Software Defined Data Center (SDDC) Market Size and Forecast, By Network Solution (SDN, SDS, SDC), By end-use (Large-Scale, Medium-Scale, Small-Scale), By Network Services (Consulting & Assessment, Integration & Deployment Migration, Managed Services), By Industry (IT & Telecom, Retail, Healthcare, BFSI & Government, Manufacturing) and Trend Analysis, 2014 - 2024

- Published: August, 2017

- Format: Electronic (PDF)

- Number of pages: 70

- Industry: Technology

Industry Insights

The global software defined data center market size was valued at USD 26.33 billion in 2016 and is expected to grow owing to its benefits such as advances in networking capability, reduction in storage cost, virtualization and high flexibility. Furthermore, the SDDC market is expected to grow on account of the increasing demand for centralized management, optimized networking resources, increased security and reduced operational overheads.

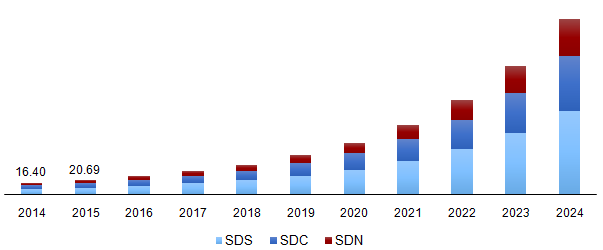

Global software defined data center market revenue, by network solution, 2014 - 2024 (USD Billion)

The market is also expected to increase due to the shift of multiple organizations from traditional data centers to the software-defined data center, as it facilitates effective data center management, efficiently handles the increase in the data traffic, and provides easy and efficient networking. Rising awareness regarding the benefits of the software is expected to drive its growth over the projected period.

Organisations which require large data centres and specifically work from multiple locations are benefited the most from the SDDC. While SDDC implementation has its advantages, difficulty in integration with existing IT infrastructure of companies and the rising threat related to data security may impede market growth. In addition, the existing initial investment for SDDC implementation also affects the adoption rate.

Segmentation by Network Solutions

• Software Defined Networking (SDN)

• Software Defined Storage (SDS)

• Software Defined Compute (SDC)

Software Defined Storage (SDS) accounted for 47.9% in 2016 and is expected to witness the highest growth over the forecast period. This market will be primarily driven by its effectiveness in data storage management on cloud-based platforms. Furthermore, it provides storage flexibility as it adapts itself according to the business requirements and minimizes backup issues by providing auto backup features.

Software Defined Networking (SDN) is expected to grow at a CAGR of 33.4% over the projected period as it is a dynamic architecture which is adaptable, manageable, cost effective, and suitable for run-time applications. It is directly programmable and allows the user to manage, secure, and optimize network resources through an automated SDN program.

Segmentation by end-use

• Large Scale Enterprises

• Medium Scale Enterprises

• Small Scale Enterprises

Large-scale enterprises were the most significant contributor valued at USD 15.11 billion in 2016 and are expected to maintain their position over the forecast period. The high rate of adaptation of new technologies by these enterprises is expected to propel growth over the next few years.

Small scale enterprises are expected to show the fastest growth over the forecast period owing to increasing adoption of SDDC across all small scale enterprises. Rising awareness regarding the long-term benefits the technology is expected to result in growth at a CAGR of 35.5% from 2017 to 2024.

Segmentation by Services

• Consulting & Assessment Services

• Integration & Deployment Migration Services

• Managed Services

The managed services segment contributed the largest market share accounting for 36.6% in 2016 and is expected to grow as a result of growing inclination towards SDDC in multiple industries including IT & telecom, manufacturing and retail.

Consulting & assessment services are anticipated to grow at a CAGR of 33.9% over the next few years on account of rising number of firms shifting from traditional technologies for storing to the new ones. Rising inclination to invest in the latest technologies to protect their businesses and cater to a broader audience is expected to drive the market over the projected period.

Segmentation by Industry

• IT & Telecom

• Retail

• Healthcare

• BFSI & Government

• Manufacturing

• Others

BFSI & Government segment held the lion's share of the SDDC market accounting for 24.9% in 2016. The banking sector has become more competitive than before and is concentrating on providing facilities such as internet banking and banking applications where SDDC comes into play. As a result, this sector is expected to show lucrative growth in the future regarding automation which is projected to spur the growth of software defined data center market.

IT & telecom was the second largest segment of the market in 2016 and is expected to witness above-average growth at a CAGR of 34.8% over the forecast period owing to its flexible operations and its adaptation to frequently changing user requirements. Some of the factors responsible for its growth include efficient utilization of resources and data security.

Segmentation by region

• North America

• U.S.

• Europe

• UK

• Germany

• Asia Pacific

• India

• China

• Central & South America

• MEA

North America contributed to 47.6% of the revenues generated in 2016 and is expected to grow sluggishly over the forecast period on account of saturation. Over the past few years, there has been a relatively high adoption of SDDC for the efficient data management, flexibility and scalability among numerous enterprises in the region.

Asia Pacific is expected to grow at the fastest CAGR of 36.7% over the forecast period owing to rising need of data storage, cost effectiveness in countries such as India, China and Japan. Europe commands the second largest share of the global SDDC market.

Competitive Landscape

The global software defined data center market is marked by the presence of well-established players. The leading players command a major share of the industry and are focusing on new product launches and consolidating their presence globally. Some of the leading companies in the SDDC industry include VMware Inc., Microsoft Corporation, HPE Co, EMC Corporation, Cisco Systems Inc, Hitachi, Ltd., IBM Corporation, Fujitsu, NEC Corporation, and Citrix Systems.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service