Tempeh Market Size And Forecast, By Product Type (Conventional, Organic), By Distribution Channel (Offline, Online), By Region (North America, Europe, Asia Pacific, Rest of the World) And Trend Analysis, 2019 - 2025

- Published: March, 2019

- Format: Electronic (PDF)

- Number of pages: 65

- Industry: Nutraceuticals & Functional Foods

Industry Insights

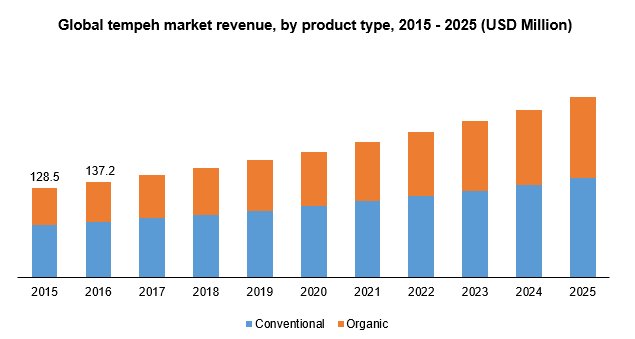

The global tempeh market was valued at USD 146.7 million in 2017 and is expected to grow at a CAGR of more than 7.0% from 2017 to 2025. Gaining popularity of meat substitutes in light of the rising glutamic disorders is expected to spur demand in the coming years. Also, the shifting preference towards vegan diet in countries such as the U.S. and U.K. as an alternative to meat-based products is projected to have a positive impact on the market.

Segmentation by Product Type

• Conventional

• Organic

Conventional tempeh dominated the market with a share of more than 55.0% in 2017. The conventional form is lower priced compared to its organic counterpart and is targeted at the mass market.

Organic tempeh is expected to witness the fastest growth at a CAGR of 8.2% from 2017 to 2025. The increasing vegan population globally coupled with the rising preference for organic products is expected to be beneficial for market in the coming years. The launch of ready-to-eat products in varying taste and flavors aimed at time pressed health conscious consumers is expected to spur market growth.

Segmentation by Distribution Channel

• Offline

• Online

Tempeh was predominantly sold through offline channels with a revenue contribution of more than USD 125.0 million in 2017. Hypermarkets & supermarkets were the largest revenue contributor as these have the highest footfall and usually stock a large variety of products at varying prices. Stores such as SPAR, Walmart, and Carrefour are among the leading hypermarkets & supermarkets.

The online channel is expected to be the fastest growing distribution medium with a CAGR of more than 8.0% from 2017 to 2025. This distribution channel suits the changing consumer lifestyle where tech-savvy and time-pressed consumers prefer ordering online to save time, compare products, and get them delivered to their doorsteps.

Segmentation by Region

• North America

• Europe

• Asia Pacific

• Rest of the World

Asia Pacific dominated the market with a share of more than 38.0% in 2017. The consumption of tempeh was dominant in countries such as China, Japan, and Indonesia and a continual trend is expected to result in market growth. Increasing health awareness among consumers has led to the demand for tempeh products in the region. Indonesia is the largest producer of tempeh and the product is used as a staple source of protein in the country. Over the coming years, increasing preference as a functional food in countries such as India and China will also add to its demand in the region.

North America is expected to grow at a CAGR of 8.3% from 2017 to 2025. Rising vegan population and the demand for meat alternatives is expected to add to the market demand in the region over the coming years. The U.S. is expected to be a key country where the demand is expected to spur the launch of a variety of ready-to-eat tempeh products over the coming years.

Competitive Landscape

The global tempeh market is marked by the presence of regional and local players. In the coming years, the market is expected to witness the launch of new products. Growth is expected from countries such as the U.S. where the increasing inclination towards protein-rich meat alternative and the rise of vegan culture is driving demand.

New product launches in the ready-to-eat segment is expected mainly in countries such as the U.S., where consumption will be led by consumers switching to vegan products. Some of the key companies in the market include Noble Bean Inc., Turtle Island Foods, Inc., LIGHTLIFE FOODS, INC., Nutrisoy Pty Ltd, Lalibela Farm, Mighty Bean Tempeh Sunshine Coast, HENRY'S TEMPEH INC., and Organic Village Food.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service