Synthetic & Bio Superabsorbent Polymers Market Size and Forecast, By Type (Bio SAP, Synthetic SAP), By Application (Agriculture, Diapers, Female Hygiene Products) And Trend Analysis, 2015 - 2025

- Published: November, 2018

- Format: Electronic (PDF)

- Number of pages: 62

- Industry: Plastics, Polymers & Resins

Industry Insights

The global Synthetic & bio superabsorbent polymers market size was valued at USD 7.25 billion in 2017. It is anticipated to expand at a CAGR of 4.7% during the forecast period. Factors such as growing population and disposable income are anticipated to drive the market. Rising awareness regarding the benefits and availability of environmentally sustainable baby diapers is projected to play a key role in boosting the market growth.

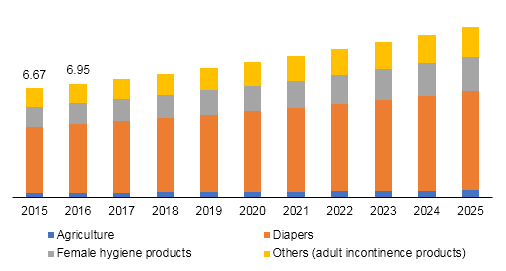

Synthetic & bio superabsorbent polymers market revenue, by application, 2015 - 2025 (USD Billion)

Superabsorbent polymers (SAP) are extensively used in agriculture, horticulture, and pharmaceutical industries. They are used for manufacturing diapers and female hygiene products. Once introduced into soil, superabsorbent polymers enhance its water absorbing capacity by 300 times. They also reduce the requirement of watering frequency by 50%. Such properties render high suitability for SAP to be used for agriculture as well as horticulture applications. Major manufacturers are Hydrosorb Inc.; M2 Polymer Technologies Inc.; and Horticultural Alliance, Inc.

Growing use of absorbent pads for bottling and meat packaging is projected to encourage growth of the synthetic & bio superabsorbent polymers market over the forecast period. Rising use of absorbing pads to protect meat from moisture, contamination, and temperature is projected to drive demand from packaging industry. In addition, rising R&D to develop advanced polymers is anticipated to further drive growth. For instance, in 2015, the Indian Agriculture Research Institute (IARI) developed a novel hydrophilic superabsorbent polymer to improve water holding capacity of soil. Easy availability of raw materials such as cellulose, cassava, and potato has created potential opportunities for many market players.

Other than agriculture and personal care products, rising use of superabsorbent polymers in artificial snow has increased over the past few years. Layered construction of polymers in adult diapers improves fluid absorption at the core structure, making the product efficient and hygienic. This factor is anticipated to drive the product demand from countries with high geriatric population.

In addition, use of superabsorbent polymer material in sandbags has increased. It is used as a temporary protection against flooding and extensively used in flood protection, factory protection, water line construction on highways, and river banks. Growing demand from movies, snow parties, ski resorts, and other entertainment application is expected to create avenues for new entrants. Innovative product offerings by well-established market players are expected to attract more customers.

Segmentation by Type

• Bio SAP

• Synthetic SAP

In 2017, synthetic SAP accounted for more than 90.0% of overall market share in terms of revenue. Superabsorbent polymers are a network of hydrophilic macromolecules with the ability to hold or absorb a large amount of water and biological fluids. High expansion and absorption properties make them suitable for use in personal care products. Increasing use for the production of diapers and female hygiene products is anticipated to enhance market growth over the forecast period.

The biobased SAP segment is anticipated to expand at a CAGR of 8.1% over the forecast period. Rising demand for easy to use, faster water absorption, and skin friendly hygiene products is expected to drive growth of the synthetic & bio superabsorbent polymers market over the forecast period. This material is produced by employing renewable raw materials such as cellulose, starch, natural gums, and chitin. New product development and continuous research activities in bio-based polymers are anticipated to create a potential opportunity for new market entrants.

Segmentation by Application

• Agriculture

• Diapers

• Female Hygiene Products

• Others

Polymers are versatile materials, extensively used in various agricultural applications. Upward trends in polymer biodegradation and superabsorbent are anticipated to support industry growth. The diapers segment dominated the global market in 2017. It is anticipated to be the fastest growing segment over the forecast period owing to high birth rate across the world.

Plants need macronutrients and micronutrients for healthy growth. These nutrients are not always available in the environment at sufficient level. Addition of superabsorbent polymers can improve the nutritional absorption quality of soil. This factor is anticipated to drive the demand from agriculture segment in near future.

The extensive uses in agriculture, female hygiene product, diapers, and others coupled with rising environmental concerns and awareness about natural polymers is expected to fuel market expansion.

Segmentation by Region

• North America

• U.S.

• Europe

• U.K.

• Germany

• Asia Pacific and Oceania

• China

• India

• Middle East & Africa

• Central & South America

North America accounted for about 30.0% of overall market share in 2017. Rise in aging population has been one of the major regional market driving factors. High awareness and social acceptance regarding a wide range of health issues have resulted in changing the demand landscape of the hygiene industry. Major companies operating in this region are L’Oreal; Procter & Gamble Co; Unilever Plc.; Avon Products; Colgate-Palmolive Company; Beiersdorf AG; BASF SE; Johnson & Johnson; and Estee Lauder Companies, Inc.

Asia Pacific held the largest market share in the past and is anticipated to continue growing over the forecast period. Growing personal care and hygiene industry in Taiwan, China, South Korea, India, and Japan is expected to be a favorable factor for synthetic & bio superabsorbent polymer market over the projected period. Increasing investments by leading companies such as P&G and Kimberly-Clark is anticipated to promote demand over the forecast period.

Growing consumer awareness regarding baby hygiene products in emerging economies such as India and China is expected to be a critical driving factor. Rising disposable income and expansion of the middle class in these countries has led to changing consumer preferences. This factor is also anticipated to bode well for regional expansion of the industry over the forecast period.

Competitive Landscape

The industry is marked by the existence of well-established players. Major players operating in the synthetic and bio superabsorbent polymers market comprise BASF SE, Nippon Shokubai Co. Ltd, Evonik Industries AG, KAO Corporation, and. Other vendors functioning in the industry are Rodenburg Biopolymers, Formosa Plastics Group, Bayer AG, and Mitsubishi Chemical Holdings Corporation. Some other market participants include Procter & Gamble (Pampers), Kimberly-Clark (Huggies), Wipro (baby diapers), and Godrej (snuggy diapers). Product innovation is anticipated to create growth avenues for the companies over the forecast period.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service