Recycled Plastics Market Size And Forecast, by Product (PET, PE, PP), by Application (Packaging, Building & Construction, Automotive, Electrical & Electronics), and Segment Forecast, 2015 - 2025

- Published: February, 2019

- Format: Electronic (PDF)

- Number of pages: 80

- Industry: Plastics, Polymers & Resins

Industry Insights

The global recycled plastics market was valued at USD 32.48 billion in 2017. Rising environmental concerns and the increasing focus on conserving resources and diverting plastics from landfills are among the favorable factors that are benefiting the market. Also, recycling saves energy and helps in conserving natural resources as recycling consumes around 80.0% less energy than producing new plastic.

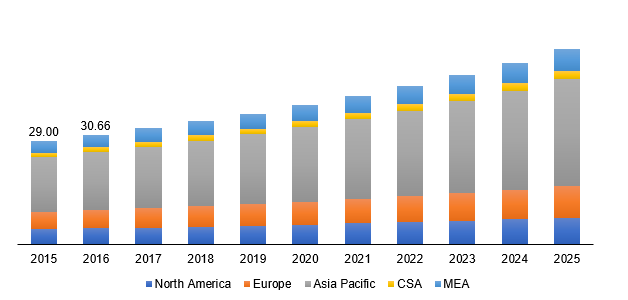

Global recycled plastics market, by region, 2015 - 2025 (USD Billion)

Over the past few years, prominent multi-national companies including Coca-Cola and Nestle are focusing on using recycled plastics. Coca-Cola Europe subsidiary plans to increase the content of recycled plastic or RPET in its bottles to 40.0% by 2020, while Nestlé Waters North America (NWNA), one of the prominent beverage companies in North America, plans to utilize 25.0% of the recycled plastics in product packaging across the U.S. by the end of 2021.

Segmentation by Product

• PP

• PE

• PET

• Other

In 2017, Polyethylene (PE) was the largest product segment accounting for around 30.0% of volume share. The segment is expected to witness grow on account of increasing volume, particularly in the packaging industry.

Polyethylene Terephthalate (PET) is one of the most widely recycled plastic globally. PET is easy to recycle and incurs low recycling cost. As PET plastic bottles are most preferred for packaging soft drinks, the scope of recycling a PET is expected to remain buoyant over the coming years. In 2017, the PET segment accounted for well over 20.0% revenue share of the global recycled plastics market.

The revenue share of other plastics was valued at around USD12.30 billion in 2017. The segment mainly comprises polymers such as Polystyrene (PS) and Polyamide (PA). Value contribution of these products in the market is expected to increase from 2015 to 2025 given their increasing usage in construction and automotive sectors.

Segmentation by application

• Packaging

• Building & Construction

• Automotive

• Electrical & Electronics

• Other

In 2017, packaging accounted for more than 40.0% of the global volume share. Sustainable packaging initiatives adopted by companies in the food & beverages sector and stringent regulations by authorities such as the U.S. EPA and European Commission towards limiting the scope of chemical-derived material is expected to have a positive impact on the market. Improved quality and safety of post-consumer recycled plastics intended for food packaging is expected to remain a key trend in the near future.

Increasing consumption of packed food, takeaway food, and food delivery services in various countries globally has led to an increased demand for plastic packaging. According to the Institute for European Environmental Policies, by 2020, around 900 billion packaged food items will be consumed in Europe annually, which creates a huge scope for the market.

In the U.S., the government is emphasizing on the use of recycled plastics for food packaging. To this end, the Food and Drug Administration (FDA) has allowed the use of recycled PET in packaging including fruit and meat packaging.

Segmentation by region

• North America

• Europe

• Asia Pacific

• Central & South America (CSA)

• Middle East & Africa (MEA)

In 2017, Asia Pacific accounted for more than 50.0% revenue share of the market. The growing demand for an alternative to virgin plastic in countries such as China, Japan, and India is expected to have a positive impact on recycled plastics demand. Recycled plastics will witness demand from food & beverages and personal care products sector where it will be used for packaging.

Europe, on the other hand, accounted for more than 15.0% revenue share of the market in 2017. Demand for recycled plastic is expected to strengthen on the backdrop of various frameworks advocating the importance of reducing carbon footprints and energy conservation from various sectors including automotive. Some of the leading automotive manufacturers plan to use recycled plastics to reduce their carbon footprint. For instance, Volvo, a Swedish vehicle company, announced that from 2025, around 25.0% of the plastics used in its new vehicles will be made from recycled materials.

Competitive Landscape

The global market is fragmented with a high concentration of many small and medium recycling firms. Many recyclers are active in Asia Pacific countries such as China and India. Some of the prominent vendors in the market are Veolia, Jayplas, SUEZ, B. Schoenberg & Co., Inc., Plastipak Holdings, Inc., CUSTOM POLYMERS, Green Line Polymers, and Clear Path Recycling.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service