Smart Water Grid Market Size And Forecast, By Technology (Smart Infrastructure, Control & Automation, ICT & Analytical Software, Design & Engineering), By Application (Residential, Commercial, Utility), And Trend Analysis, 2014 - 2025

- Published: September, 2017

- Format: Electronic (PDF)

- Number of pages: 60

- Industry: Water & Sludge Treatment

Industry Insights

The global smart water grid market size was valued at USD 6.50 billion in 2016 and is expected to grow owing to factors such water scarcity, the disproportion of demand and supply, advancement in technologies provided by ICT, and management of ageing infrastructure. Inaccurate bills issued by agencies has been driving the need for installation of smart water grids to control and keep a tab on the distribution for smooth supply.

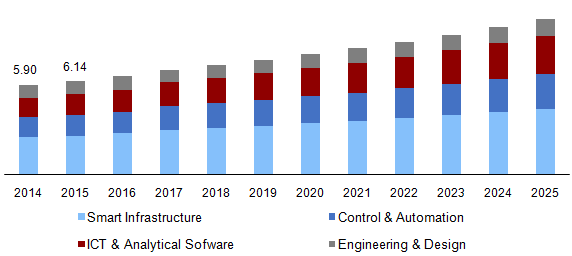

Global smart water grid market revenue, by technology, 2014 - 2025 (USD Billion)

Integration of smart water grid with ICT (Information and Communication Technologies) has resulted in constant and remote monitoring, maintenance, and tracking of distribution management. Strict guidelines towards the preservation and the regulation of circulation network will drive smart water metering market. Countries such as Saudi Arabia and India are required to prioritize water conservation and wastage, particularly in drought-affected parts of the region.

The increase in the installation of smart water grids across the globe has brought drastic change among emerging economies in the case of distribution. It is witnessed that large scale & reformed processes by commercial bodies, workers, and administrators play a significant role in the growth.

Numerous smart grid technologies such as ICT & analytical software, control & automation and smart infrastructure are available in the marketplace to achieve energy efficiency from residential, commercial, and utilities. However, limitations such as huge capital investment, the absence of monitoring support, and lack of government initiatives have resulted in hampering the market.

Segmentation by Technology

• Smart Infrastructure

• Control & Automation

• ICT & Analytical Software

• Design & Engineering

The ICT & analytical software segment is expected to grow by 5.9% CAGR over the forecast period, owing to the advancements in smart technologies and need for error free billing. Increase in the installation of these grids and the rapidly rising scarcity worldwide is driving the market.

ICT & analytical software is a fundamental technique as it displays behavioural economics and mind-set of users in terms of water consumption. To attain the target of 146.89 litres/capita/day by 2020 and 139.50 litres/capita/day by 2030, numerous governments are discovering the relationship between real-time water distribution data and response from smart devices & technologies that can influence ingesting behavioural fluctuations of local customers.

Control & automation is one of the most commonly used technique for the balanced demand and supply of water. The control & automation segment is anticipated to witness steady growth at a CAGR of 4.9% over the forecast period as digitalization helps in displaying accurate consumption with a marginal error.

Key players in the market are indulging in R&D with new and better control as well as automation integrated with ICT & analytical software as it can reduce the cost of water distribution and minimize the risk of monitor tinkering & theft. Data fortification is significant as consumption patterns could be subtle and personal. Furthermore, cost efficiency is a primary consideration for household and commercial administration solutions and is a critical factor in validating the cost effectiveness of smart devices.

Segmentation by Application

• Residential

• Commercial

• Utility

The market size for residential applications was valued at USD 2.92 billion in 2016 owing to the billing disputes faced by the consumers. Furthermore, it also allows flexible analysis of timetables and eradicating interruptions in the swift billing of residential accounts.

Commercial segment is likely to be the fastest-growing segment during the forecast period at a CAGR of 6.8% owing to the rapid industrialization and commercialization. This trend is expected to be especially visible in emerging economies of Asia Pacific.

Segmentation by Region

• North America

• U.S.

• Europe

• UK

• Asia Pacific

• China

• India

• Middle East & Africa

• Saudi Arabia

• Central & South America

North America smart water grid market dominated the industry accounting for 42.4% of the share in 2016. Factors such as advanced technologies and reduction in billing errors & disputes for the customer benefits are the driving factors for the growth in the region.

Asia Pacific is expected to witness the fastest growth at a 6.6% CAGR over the forecast period, owing to a large number of population and commercialisation in the region. Additionally, the increase in production and sales of advanced metering infrastructure gave a boost to the market. Saudi Arabia is estimated to witness a steady growth over the forecast period owing to the water scarcity and implementation delays in the country.

Competitive Landscape

The industry comprises several prominent players such as Itron Inc, Siemens AG, Neptune Technology, Landis+Gyr, Diehl Stiftung & Co. KG and ABB. These companies have been heavily investing in the smart water grid market due to the increase in the focus on distribution, monitoring, upgrade of infrastructure and advancement in technologies.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service