Synthetic Diamond Market Size and Forecast, by Process [High-Pressure, High-Temperature (HPHT), Chemical Vapor Deposition (CVD)], by Type (Rough, Polished), by Application (Construction & Mining, Electronics, Jewelry, Healthcare) and Trend Analysis, 2014 - 2024

- Published: September, 2017

- Format: Electronic (PDF)

- Number of pages: 60

- Industry: Advanced Materials

Industry Insights

The global synthetic diamond market size was estimated to be worth USD 14.9 billion in 2016. Also known as cultured, cultivated or artificial diamonds, they are increasingly used for an array of applications other than industrial including abrasives, laser optics, and telecommunication.

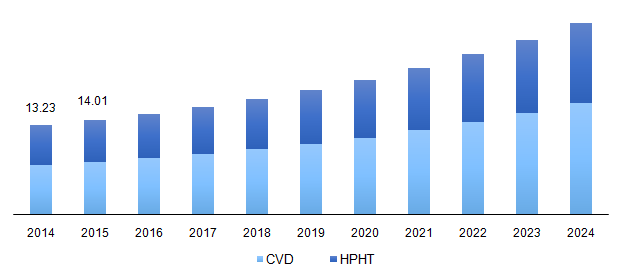

Global synthetic diamond market revenue, by process, 2014 - 2024 (USD Billion)

Relatively lower price and a higher production rate of these as compared to natural diamonds are expected to result in driving the growth of the market over the next few years. In addition, flexibility to alter properties of the laboratory-grown crystal to suit specific applications such as cutting or conduction of electricity makes it a viable choice across a broad range of industries.

Increasing substitution of natural diamond with its synthetic counterpart has resulted in opening new avenues for the market. In addition to this, low price and seamless supply have resulted in opening opportunities for the utilization of the gem in industries which refrained from using the product such as the use of Monolithic Diamond Raman Lasers in biomedical applications.

The growth of the construction and biomedical industries is expected to boost the growth of the market over the projected period. Increasing spending on infrastructure as well as the growth of industrialization in emerging economies of Asia Pacific will drive the growth of the market in the region over the next few years.

Properties such as high thermal conductivity of approximately 460 watts per meter-kelvin and low coefficient of friction of 0.5 make synthetically-manufactured gems exceptional and valuable in the industrial application as compared to steel, tungsten carbide, silicon nitride and other industrial materials. However, although synthetic diamonds are 40% to 50% cheaper than natural ones, they are still costlier than any other industrial materials, which is expected to deter their growth.

Segmentation by Process

• HPHT (High Pressure High Treatment)

• CVD (Chemical Vapor Deposition)

Traditionally, HPHT was extensively used for manufacturing diamonds. However, the products formed are usually yellow or brown, except blue. Very rarely is an HPHT synthetic diamond colorless rendering it unsuitable for numerous applications.

The emergence of CVD has resulted in the segment dominating the market with a 55.9% share in 2016. Using this method, these crystals are grown in an apparatus at moderate temperatures and low pressure in a vacuum chamber. Rising demand for colorless diamonds, especially in jewelry, is anticipated to result in its accelerated growth over the projected period.

Segmentation by Type

• Rough

• Polished

Rough synthetic diamond dominated the market in 2016 accounting for 63.6% of the share. Huge demand for these stones for cutting, drilling, and polishing has resulted in the segment establishing its dominance in the market over the past few years, and the trend is expected to continue over the projected period.

Rapid industrialization, particularly in Asia Pacific and Central & South America are projected to result in augmenting the demand for rough gems. The short production time of these products has led to diminishing the supply-demand gap for diamonds in industrial use.

Segmentation by Application

• Construction & Mining

• Electronics

• Jewelry

• Healthcare

• Others

Construction & mining was one of the largest application segment of the market valued at USD 4.47 billion in 2016. Increasing infrastructure spending coupled with the steady growth of the mining industry is anticipated to boost market growth, particularly in emerging economies all around the world.

Demand for synthetic stones in jewelry has witnessed a tremendous upsurge over the past few years. Increasing awareness regarding fashion, particularly in terms of adorned accessories, has resulted in driving the growth of the segment. Availability of relatively low-cost jewelry with stones has resulted in changing consumer purchasing choice from natural to their synthetically manufactured.

Segmentation by Region

• North America

• U.S.

• Europe

• Russia

• Asia Pacific

• India

• China

• Rest of the World (RoW)

Asia Pacific was the largest market accounting for 48% of the share in 2016 and is likely to witness the fastest growth over the next few years as a result of the evolution of the manufacturing sector in the region. Besides manufacturing and exporting, the region has had exhibited patterns of an enormous domestic demand due to the development of infrastructure. These factors are to play a major role in driving the growth of the industry in the region over the next few years.

North America and Europe accounted for almost an equivalent market share in the same year. However, these regions are likely to witness a sluggish growth in tandem with the development of the manufacturing sector. Moreover, stringent regulations to reduce mining activities in light of reducing carbon footprint is likely to have an adverse effect on the market in these regions during the forecast period.

Competitive landscape

Key players operating in the industry include Applied Diamond Inc., Centaurus Technologies Inc., Element Six, ILJIN, and New Diamond Technology. Strong R&D activities resulting in customization for determining the carat of the stone is expected to open various in future owing to its unique lattice structure and strong acoustic properties.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service