Singapore Frozen Food Market Size and Forecast by Type (Frozen ready meals, Frozen pizza, Frozen fish/seafood, Frozen meat, Frozen potato products, Frozen bakery products), by Distribution Channel (Online, Offline) And Trend Analysis, 2014 - 2024

- Published: March, 2018

- Format: Electronic (PDF)

- Number of pages: 50

- Industry: Food & Beverages

Industry Insights

Singapore frozen food market was valued at USD 113.4 million in the year 2016. Being located on major sea and air routes within Asia Pacific region has benefitted and contributed to making it a regional headquarter for financial companies as well as food and agriculture-related companies. The country has no local agriculture production owing to unfavourable land conditions hence the country entirely depends on imports for all food requirements. Furthermore, no tariff and excise duty on food and agriculture-related products are expected to drive the market for frozen food in Singapore. However, import tariffs and excise duty are applicable on tobacco products and alcoholic beverages and 7% GST is levied on all goods at the time of distribution.

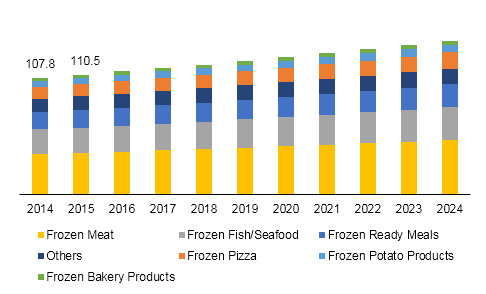

Singapore frozen food market revenue, by type, 2014 - 2024 (USD Million)

Frozen food consuming population is increasing in Singapore owing to easy preparation, no-clean, and simple operation of frozen food products. Key players are building intelligent giant factories and storages to focus on cold storage transport, and are using high-quality ingredients to cut the processing time and improve the production volume.

Segmentation by Type

• Frozen ready meals

• Frozen pizza

• Frozen fish/seafood

• Frozen Meat

• Frozen potato products

• Frozen bakery products

• others

Frozen meat products are the largest segment of the market in Singapore, accounting for a maximum market revenue share of more than 30% in the year 2016 and is expected to grow at a healthy growth rate owing to the changing perception of local people towards frozen meat and seafood products. Fish segment is the second largest frozen food market owing to maximum import. People in this country are expected to consume 22kg of fish and sea food per person yearly that surpasses the global average by 2 kg. Hence, frozen fish and seafood is projected to see significant growth over the future period.

Segmentation by Distribution Channel

• Online

• Offline

Offline distribution is the leading distribution channel for frozen food products in Singapore and has accounted for maximum market revenue share. In 2016, supermarkets and hypermarkets which are leading offline channels, accounted for around half the market share and are expected to show descent growth in the future. Modern retailers are carrying a large range of foreign products as compared to traditional retailers which are expected to attract more local people. Furthermore, wet and dry sections are also included in Singapore’s super and hyper markets so that customers can opt for any of the frozen food products depending upon the category with ease.

Competitive landscape

Frozen food market in the country is marked by the presence of established companies such as Auric Pacific Group and Ken Ken Food, offering a considerable array of products. Over the coming years, the vendors are expected to focus on product innovation more so in frozen meat products, which gains higher consumer preference amongst the various segments. In terms of preference to distribution channel, the vendors are expected to focus on online channel, where the relative growth is relatively higher compared to offline channel. However, over the forecast period, hypermarkets and supermarkets will continue to remain a key retail sales venue for the market.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service