Titanium Dioxide (TiO2) Market Size and Forecast, By Manufacturing Process (Chloride Route, Sulfate Process), By product (Anatase, Rutile), By Application (Paints & Coatings, Plastics, Paper, Ink, Specialties) And Trend Analysis, 2014 - 2024

- Published: May, 2017

- Format: Electronic (PDF)

- Number of pages: 91

- Industry: Paints, Coatings & Printing Inks

Industry Insights

The global titanium dioxide market was estimated at USD 13.70 billion in 2016 and is expected to witness significant growth on account of its increasing use in paints, plastics, paper & pulp, cosmetics, inks, fibers, rubber, food and pharmaceuticals. Growth of these sectors is expected to further propel the growth of the market over the forecast period.

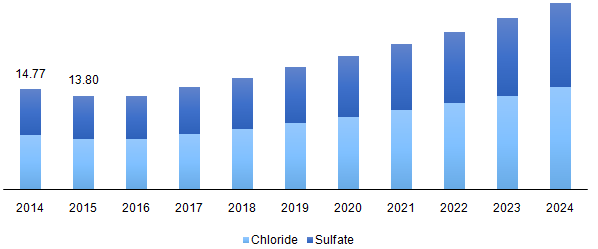

Global titanium dioxide market revenue, by manufacturing process, 2014 – 2024 (USD Billion)

Over the past few years, the market of doped titanium dioxide nanoparticles has been increasing owing to its increasing application in solar cells. Doping of nanoparticles helps in enhancing amount of absorption in visible light. For instance, tungsten doped titanium dioxide nanoparticles are used in photo catalysis of sunlight and visible light, widening its application in solar energy.

Technological development has led to improvement in the manufacturing process to give high yield & quality. For instance, in October 2012, Argex Titanium Inc., developed a CTL process which involves low cost feed material producing high quality titanium dioxide. This method has helped the company to increase its contribution in global titanium dioxide market.

Stringent government policies are anticipated to restrain the market growth of titanium dioxide during the study period. Several harmful acid wastes are produced during the manufacturing of titanium dioxide. Various regulations have been implemented to reduce the emission of these wastes. The sulfate process results in large quantities of solid waste as well as acids. However, manufacturers based in china are adopting substitutes to reduce pollution due to strict government regulations pertaining to waste disposal of titanium dioxide.

Segmentation by manufacturing process

• Chloride route

• Sulfate process

Chloride route accounted for 51.9% of market share in 2016 and is expected to grow with a highest CAGR during the forecast period. Chloride route helps in maintaining uniform particle size and increasing the yield, which is essential to maintain the quality of final product. Chloride route is environment friendly manufacturing process which produces less solid waste hence used my most of the manufacturers. The sulfate process accounted CAGR of 3.9% and is expected to grow at a positive CAGR over the forecast period owing to its application in manufacturing of anatase ore.

Segmentation by product

• Rutile

• Anatase

Rutile is most common natural form of titanium dioxide. In terms of volume, Rutile form contributed 55.60% in 2016. Rutile form of titanium dioxide is used in manufacturing of polarization optics for longer and visible infrared wavelengths and it is also used as a UV absorbing agent.

Anatase ore contributed 44.40% of the overall volume share in 2016 and is expected to grow with a maximum CAGR during the forecast period due to its increasing application as whitening agent in paper, tooth paste & ceramics industry. Growth in paints, paper and ceramic industry will play a key role in increasing the market for anatase ore.

Segmentation by application

• Paints & coatings

• Plastics

• Paper

• Inks

• Specialties

• others

Paints & coatings accounted for 57.40% of the overall volume share in 2016. Rising demand of titanium dioxide in automotive paints as a whitening pigment will play a key factor for growth of global market. Also, growth in construction sector is expected to play a significant role in increasing the demand of titanium dioxide during the forecast period.

Furthermore, plastics segment is expected to show lucrative growth over the forecast period owing to the increasing demand of plastic items.

Segmentation by region

• North America

• U.S

• Europe

• Germany

• UK

• Asia Pacific

• China

• India

• Central & South America

• MEA

Asia Pacific dominated the global market in terms of volume in 2016. Continuous availability of resources and innovation in technology has resulted in such growth in the production. Central & South America and MEA together accounted for less than 15% of the volume share in 2016, these regions are anticipated to witness the highest growth over the projected period due to increased availability of market statistics figures and key players. Brazil is expected to be a lucrative market due to its Paraiba mine which is helping in generating revenue as well as employment.

Competitive landscape

The global market is consolidated in nature with the presence of a limited number of manufacturers primarily concentrated in Asia pacific and Europe. Key vendors with the market include Argex Titanium Inc. The chemours company, Cristal, KRONOS worldwide Inc. Tronox Limited, Ishihara sangyo kaisha LTD. Companies are focusing on R&D and product innovation to increase their presence in the global market.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service