Global Refrigerated Trucks Market Size And Forecast, By Vehicle Type (LCV, MCV, HCV), By Application (Food, Pharmaceuticals), By Region (North America, Europe, Asia Pacific, Central & South America, Middle East & Africa), And Trend Analysis, 2019 - 2025

- Published: February, 2019

- Format: Electronic (PDF)

- Number of pages: 65

- Industry: Automotive & Transportation

Industry Insights

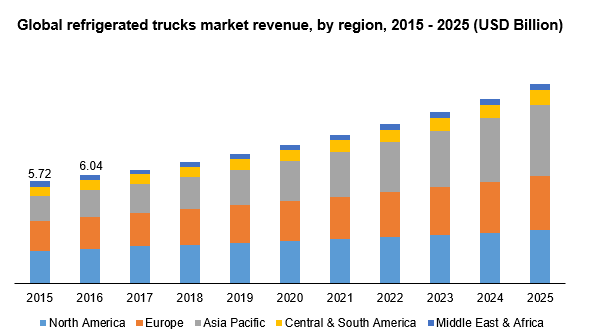

The global refrigerated trucks market was valued at USD 6.36 billion in 2017 and is projected to grow at a CAGR of 7.3% from 2017 to 2025. Increasing demand for fresh and frozen food products such as fruits & vegetables, meat, and dairy is expected to remain the principal driving force in the near future.

Segmentation by Vehicle Type

• LCV (Light Commercial Vehicle)

• MCV (Medium Commercial Vehicle)

• HCV (Heavy Commercial Vehicle)

HCV dominated the market with a share of around 39.0% in 2017. HCVs are majorly used for long distance transportation of perishable goods. These trucks bring in efficiency as they have higher capacity and can transport multiple product categories such as fish, meat, and dairy products as they are mostly equipped with the multi-temperature refrigerated system.

The LCV segment is expected to witness fastest growth at a CAGR of over 8.0% from 2017 to 2025. LCVs are preferred for intracity transportation of perishable products. Refrigerated LCVs are effective in city driving conditions and their demand is expected to increase with the growth in FMCG and e-commerce sectors. The demand will strengthen with the rise in online food and grocery shopping in the coming years.

Segmentation by Application

• Food

• Pharmaceutical

• Others

Food industry dominated the market accounting for more than 60.0% in 2017. The rising demand for fresh and temperature sensitive food products such as fruits and vegetables are fueling the growth of refrigerated trucks. Also, the increase in online delivery of frozen and chilled product categories such as food and beverages are supporting the growth opportunities for refrigerated transportation.

Refrigerated trucks are expected to find strong presence in supplying organic fruits and vegetables on account of maintaining their freshness and shelf-life for a longer-time period. Growing importance of organic foods in countries such as the U.S., Germany and U.K. as a result of stringent restrictions on the incorporation intake of synthetic ingredients in food products is expected to promote the scope of the refrigerated trucks in the near future.

Demand from pharmaceutical industry is expected to growth at a CAGR of more than 6.0% from 2017 to 2025. Refrigerated and temperature-controlled transportation is needed to ensure safe transportation of pharmaceutical products from manufacturers to distributors and pharmacies. The need for effective transportation is all the more important in pharma sector as various medicines, mainly liquid forms become ineffective if not transported in proper temperature-controlled environment.

Segmentation by Region

• North America

• Europe

• Asia Pacific

• Central & South America

• Middle East & Africa

North America was the largest market accounting for more than 32.0% of the market in 2017. The U.S. is a key country in the region where the changing food consumption pattern is driving changes in the logistics industry at large. The increasing demand for fresh and perishable food products including fruits and vegetables is adding to the demand for multi-temp truck bodies. Also, the country has a high concentration of QSRs such as Subway, Burger King, Taco Bell, KFC, Pizza Hut, and McDonald's, which require a regular supply of frozen and fresh food products.

Asia pacific is expected to be the fastest growing market at a CAGR of more than 12.0% from 2017 to 2025. The growing consumption of frozen and chilled food products in the region is expected to drive growth in the market. The demand is expected to be relatively strong from countries such as India, China, and Japan where the demand for frozen and chilled products is on the rise. Time-pressed consumers are increasingly opting for frozen ready to cook food products.

Competitive Landscape

The refrigerated trucks market is marked by the presence of established companies such as China International Marine Containers (Group) Ltd, Wabash National Corporation, Great Dane LLC, Schmitz Cargobull AG, Kögel Trailer GmbH & Co.KG, HYUNDAI Translead, Inc., KRONE, CHEREAU, LAMBERET SAS, and GRW Tankers and Trailers.

Service providers transport a large volume and variety of climate-sensitive products across verticals such as food and pharmaceutical. In the coming years, manufacturers are expected to focus on consolidating their presence in growth countries such as India and China, where lifestyle changes and growth in infrastructure is expected to support the demand for fresh and frozen products. Partnership with logistics service providers are expected in order to meet the growing demand for cold logistics.

Also, the emphasis on sourcing sustainable reefer transportation fleet in light of reducing carbon footprint is expected to strengthen in the coming years. The trend is evident in countries such as the U.S. and is expected to gain traction in countries such as India and China where the demand for reefer transportation is expected to strengthen over the coming years. For instance, in 2013, Coca-Cola deployed electric refrigerated trucks in the U.S. to reduce its carbon footprint.

Over the past few years the major companies have expanded their business strategically through merger & acquisition, product innovation, and business diversification. In September 2017, Wabash National Corporation acquired the Supreme Industries, Inc. the U.S. based manufacturer of truck bodies. This acquisition is expected to help in business diversification of Wabash with the help of Supreme’s product portfolio.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service