Sucralose Market Size And Forecast, By Grade (Food, Pharmaceutical), By Application (Beverages, Food, Drugs, Animal Feed), And Trend Analysis, 2015 - 2025

- Published: October, 2018

- Format: Electronic (PDF)

- Number of pages: 65

- Industry: Nutraceuticals & Functional Foods

Industry Insights

The global sucralose market size was valued at USD 697.4 million in 2017. It is projected to witness a CAGR of 3.0% from 2017 to 2025 on account of rising popularity of artificial sweeteners as a low calorie functional ingredient in the nutrition sector. Furthermore, high demand for frozen bakery products from emerging countries including, China and India on account of high shelf-life compared to their conventional counterparts is expected to have a positive impact market growth.

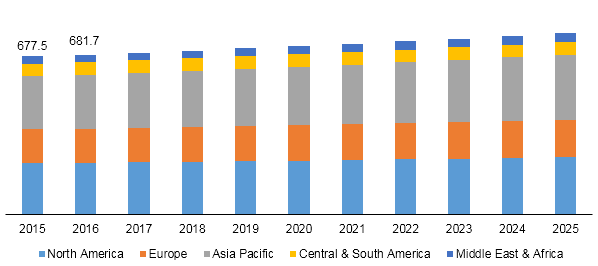

Global sucralose market revenue, by region, 2015 - 2025 (USD Million)

Sucralose finds application as a functional ingredient in formulation of fizzy drinks, table-top sweeteners, baking mixes, breakfast cereals, and salad dressing. It is considered at 650 times sweeter than sugar and is also utilized as an excipient in healthcare industry on account of high solubility and excellent pH stability. Rising importance of excipients as a binding agent in drug formulations is expected to promote the scope of sucralose over the next eight years.

Segmentation by Grade

• Food

• Pharmaceutical

• Others

Food grade sucralose market was valued at USD 629.2 million in 2017 owing to the positive outlook towards food processing sector of emerging economies including, China, India and Bangladesh as a result of investment-friendly government policies is expected to open new avenues for food grade sucralose.

The increasing acceptance of sucralose as a safe product for direct human consumption by various food regulatory authorities is expected to drive adoption over the forecast period. For instance, the U.S. Food and Drugs Administration (FDA) has approved sucralose as a functional ingredient in various food products including, confectioneries, puddings, baked goods, frozen desserts, and beverages.

Pharma grade forms are projected to witness a revenue based CAGR of 3.0% from the period of 2017 to 2025. Pharma grade sucralose is projected to gain momentum in healthcare sector on account of the rising importance of the ability of artificial sweeteners for masking the bitterness of drugs.

Segmentation by Application

• Beverages

• Food

• Drugs

• Animal feed

• Others

Use of sucralose in beverages generated a revenue of USD 300 million in 2017. Carbonated soft drinks are expected to remain one of the prominent segments where an increased spending by the leading beverage manufacturers for the incorporation of artificial sweeteners is gaining traction. For instance, Coca Cola uses sucralose in manufacturing beverages such as Diet Coke, Minute Maid, and fruit juices.

The food segment is projected to consume a volume of 6.66 million tons by the end of 2025. Rising focus on enhanced nutritional content of baked goods and other food products is expected to promote the adoption of sucralose as a functional ingredient with zero calorific value.

Segmentation by Region

• North America

• Europe

• Asia Pacific

• Central & South America

• Middle East & Africa

North America sucralose industry accounted for over 30.0% of market share in 2017 and is expected to observe further growth over the forecast period owing to increasing health awareness among consumers. Rising prevalence of diseases such as diabetes, heart attack, blood pressure, and anemia have compelled consumers to find sugar substitutes, including, sucralose.

In February 2018, the European Commission imposed a ban on the use of artificial sweeteners in dietetic baked goods as a part of Commission Regulation 2018/97. This regulation is expected to limit the scope of artificial sweeteners including sucralose as functional ingredients for diet-based products in bakery industry of Europe over the next eight years.

Asia Pacific is expected to foresee fastest CAGR of 2.1% in terms of volume from 2017 to 2025. Expansion of food processing industry in China on account of continuous year-on-year growth from 2014 to 2017, in terms of export volumes of baked goods and dairy products is expected to remain a favorable trend in near future.

Competitive Landscape

Over the past few years, manufacturers such as Tate & Lyle have formed strategic partnerships with distributors and contract manufacturers for producing sucralose with advanced properties. The rising popularity of e-commerce portals, including Made-in-China and Alibaba, as a medium to procure industrial commodities and consumable items is expected to provide buyers with new platforms for selling and distributing artificial sweeteners in near future.

The availability of raw material supply due to significant sugarcane production in Argentina and Brazil is expected to attract foreign investments. This factor is anticipated to result in growth of sucralose market over the forecast period. In 2015, Tate & Lyle, P.L.C. acquired a majority stake in Gemacom Tech, a provider of sweeteners, starches, colorants, and aromas in Brazil. This acquisition is expected to increase the market reach of Tate & Lyle in Brazil over the next eight years.

The easy access of raw materials as a result of large number of sugar processing units in India and China is expected to encourage market participants to establish their strategic business units in vicinity. However, the predominant consumption of sugar for direct human consumption is projected to limit the access of feedstock to the sucralose processing firms in near future.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service