systems to combat the rising electricity costs.

Around 89% of the consumers worldwide use recreational vehicles for camping purposes. The privately owned RV campgrounds are mostly found near major tourist prone routes and sometimes even in metropolitan areas. These campgrounds are facilitated with various amenities such as swimming pools, playgrounds, game rooms, snack areas and others to drive in more footfalls thereby promoting the commercial recreational vehicle concept.

Segmentation by product

• Towable

• Motorhomes

Towable segment includes any RV that needs to be towed along by another vehicle. Such types of recreational vehicles are hitched onto a truck that can be difficult to control while switching lanes. However, towable RVs are less expensive and provide more convenience due to a detachable vehicle which also serves the purpose of exploring other areas in and around where the vehicle is stationed.

Towable RV are of various types such as travel trailers, 5th wheel trailers, folding and tent trailers, and toy haulers. The global towable recreational vehicles market value was worth USD 42.27 billion in 2017 thereby exhibiting a CAGR of 4.08% from 2017 to 2025.

Motorhomes are designed to be completely self-contained and are easier to set up at the camp-sites and provide enough room for the passengers to move about while on the road. Motorhomes can be categorized into three types namely class A, B and C. Among the three types, Class A represents the spacious and most expensive recreational vehicle which are usually preferred by the travelers. Few variants of Class A include converted buses and purpose built models. This model offers ample living space and cargo storage with the facility of integrating various luxurious amenities.

Unlike Class A, Class B does not feature luxurious amenities and lack space and hence is suitable for not more than 2-3 people. Class C models are not designed with sufficient fuel efficiency as compared to Class A. Hence Class A models are most preferred among the consumers owing to its advanced features and functionalities. Motorhomes category accounted for about 22.62% share in the total market and is expected to grow at a CAGR of 4.20% from 2017 to 2025.

Segmentation by application

• Commercial

• Domestic

Commercial recreational vehicle market holds a share of more than 40% in 2017 accounting to a value of USD 22.51 billion. This market is expected to grow with a CAGR of 4.24% from 2017 to 2025. Commercial vehicles are gaining increasing traction owing to the increasing tourism industry. The need to provide a compact relaxing area along with the various other recreational facilities. About 97% of the recreational vehicles are used by the tourists and locals for camping purposes. Camping has evolved as the most common outdoor recreational activity among the tourists who prefer a compact living area integrated with various other luxurious facilities. This scenario is expected to propel the growth of the market which is considered as the most convenient way of camping.

The domestic application holds a majority share in the global recreational vehicle market, thereby having a value of USD 32.11 billion in 2017. Both families and individual travelers exhibit strong potentials for the increased sales of the domestic vehicles. Consumers across the world are seeking for short trips and camping in RV. Middle-income consumers ranging between 55 to 64 years had the highest ownership of recreational vehicles and as per the recent trend people aged between 35 - 40 years are contributing to the maximum demand for these vehicles. RV purchases are mostly discretionary and therefore demand is highly influenced by the consumer confidence and willingness. For instance, with the recovery of the U.S. economy has recovered over the past few years, the purchase of financed non-essential items, such as RVs being one of them is trending among the consumers.

Segmentation by geography

• North America

• Europe

• Asia Pacific

• Central & South America

• Middle East & Africa

North America accounts for a majority share in the global market with 43.46% in 2017. U.S. drives the majority revenue for North America market wherein approximately 10 billion households own recreational vehicles. Current models for these vehicles are designed with fuel-efficient diesel engines along with lighter composites, which is expected to reduce the carbon emissions.

North America market is projected to witness potential growth in the domestic RV market owing to the increasing trend of short trip and getaways among the households. Domestic trips made by the U.S. residents are expected to increase in 2018, offering a potential opportunity for the global industry.

Australia represents a large market in the APAC market. It has almost 19 major manufacturers along with approximately 200 small producers. About 70% of the RVs purchased in Australia are manufactured by the country itself. The country also provides about 2,300 campgrounds for these vehicles. Australia is considered to have the fastest growing tourism industry which has been a major driving factor for the significant demand for recreational vehicles market.

Competitive Landscape

Some of the key players in the global recreational vehicle market include Winnebago Industries, REV Recreation Group, Forest River Inc., Airstream, DRV Luxury Suites, Dutchmen RV, Cruiser RV, Erwin Hymer Group SE, Grand Design RV, Highland Ridge, and others.

The manufacturers are focusing on commercializing vehicles integrated with advanced technologies with an aim to improve the consumer experience. For instance, In September 2017, Winnebago Industries had launched Rvs including the Revel, Horizon and Intent, to the motorhome product lines and Minnie Plus Fifth Wheels in the towable range.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service